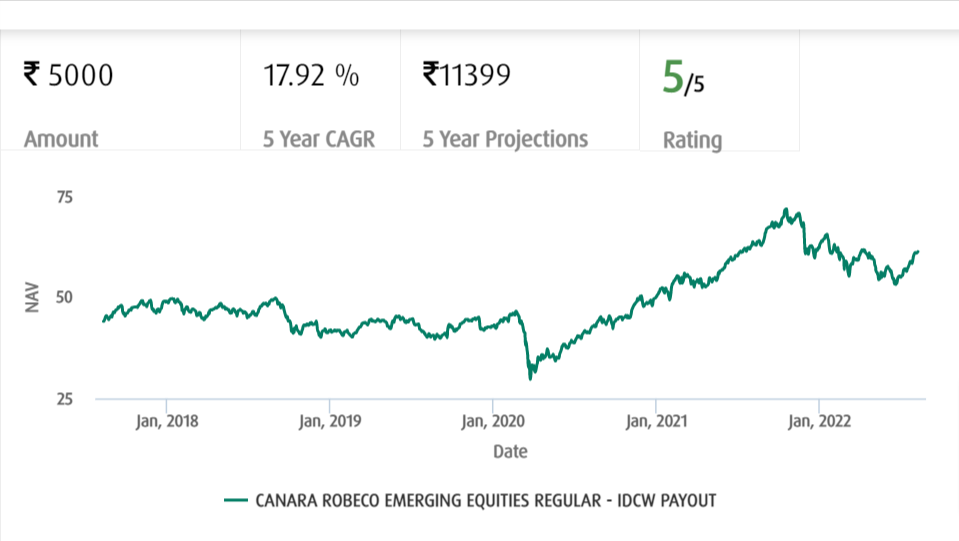

Canara Robeco Emerging Equities - IDCW Payout

(Note: Based on the data as of 9th August 2022)

Suitability

This scheme is aimed at generating capital appreciation along with a regular income payout to the investors by making investments in large cap and mid-cap stocks. However, the scheme carries a high risk of loss in the value of investments.

Scheme Details

|

Scheme Launch Date |

March 2005 |

|

Scheme Type |

Open Ended Fund- Equity |

|

Minimum Investment Amount |

Rs. 5,000 (Initial); Rs. 1,000 (Additional) |

|

Minimum SIP Amount |

Rs. 1,000 |

|

Expense Ratio |

1.94% |

|

Fund Managers |

Shridatta Bhandwaldar |

|

Exit Load |

Entry Load: Nil & Exit Load: 1% of sales value if sold before 365 days |

|

Risk |

Very High |

|

AUM (in Cr.) |

Rs. 9632.66 |

|

Investment Horizon |

Mid Term to Long Term |

About Fund Managers:

The Fund is managed by the following fund managers:

|

Shridatta Bhandwaldar |

He is a BE(Mech.) and MMS (Finance). He was earlier associated with SBI Pension Funds Private Limited as Head- Research, Heritage Advisory Private Limited as Senior Equity Analyst, Motilal Oswal Securities, and MF Global Securities |

Trailing Returns (%)

|

|

YTD |

1-Day |

1-W |

1-M |

3-M |

6-M |

1-Y |

3-Y |

5-Y |

7-Y |

10-Y |

|

Canara Robeco Emerging Equities- IDCW Payout |

-2.62 |

0.59 |

0.53 |

7.65 |

8.30 |

0.22 |

5.46 |

22.01 |

12.32 |

13.82 |

20.65 |

Benchmark Returns:

|

|

1 Year Return |

3 Year Return |

5 Year Return |

10 Year Return |

Returns since inception |

|

Nifty Large Midcap 250 TRI |

67.87 |

16.18 |

16.74 |

14.72 |

17.79 |

Peer Comparison

|

Mutual Fund |

Rating |

NAV |

1 Yr Return |

3 Yr Return |

5 Yr Return |

10 Yr Return |

Return Since Inception |

|

Invesco India Growth Opportunities Fund- IDCW Payout |

5 |

25.45 |

2.70 |

16.37 |

11.37 |

15.35 |

11.52 |

|

LIC MF Large and Midcap Fund- Regular Plan- Dividend Payout |

5 |

20.57 |

54.85 |

14.57 |

16.11 |

NA |

12.66 |

|

Axis Growth Opportunities Fund- Regular Plan |

5 |

- |

5.48 |

23.77 |

- |

- |

- |

|

Kotak Equities Opportunities Fund- IDCW Pay out |

4 |

34.75 |

7.12 |

20.46 |

12.17 |

16.24 |

18.17 |

|

Tata Large and Midcap Fund Regular- IDCW Pay out |

4 |

54.72 |

57.33 |

17.25 |

14.18 |

14.21 |

12.80 |

Fund Allocations: The fund has approx. 94.20% investment in domestic equities of which 43.24% is in large-cap stocks, 27.13% in mid-cap stocks and 5.05% in small-cap stocks

Top 10 Companies in Portfolio

|

Company Name |

Sector |

P/E |

% Assets |

|

ICICI Bank Limited |

Financial |

20.99 |

6.64 |

|

HDFC Bank Limited |

Financial |

20.45 |

5.73 |

|

Infosys Limited |

Technology |

30.58 |

4.37 |

|

Reliance Industries Ltd. |

Refinery |

26.16 |

4.19 |

|

State Bank of India |

Financial |

13.15 |

3.71 |

|

Axis Bank Limited |

Financial |

14.19 |

3.02 |

|

Bajaj Finance |

Financial |

51.55 |

2.95 |

|

UNO Minda |

Automobile |

65.67 |

2.53 |

|

Bharti Airtel |

Telecom |

75.20 |

2.49 |

|

Cholamandalam Investment & Finance |

Financial |

26.81 |

2.39 |

Sector-wise Allocation of Fund

|

Sector |

Allocation of Assets (%) |

|

Basic Materials |

10.09 |

|

Consumer |

15.44 |

|

Financial Services |

28.49 |

|

Real Estate |

1.34 |

|

Communication Services |

3.11 |

|

Energy |

5.61 |

|

Industrials |

12.34 |

|

Technology |

9.18 |

|

Consumer Defensive |

4.74 |

|

Healthcare |

8.25 |

Disclaimer: Mutual Funds investments are subject to market risk. Therefore, it is advised to read the scheme documents carefully before making any investment. The above figures are based on the market data of the various mutual funds over the period and should not be solely made the basis of investment. Taxwink shall not be responsible for any loss caused to any person in any manner on any investment made on the basis of the above information.