Income Tax (CBDT) extends due date of filing various IT forms on 29-08-2021

The newly launched Income Tax Portal by the Income Tax Department is facing numerous technical glitches and the same is happening in the life of the taxpayers and tax professionals. For almost 3 months after the launch of the portal, the portal developer has failed to remove the glitches. Due to this, the taxpayers are not able to furnish various IT forms including Form 10A, Form 3 & 4 of Vivad Se Vishwas Scheme, 15CA & 15CB of last month, Form No. 1 etc.

Even there are technical problems in smooth filing of various IT returns which has hampered the taxpayers from submitting their tax declarations. Earlier, the CBDT had already extended the due dates of these forms looking into the persistent problems. Now, on 29th August, 2021, the CBDT has to again extend the deadlines for filing of various IT forms. However, no extension of due dates has been made in respect of Income Tax Returns which is also expected in due course.

The Board of Direct Taxes (Income Tax Department) vide Circular No. 16/2021 dated 29.08.2021, in exercise of its power under section 119 of the Income Tax Act, 1961 (hereinafter referred to as “the Act”) has issued circular with respect to:

Extension of time lines for electronic filing of various Forms under Income Tax Act, 1961

|

Nature of compliance |

Forms under Income Tax to be filed |

Original Due Date |

Extended Due Date |

Application for Registration/ provisional registration/ intimation/ approval/ provisional approval of trusts/ Institutions/ Research Associations etc. under section 12A, 80G, 10(23C), 35(1) |

Form No. 10A/ Form No. 10AB |

30-06-2021 (extended earlier to 31-08-2021) |

31-03-2022 |

Equalisation Levy Statement for the F.Y. 2020-21 |

Form No. 1 |

30-06-2021 (earlier extended to 31-08-2021) |

31-12-2021 |

Quarterly Statement to be furnished by the authorized dealer in respect of remittances made for the quarter ending on 30th June, 2021 |

Form No. 15CC |

15-07-2021 (earlier extended to 31-08-2021) |

30-11-2021 |

Quarterly Statement to be furnished by the authorized dealer in respect of remittances made for the quarter ending on 30th September, 2021 |

Form No. 15CC |

15-10-2021 |

31-12-2021 |

Uploading of Declarations received in Form No. 15G/15H for the quarter ending 30th June, 2021 |

Form No. 15G/15H |

15-07-2021 (earlier extended to 31-08-2021) |

30-11-2021 |

Uploading of Declarations received in Form No. 15G/15H for the quarter ending 30th September, 2021 |

Form No. 15G/15H |

15-10-2021 |

31-12-2021 |

Intimation to be made by Sovereign Wealth Fund in respect of investments made by it in India for quarter ending on 30th June, 2021 |

Form II SWF |

31-07-2021 (earlier extended to 30-09-2021) |

30-11-2021 |

Intimation to be made by Sovereign Wealth Fund in respect of investments made by it in India for quarter ending on 30th September, 2021 |

Form II SWF |

31-10-2021 |

31-12-2021 |

Intimation to be made by a Pension Fund in respect of each investment made by it in India for the quarter ending on 30th June, 2021 |

Form No. 10BBB |

31-07-2021 (earlier extended to 30-09-2021) |

30-11-2021 |

Intimation to be made by a Pension Fund in respect of each investment made by it in India for the quarter ending on 30th September, 2021 |

Form No. 10BBB |

31-10-2021 |

31-12-2021 |

Intimation by a constituent entity, resident in India, of an international group, the parent entity of which is not resident in India for the purpose of section 286(1) |

Form No. 3CEAC (Rule 10DB) |

30-11-2021 |

31-12-2021 |

Report by a parent entity or an alternate reporting entity or any other constituent entity, resident in India, for the purposes of section 286(2)/ 286(4) |

Form No. 3CEAD |

30-11-2021 |

31-12-2021 |

Intimation on behalf of an international group for the purposes of the proviso t sub-section (4) of section 286 of the Act |

Form No. 3CEAE |

30-11-2021 |

31-12-2021 |

Read the Circular on the following link:

Circular No. 16/2021 dated 29th August, 2021

Last date of filing Form No. 10A

- The most important extension of all the above deadlines is in the case of Form No. 10A to be filed by the existing trusts/ institutions/ research associations in respect of renewal of their registration u/s 12A/80G/35.

- Form No. 10A which was earlier required to be filed by 30th June, 2021 (extended till 31-08-2021) can now be filed till 31st March 2022. This has come as a big relaxation for millions of stakeholders who were not able to comply the law due to technical glitches on the portal.

