How to check Income Tax Refund Status Online?

The due date of filing the income tax return is 31st July for non-audit taxpayers and 31st October for audited taxpayers. For the year 2020-21, the due date was extended and now almost all the taxpayers have already filed their ITRs and now waiting for their tax refunds. Let’s discuss the concept of income tax refund and how to check refund status online.

What is Income Tax Refund?

Every taxpayer in India is obliged to deposit advance tax where his/her estimated tax liability for the year is more than Rs. 10,000. Further, TDS is also deducted from their income in certain cases. While filing the ITR, the taxpayers compute their tax liability and claim a refund of the excess tax paid by him i.e. (Advance Tax Paid + TDS deducted in his cases- Computed Tax Liability). This amount claimed by the taxpayer is known as “Income Tax Refund”.

How to claim Income Tax Refund?

For claiming an income tax refund, you are required to submit income tax return online. Submitting the income tax return is not sufficient, you should also verify the ITR through Aadhar OTP or digital signature. If you are not able to verify ITR using OTP, you may also send the signed copy of ITR-V to CPC Bangalore. Refund will be credited to your bank account only after the successful processing of your return.

How to check Income Tax Refund Status online?

Income tax refund status can be checked by logging in to the NSDL website. Here are 3 simple steps to check Income Tax Refund:

Step-I: Click here to navigate to the NSDL website and check refund status

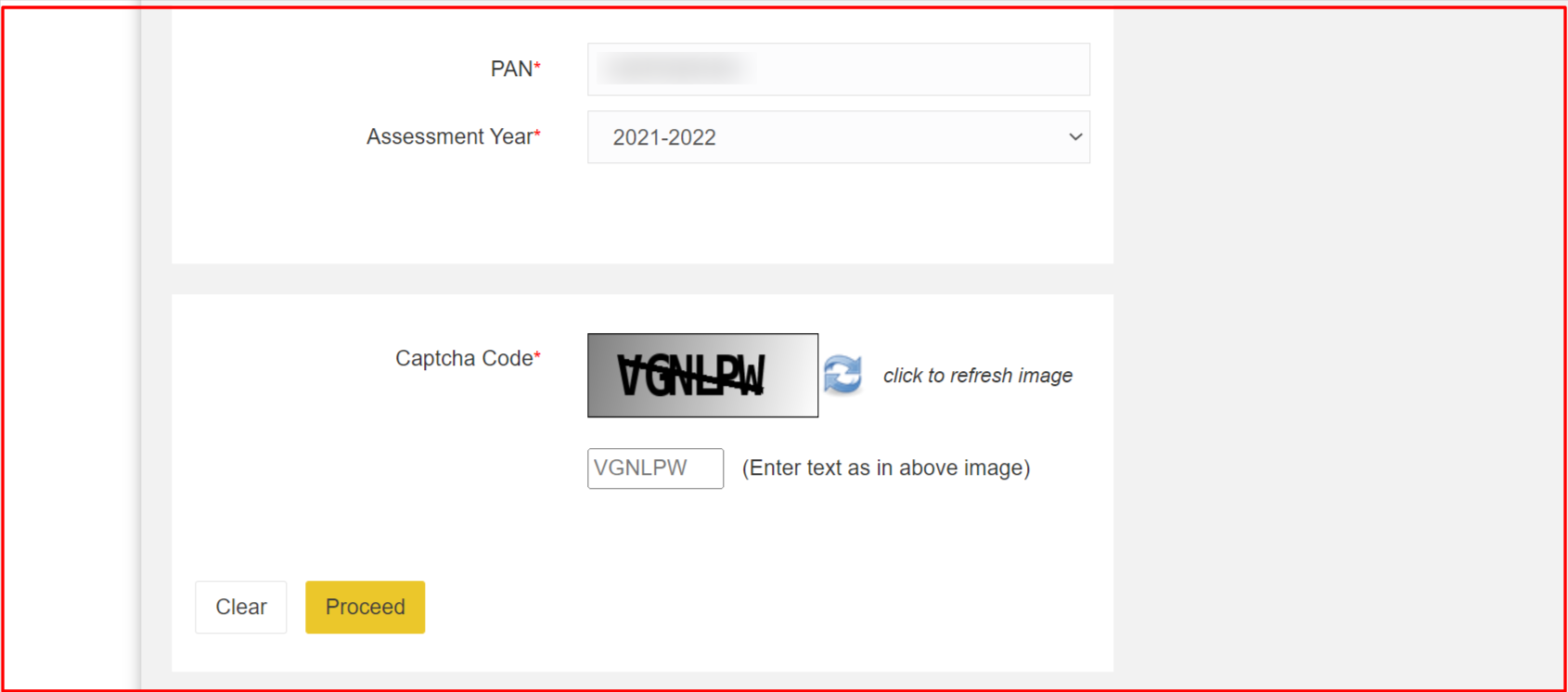

Step-II: The following page will appear before you. You need to fill in the following details in the form and click on ‘Proceed’:

