All About LLP Incorporation

What is LLP in Actual?

LLP is a Limited Liability Partnership is a corporate business platform that provides the benefits of limited liability of a company to its members and also allows them to manage their internal management based on the mutually arrived agreement as in the case of a partnership firm.

A corporate business vehicle that enables professional expertise and entrepreneurial initiative to combine and operate in a flexible, innovative and efficient manner, providing benefits of limited liability while allowing its members the flexibility for organizing their internal structure as a partnership”

The Partners are required to contribute towards the LLP as specified in the LLP Agreement. Their share can be in any form i.e. tangible or intangible, movable or immovable property, monies, and cash.

In terms of liability under Limited Liability Partnership, the Company is liable for losses or debts if arise in running the business where the individual members of the LLP shall not be liable for such losses or debts.

What are the features of LLP Incorporation?

-

Partners Criteria: Minimum of 2 partners are required to form an LLP as per Section 6(1) of the Limited Liability Partnership Act, 2008. However, there is no limit on the maximum number of partners.

-

Contribution Requirement: No requirement of Minimum Capital Contribution.

-

Liability of Partners: The liability of Partners is limited to their contribution of share in the business. A partner is liable for his wrongful acts. One Partner is not responsible for the acts of others due to negligence or misconduct.

-

Legal entity- LLP is a body incorporated and a legal entity separate from its partners having perpetual succession as per Section 3 of the Limited Liability Partnership Act, 2008.

-

Audit of Accounts from Professionals: LLP shall maintain annual accounts where an audit of the accounts is required only if the contribution exceeds Rs. 25 lakh or annual turnover exceeds Rs. 40 lakhs.

-

Admission or Retirement of Partner: LLP can continue its existence irrespective of changes in partners.

-

Designated Partners: LLP shall have two individuals as designated partners and one of them shall be a resident of India.

Who will be the Partners in an LLP

(a) An Individual unless disqualified

(b) A Body Corporate which includes:

- Indian Company

- Companies incorporated outside India

- LLP registered in India

- LLP incorporated outside India

The below mentioned cannot act as partners/designated partners in an LLP as they are not covered in the definition of Individual/body corporate

-

An individual, if he is of unsound mind by a Court of competent jurisdiction; is an undischarged insolvent, or he applied to be adjudicated as an insolvent and his application is pending.

-

A Minor

-

Corporation sole

-

Co-operative society

-

Trust (subject to certain exceptions as mentioned in the article)

-

Partnership firm

-

Association of person

-

Hindu Undivided family.

-

Other forms of unregistered business entities.

MCA Clarifications on who can be a partner in an LLP

As per MCA Circular No. 13/2013, it has been clarified that under Section 5 of the LLP Act, 2008 only an Individual or a Body Corporate may be a partner in a Limited Liability Partnership. A HUF cannot be treated as a Body Corporate for LLP Act, 2008. Therefore, a HUF or its Karta cannot become a designated partner in an LLP.

As per MCA Circular No. 37/2014, it has been clarified that in the case of a Trust which is registered under the regulations prescribed under the Securities & Exchange Board of India Act, 1992 viz. "Real Estate Investment Trust" (REIT) or "Infrastructure Investment Trust" (lnvlTs) or such other Trusts, it is not barred for a trustee, being a body corporate, to hold partnership in an LLP in its name without the addition of the statement that it is a trustee. It shall be noted that all other trusts, not formed according to the regulations prescribed by SEBI Laws do not qualify as a body corporate and hence cannot become a partner in LLP. |

Conversion of LLP into Company

A Partnership Firm and LLP can be converted into a company by following the prescribed rules and regulations.

Annual Filing Compliances of LLP

An LLP needs to file two basic forms to jurisdictional ROC

- Form 11: Annual Return Form needs to be file by 30th May every F.Y.