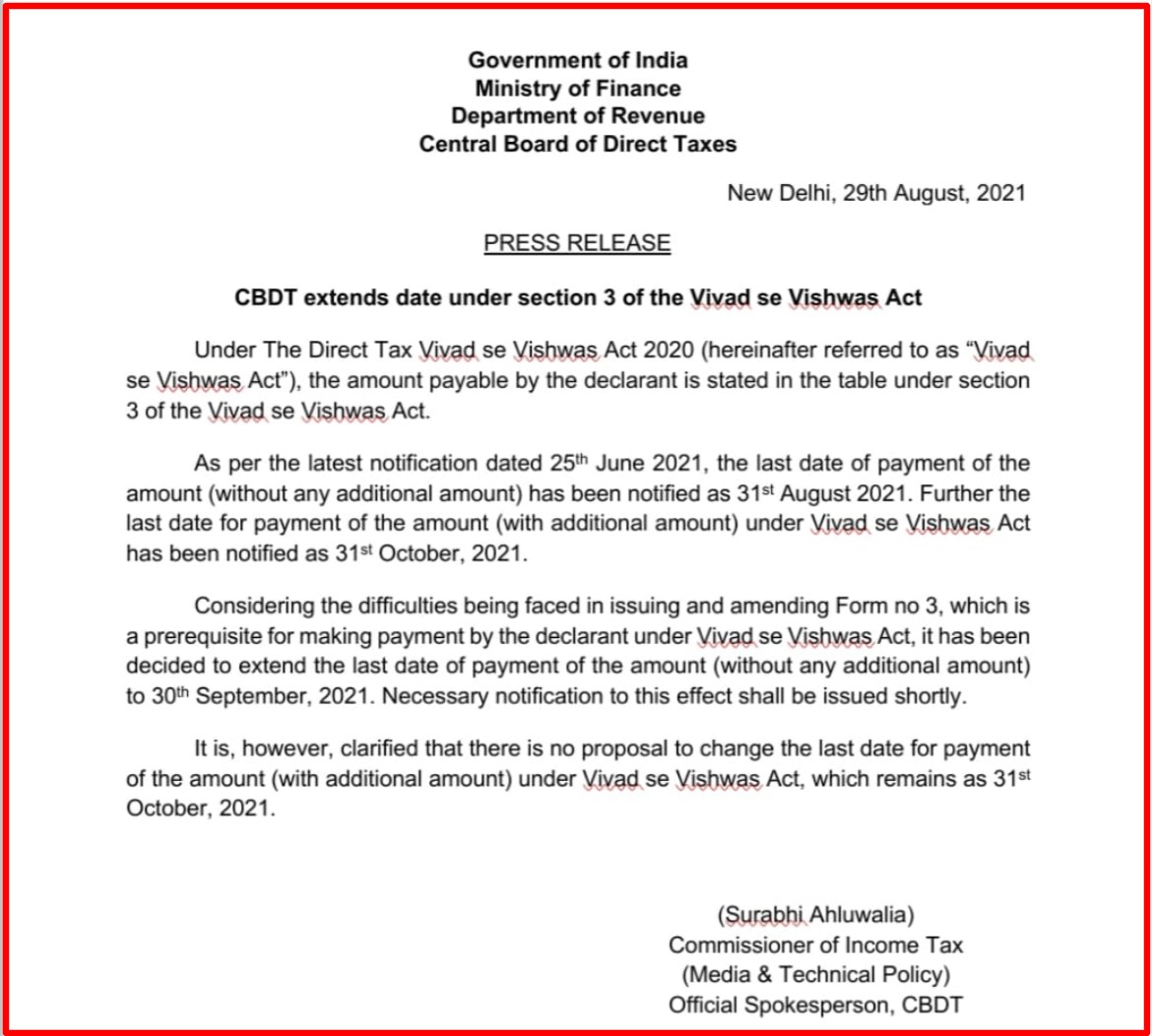

Last date of Vivad Se Vishwas Scheme extended

- The CBDT has made one more important extension which is not covered by Circular No. 16/2021. This is in respect of last date of payment under Direct Tax Vivad Se Vishwas Act (DTVSV).

- The CBDT has further extended the deadline for the payment of amount under Vivad Se Vishwas Act without any additional amount by a month till 30th September 2021. The earlier deadline for payment of the amount under the Act was 31st August, 2021.

- In the Press Release dated 29th August, 2021, the CBDT stated that the decision to extend the due date was taken considering the difficulties being faced in issuing and amending Form No. 3, which is a prerequisite for making payment by the declarant under the Vivad Se Vishwas Act.

- However, it has been clarified that there is no proposal to change the last date for payment of the amount with additional amount under Vivad Se Vishwas Act, which remains as 31st October, 2021.

Thus, the following are the deadlines in respect of Vivad Se Vishwas Act:

|

Nature of Compliance |

Due Date |

Extended Due Date |

|

Payment of Tax Amount without any additional amount under Vivad Se Vishwas Act |

31-08-2021 |

30-09-2021 |

|

Payment of Tax Amount with additional amount under Vivad Se Vishwas Act |

31-10-2021 |

No change: 31-10-2021 |

Source: CBDT Circular & Press Release