CBDT extends due date for filing of Equalisation Levy Form-1 and other forms

- Due to the technical glitches in the new Income Tax Portal, the stakeholders were facing problems in filing of various forms electronically on the portal. Looking into the situation, CBDT has earlier extended various due dates of compliances under Income Tax Act, 1961. Due to continuing problems, CBDT has further extended the due date for filing Statement of Equalization Levy in Form No. 1 for F.Y. 2020-21 and various other forms vide Circular No. 15/2021 dated 3rd August, 2021.

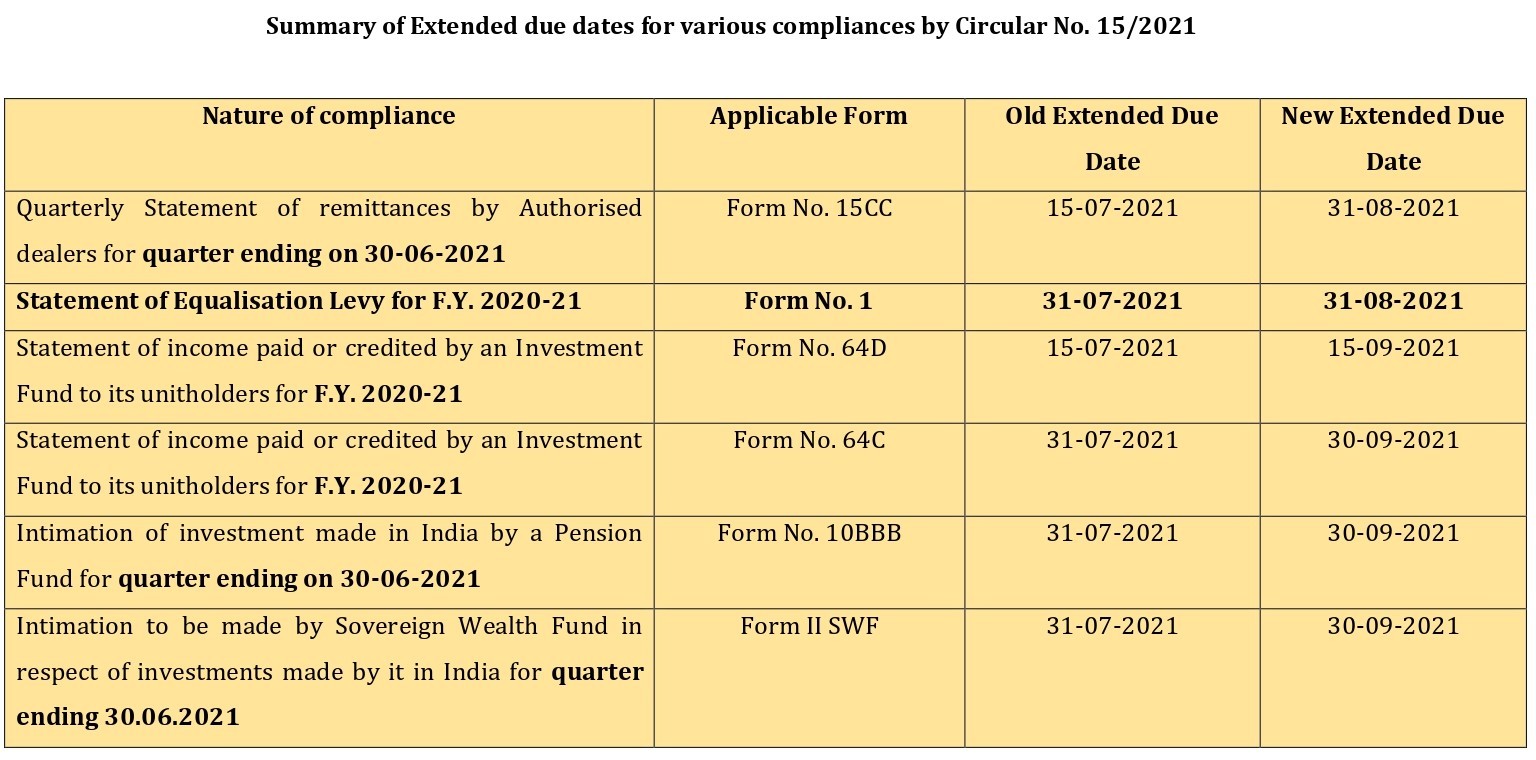

- It is to be noted that the original due date for filing of Form-1 for F.Y. 2020-21 was 30th June, 2021 which was already extended by 1 month to 31st July 2021 vide Circular No. 12/2021 dated 25/06/2021. Now, extension of due date for Form-1 has been made up to 31st August, 2021. Thus, Statement of Equalisation Levy in Form-1 for F.Y. 2020-21 can now be furnished up to 31st August, 2021. In addition to this, due dates of furnishing various other forms have also been extended. In this article, gist of various extended due dates vide Circular No. 15/2021 is given for the sake of convenience of the readers.

- One more important fact to note is that the above circular for extension has been brought after the expiry of due date of furnishing Form-1 i.e. 31st July, 2021. So, CBDT has also clarified that if any e-forms have already been submitted after 31st July, 2021 and up to 3rd August, 2021, those e-forms shall stand regularised and will not be considered as delayed filing.

Author’s Note:

Income Tax Portal has not been functioning in the manner as desired leading to various other non-compliances. The taxpayers are not able to file replies to scrutiny notices, form for appeal with CIT(A) etc. Further, OTPs are not generated on the portal leading to non-filing of various returns and forms available on the portal. Extension in due dates for filing for registration u/s 12AB & 80G is also expected as the forms have been made available with delay on the portal and the due date of 31st August, 2021 is approaching fast. Further, tab for Vivad Se Vishwas Scheme is nowhere available on the portal except filing of Form No. 3 of VSVS. The CBDT also need to look into these problems and come out with adequate extension of due dates in respect of aforesaid compliances.

Read Circular: Circular No. 15/2021 dated 3rd August, 2021

Circular No. 12/2021 dated 25/06/2021