- PAN

- Assessment Year

- Captcha Code

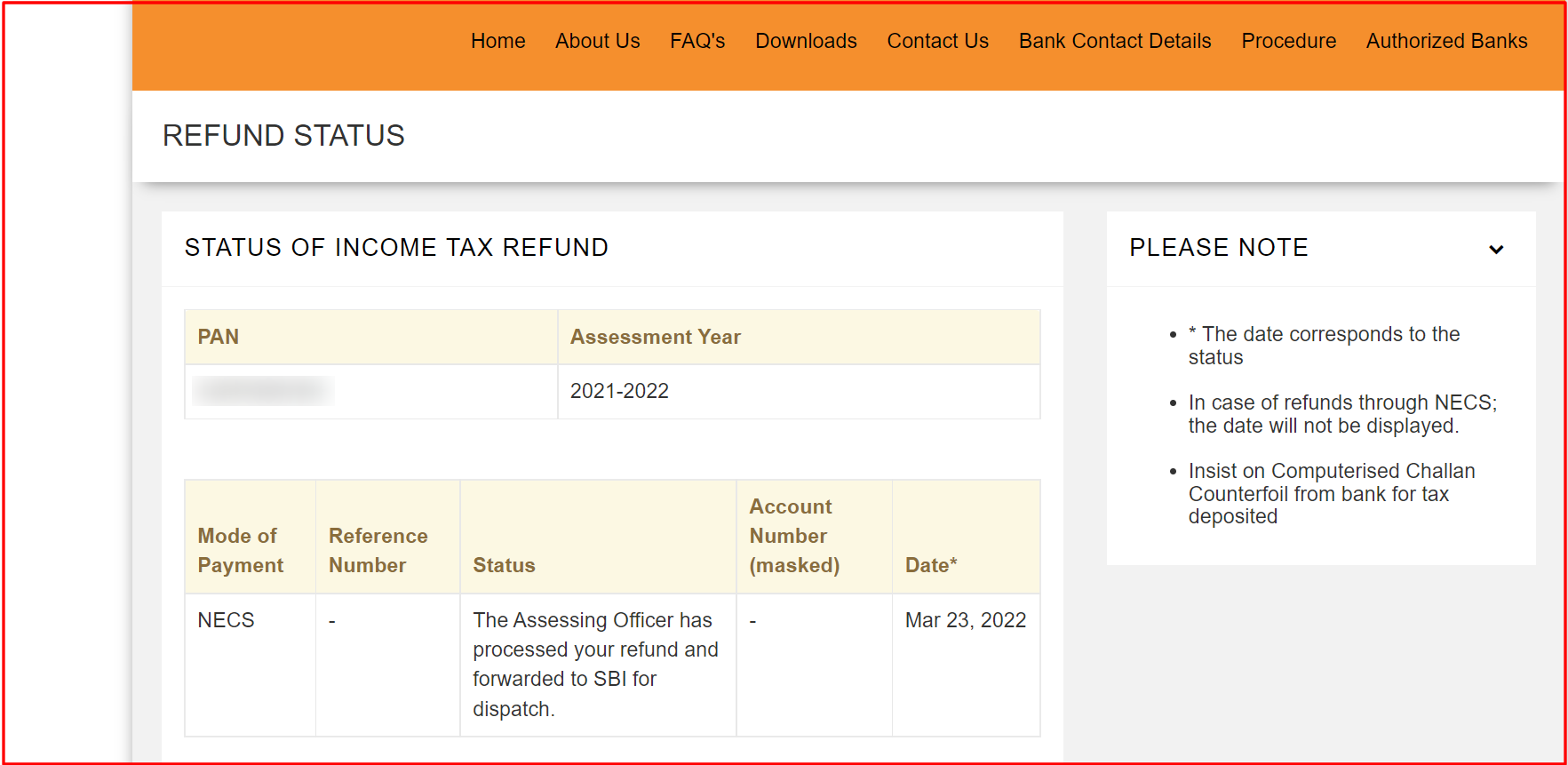

Step-III: On the next screen, you will find the status of your income tax refund.

Does Income Tax Department give interest on the income tax refund?

Yes, Section 244A of the Income Tax Act provides the provisions for interest on income tax refund. Section 244A prescribes interest at the rate of 0.5% per month or part of the month on the refund amount.

If you want to get maximum interest, file your income tax return timely!

Because interest amount is calculated from 1st April of the assessment year till the date of grant of refund if the ITR is filed timely by the taxpayer within the due date prescribed by the Income Tax Department. But if the return is filed after the prescribed due date, interest will be calculated from the date of filing of ITR to the date on which the refund is granted.

How to calculate interest on income tax refund?

Take an example to understand the calculation mechanism:

|

Financial Year |

Assessment Year |

Due date of filing ITR |

ITR filed on |

Refund Granted on |

Interest on IT refund |

|

2021-22 |

2022-23 |

31st July 2022 |

27th July 2022 |

15th Sep. 2022 |

6 months |

|

2021-22 |

2022-23 |

31st October 2022 |

29th October 2022 |

28th November, 2022 |

8 months |

|

2021-22 |

2022-23 |

31st July 2022 |

5th August 2022 |

15th Sep. 2022 |

2 months |

|

2021-22 |

2022-23 |

31st October 2022 |

7th November 2022 |

11th January 2023 |

3 months |

Is interest on income tax refund taxable?

Income Tax Refund is not taxable but interest earned on income tax refund by the taxpayer is taxable in the year in which tax refund is received by the taxpayer. Interest on Income Tax Refund is shown in the ITR under the head “Income from other Sources”.