CBDT notifies Cost Inflation Index for the Financial Year 2024-25

Do you know that the sale of any capital asset like land or building, jewellery etc. is subjected to capital gains tax under the provisions of the Income Tax Act, 1961. Capital gains can be classified into two:

- Long Term Capital Gains

- Short Term Capital Gains

Capital Gains is calculated by subtracting cost of acquisition and cost of improvement from the sale proceeds of the capital asset. However, where an asset is sold after being kept for a long period of time, the Government allows adjustment of inflation effect to the cost of acquisition & cost of improvement. This helps in calculating capital gains in real terms which is known as “Long Term Capital Gains”

For this purpose, the Government notifies “Cost Inflation Index” for every financial year. Cost Inflation Index adjusts the purchase price of assets to account for inflation, thus, ensuring that the taxpayers are taxed on their real gains rather than the nominal gains inflated by general price rise.

We can say that:

Long Term Capital Gains =

Sales Proceeds of the Capital Asset

Less: Indexed Cost of acquisition

Less: Indexed Cost of Improvement

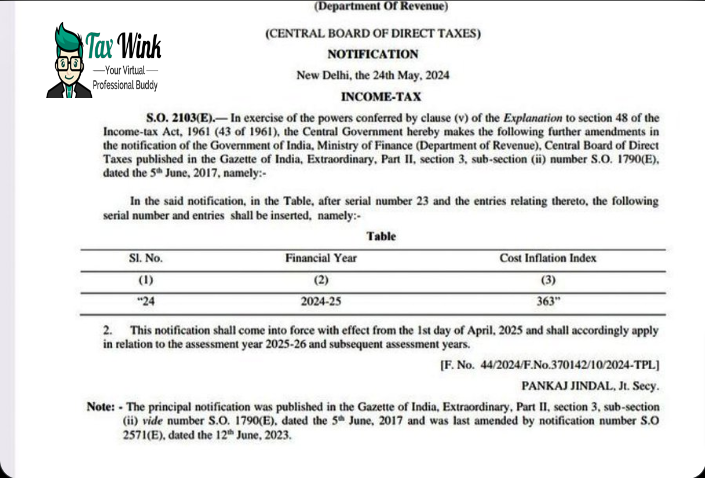

The Central Board of Direct Taxes (CBDT) has issued Notification No. 44/2024 dated 24th May 2024 for notifying the Cost Inflation Index for the Financial Year 2024-25 (Assessment Year 2025-26). According to this Notification, the Cost Inflation Index for F.Y.2024-25 shall be 363. This notification will come into effect on April 1, 2025 and will apply to the assessment year 2025-26.

The Original Notification is as follows: