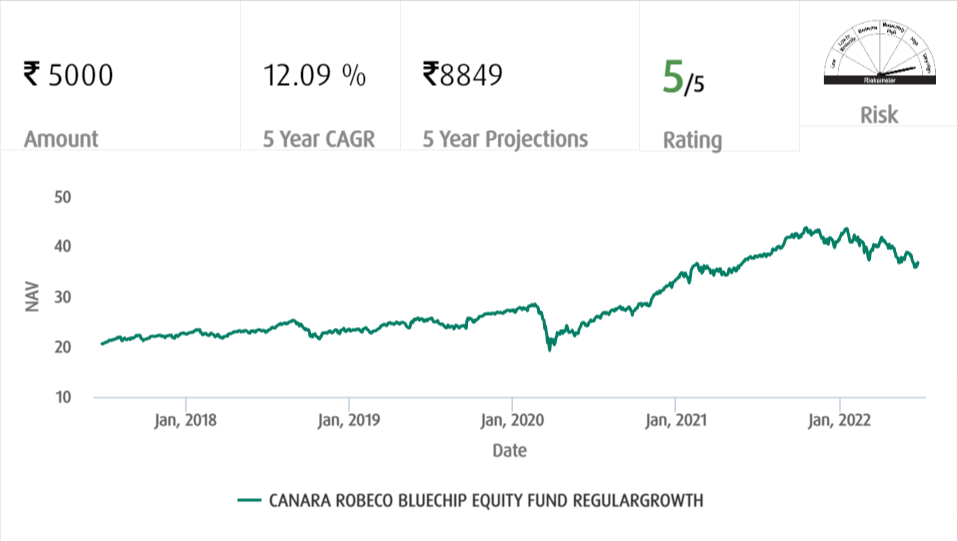

Canara Robeco Bluechip Equity Fund Regular Growth

(Note: Based on the data as of 24th June, 2022)

Objective of scheme

To provide capital appreciation to the investors by making investments in equities of companies having a large market capitalisation

Suitability

If you are an investor desirous of high returns over a long period (3-4 years) and ready to assume high risk, you can invest in this fund. In moderate or short term, there might be some losses depending on the market and economic scenario.

