Corpus Donation Letter Format

Donations received by a trust is taxable under the provisions of Income Tax Act, 1961. But this was not the case with ‘Corpus Donation’ till Financial Year 2020-21. However, from F.Y. 2021-22, an important change has been introduced by Finance Act, 2021 with regard to taxability of corpus donation. In this article, we are not discussing the amendments made by Finance Act, 2021. Rather, we will simply discuss the term ‘Corpus Donation’. Further, we will share the format of corpus donation letter which is required by most of the donors quite frequently.

Online Society Registration in Rajasthan

Click this link to avail society registration services from the experts: https://www.taxwink.com/service/society-registration-rajasthan

What is Corpus Donation under Income Tax Act?

It will be very surprising for you to know that ‘Corpus Donation’ is not defined anywhere in the Income Tax Act. So, we will understand the meaning of ‘Corpus Donation’ in general sense.

- In simple words, ‘Corpus Donation’ is a donation of permanent nature and somewhat like capital of an organization. Not every donation received by a trust is a corpus donation.

- A donation qualifies as a ‘Corpus Donation’ only when the donor makes a specific direction that such donation should form part of the corpus of the organization. If no such direction is given by the donor, the donation shall be treated as ‘voluntary contribution’ or general donation for the purpose of Income Tax Act.

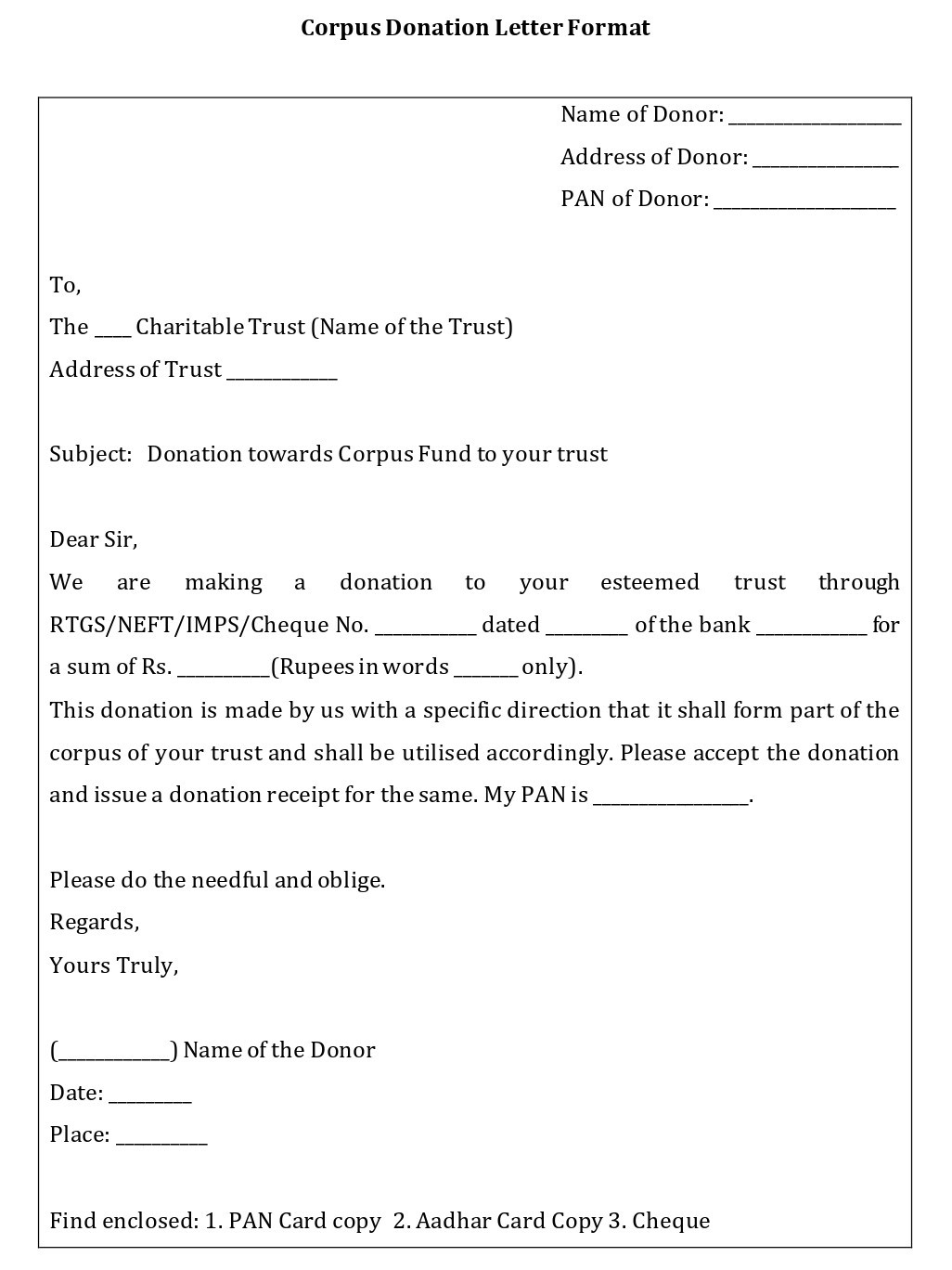

Thus, you will be needing the format of declaration for making corpus donation. The format is given below:

Corpus Donation Letter Format