- Form 08: Statement of Accounts need to be file by 30th October every F.Y

The penalty of Rs. 100/- per day

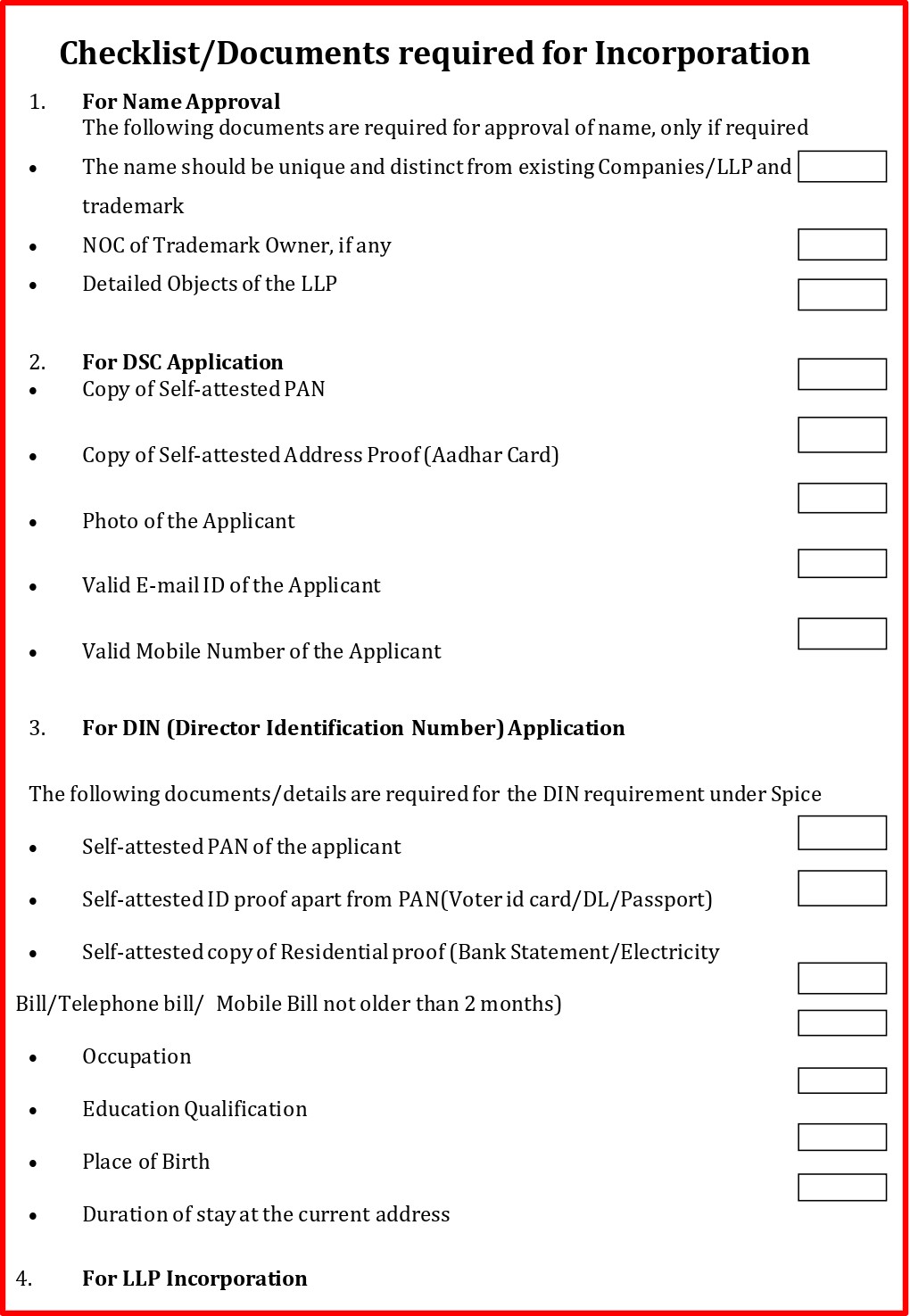

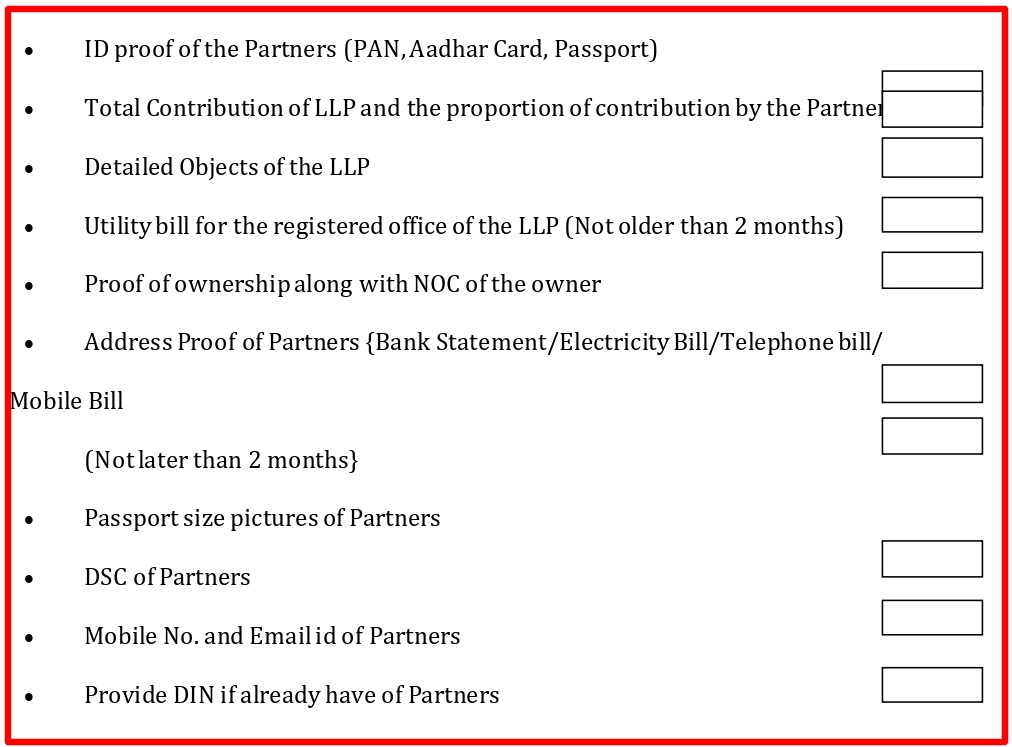

Checklist/Documents required for Incorporation

About Author:

The article is written by CS Vikash Verma who is an Associate Member of the Institute of Companies Secretaries of India having good experience in legal and secretarial matters. He specializes in providing services in Startup, RERA, Charity Commissioner- Trust matters, FDI-RBI, ROC-MCA, NCLT, and other services related thereto. He is a proprietor in Company Secretaries Firm M/s V Vikash & Co. He can be reached by mobile at 9785593575 or by email at: legalstickindia@gmail.com

Disclaimer: The above article is based on the opinion of the author and Taxwink is not responsible for the correctness of the content contained in this Article. Readers are requested to act diligently and under consultation with a professional before applying the information contained in this article.