Scheme Details

|

Scheme Launch Date |

20th August 2010 |

|

Scheme Type |

Open Ended Fund where investment can be made anytime |

|

Minimum Investment Amount |

Rs. 5000 (Initial); Rs. 1,000 (Additional) |

|

Minimum SIP Amount |

Rs. 1,000 |

|

Expense Ratio |

1.87% (as declared by the fund) vs. category average 2.21% |

|

Fund Managers |

|

|

Exit Load |

Exit Load is 1% if redeemed within 1 year. Same for SIP |

|

Risk |

Very High Risk |

|

AUM (in Cr.) |

Rs. 6858 |

|

Investment Horizon |

Long Term |

Start Investing in Mutual Funds: Click Here

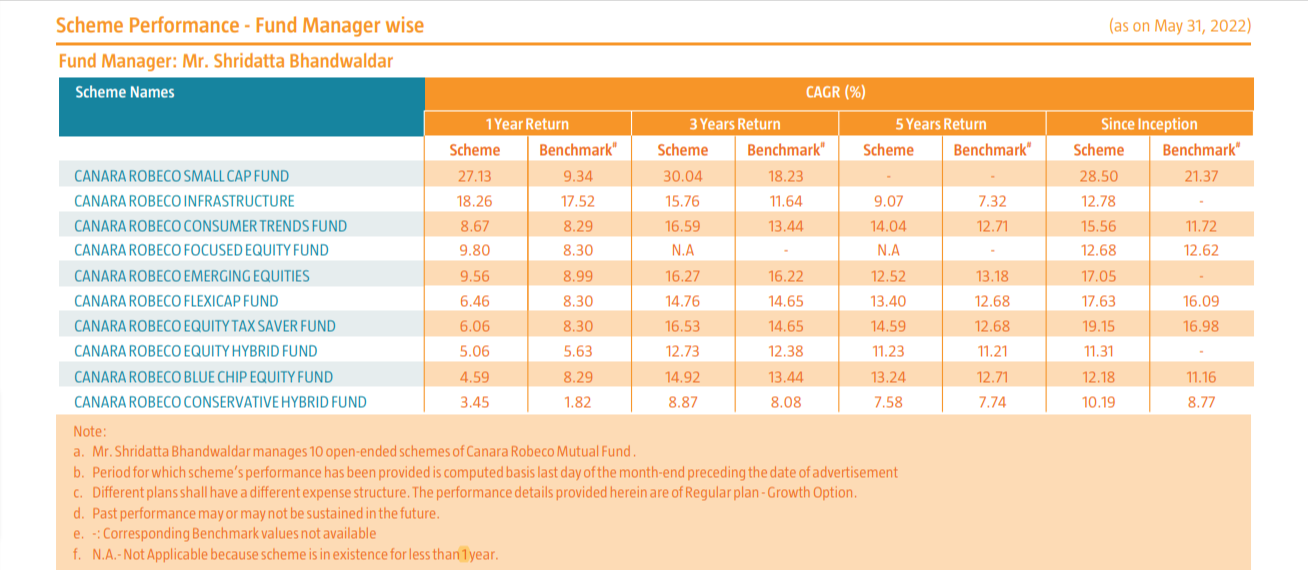

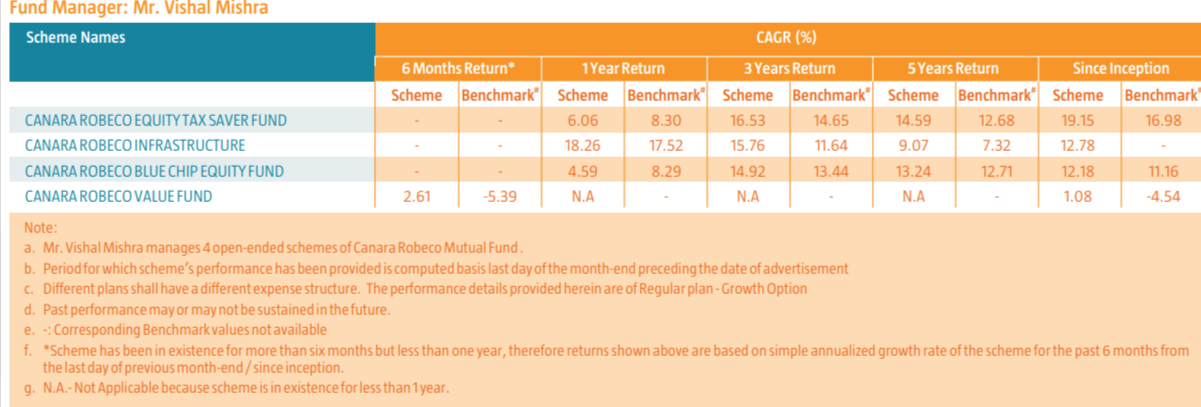

About Fund Managers

The Fund is managed by the following fund managers:

|

Mr. Vishal Mishra |

Mr. Vishal Mishra is a B. Com, ACA. He has more than 10 years of experience in the areas of equity research & credit research. Presently, he is associated with Daiwa Asset Management (India) Pvt. Ltd. for the past 4 years. His previous assignment was with Collins Stewart India Pvt. Ltd. as Asst. Vice President Research. He was also associated with IL&FS Investment Ltd., Crisil Ltd. and Quantum Information Services Ltd. |

|

Mr. Shridatta Bhandwaldar |

Mr. Shridatta Bhandwaldar is a BE (Mech.) and MMS (Finance). Prior to joining Canara Robeco Mutual Fund, he was associated with SBI Pension Funds Private Limited as Head Research, Heritage India Advisory Pvt. Ltd. as Senior Equity Analyst, Motilal Oswal Securities and MF Global Securities. |

Funds Managed by the Fund Managers

Trailing Returns (%)

|

|

YTD |

1-Day |

1-W |

1-M |

3-M |

6-M |

1-Y |

3-Y |

5-Y |

7-Y |

10-Y |

|

Canara Robeco Bluechip Equity Reg- Fund |

-11.56 |

0.88 |

2.71 |

-1.97 |

-8.21 |

-9.80 |

-2.85 |

13.44 |

12.09 |

11.22 |

13.41 |

|

S&P BSE 100 TRI |

-8.74 |

0.96 |

2.58 |

-2.52 |

-8.15 |

-6.93 |

0.90 |

12.02 |

11.48 |

10.97 |

13.53 |

|

Equity: Large Cap |

-10.44 |

0.93 |

2.66 |

-2.58 |

-8.98 |

-8.52 |

-0.71 |

10.93 |

10.35 |

9.65 |

12.61 |

Peer Comparison

|

Mutual Fund |

Rating |

NAV |

1 Yr Return |

3 Yr Return |

5 Yr Return |

10 Yr Return |

Return Since Inception |

|

MIRAE Asset Large Cap Fund- Regular Growth |

4 |

70.76 |

-0.48 |

11.10 |

10.82 |

16.25 |

14.74 |

|

Canara Robeco Bluechip Equity Fund Regular Growth |

5 |

36.80 |

-2.85 |

13.44 |

12.09 |

13.41 |

11.62 |

|

Sundaram Large Cap Fund- Regular Plan Growth |

5 |

13.28 |

-0.39 |

9.90 |

10.31 |

12.13 |

18.14 |

|

UTI Mastershare Unit Scheme- Growth Plan |

5 |

172.90 |

-1.07 |

12.27 |

10.60 |

13.04 |

17.12 |

|

Axis Bluechip Fund- Regular Growth |

5 |

39.19 |

-6.71 |

9.65 |

11.83 |

14.39 |

11.57 |

Fund Allocations: The fund has 95.27% investment in domestic equities of which 75.59% is in large cap stocks and 7.03% in mid-cap stocks.

Top 10 Companies in Portfolio

|

Company Name |

Sector |

P/E |

% Assets |

|

ICICI Bank |

Financial- Banking |

19.77 |

8.82 |

|

Reliance Industries |

Energy |

27.87 |

8.69 |

|

HDFC Bank |

Financial- Banking |

19.76 |

8.48 |

|

Infosys |

Technology |

27.44 |

6.77 |

|

Tata Consultancy Services |

Technology |

31.44 |

3.81 |

|

State Bank of India |

Financial- Banking |

11.46 |

3.45 |

|

Axis Bank |

Financial-Banking |

13.79 |

3.28 |

|

Bharti Airtel |

Telecommunication |

92.91 |

3.20 |

|

L&T |

Construction |

24.24 |

2.93 |

|

Bajaj Finance |

Financial- Others |

48.14 |

2.71 |

Sector-wise Allocation of Fund

|

Sector |

Allocation of Assets (%) |

|

Financial |

34.8% |

|

Technology |

14.3% |

|

Others |

13.4% |

|

Energy |

11.9% |

|

Consumer Staples |

7.2% |

|

Healthcare |

6.8% |

|

Construction |

6.3% |

|

Automobile |

5.3% |

Start Investing in Mutual Funds: Click Here

Disclaimer: Mutual Funds investments are subject to market risk. Therefore, it is advised to read the scheme documents carefully before making any investment. The above figures are based on the market data of the various mutual funds over the period and should not be solely made the basis of investment. Taxwink shall not be responsible for any loss caused to any person in any manner on any investment made on the basis of the above information.