E-invoicing in GST- Background and Applicability

The GST Council in its 37th meeting held on 20-09-2019 made recommendation for introducing e-invoicing in GST in a phased manner. Initially, the Government provided e-invoicing facility on a voluntary/ trial basis from 01st January 2020 and was to be then implemented for large businesses. However, the Government could not meet the expected deadline of e-invoicing implementation due to situations prevailing due to COVID-19 outbreak. Thus, the e-invoicing system has been made applicable w.e.f. 01st October 2020 initially for those taxpayers who are having annual aggregate turnover of more than INR 500 Crores.

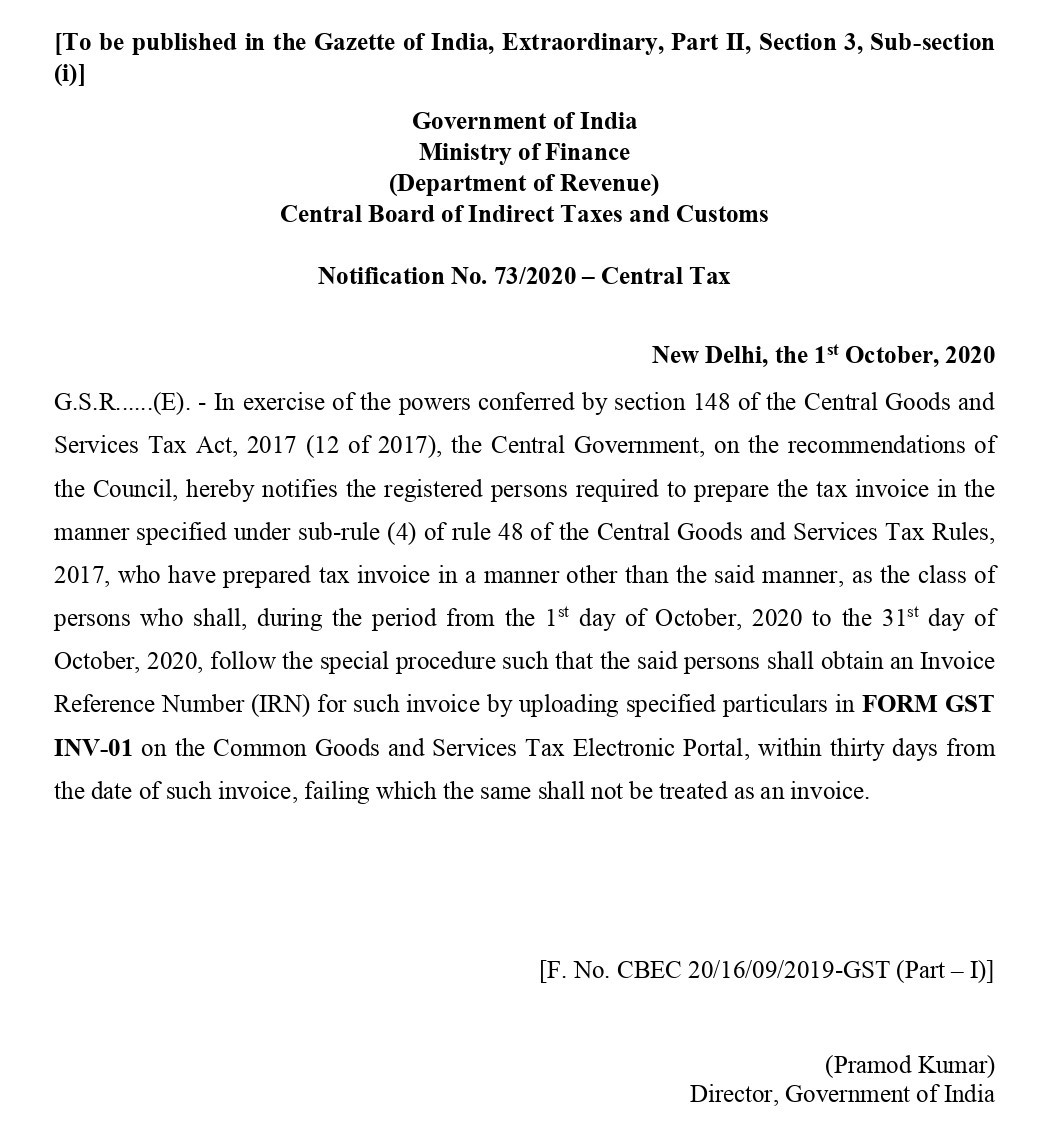

The Government later relaxed penal consequences on non-issuance of e-invoices by those taxpayers having aggregate turnover exceeding INR 500 Crores. In this respect, the Government issued a Notification No. 73/2020 dated 01st October 2020 which stated that:

“If any taxpayers (having aggregate turnover of more than INR 500 Crores) could not comply e-invoicing provisions for invoices during the period from 01-10-2020 to 31-10-2020, shall obtain an Invoice Reference Number (IRN) within 30 days of the date of invoice.”

Thereafter, the turnover limit of e-invoicing has been reduced by the Government in a phased manner bringing more and more taxpayers under e-invoicing compliances as follows:

|

Phases |

Applicable to taxpayers having an aggregate turnover more than |

Applicability Date |

Notification No. |

|

1 |

Rs. 500 Crores |

01-10-2020 |

61/2020- Central Tax |

|

2 |

Rs. 100 Crores |

01-01-2021 |

88/2020- Central Tax |

|

3 |

Rs. 50 Crores |

01-04-2021 |

05/2021- Central Tax |

|

4 |

Rs. 20 Crores |

01-04-2022 |

01/2022- Central Tax |

|

5 |

Rs. 10 Crores |

01-10-2022 |

17/2022- Central Tax |

|

6 |

Rs. 5 Crores |

01-08-2023 |

10/2023- Central Tax |

Note:

- E-invoicing provisions are applicable if the aggregate turnover of the taxpayer crosses the above thresholds in any of the financial year from 2017-18 and onwards.

- Aggregate Turnover shall include the turnover of all GSTINs under a single PAN across India.

- E-invoicing provisions are applicable only for B2B taxable supplies, B2G i.e. Business to Government supplies, supplies to SEZ (with or without payment of tax), exports (with or without payment of tax), deemed exports, stock transfers or supply of services to distinct persons and supplies under reverse charge.

- There are some categories of taxpayers who are not required to generate e-invoice even after crossing turnover thresholds namely G2B supplies, supplies by SEZ units (not developer), GTA, passenger transport service provider, services by way of admission to exhibition of cinematograph films in multiplex screens, local authority.

Disclaimer: The above article is based upon the FAQ issued by the Income Tax Department and is meant merely for educational purposes of the users. The article does not carry any corroborative value. Readers are advised to consult with an expert before applying the information contained in this article. Taxwink is not responsible for any loss or damage caused to any person due to use of any information contained in this article. For “User Support” please mail at: support@taxwink.com