Form No. 10IE- Option to choose new income tax regime

The Finance Act 2020 introduced an optional tax regime under section 115BAC of the Income Tax Act to make taxation simple for taxpayers. This section gave an option to the taxpayers to choose between the old tax regime and new tax regime with lower tax rates. A taxpayer choosing new tax regime will be paying tax at lower rates but he will be denied various exemptions & deductions available under the Income Tax Act. Section 115BAC allows the option to individual and HUF taxpayers only to opt for new tax regime. Such option has to be exercised by the taxpayer by filing Form No. 10IE online on the Income Tax Portal before e filing of income tax return. The new tax regime has increased the confusions for the taxpayer rather than simplifying the things for them. In this article, we will make a comparison of tax rates between old and new tax regime and discuss how you can file Form No. 10IE and opt for new tax regime.

Comparison of Income Tax rates under old tax regime and new tax regime

|

Old Tax Regime |

New Tax Regime |

||

|

Slabs of Income |

Tax Rate |

Slabs of Income |

Tax Rate |

|

0 to 2,50,000 |

0% |

0 to 2,50,000 |

0% |

|

2,50,001 to 5,00,000 |

5% |

2,50,001 to 5,00,000 |

5% |

|

5,00,001 to 10,00,000 |

20% |

5,00,001 to 7,50,000 |

10% |

|

Above 10,00,000 |

30% |

7,50,001 to 10,00,000 |

15% |

|

|

|

10,00,001 to 12,50,000 |

20% |

|

|

|

12,50,001 to 15,00,000 |

25% |

|

|

|

Above 15,00,000 |

30% |

What are the deductions & exemptions not available under new tax regime?

The taxpayer has to forego the following deductions & exemptions if he opts for new tax regime:

|

Exemptions/ deductions from salary income for: House Rent Allowance, Leave Travel Allowance, Children Education Allowance, Hostel Allowance, Helper Allowance, Tribal Area & Border Area Allowance, Travelling Allowance, Food Coupons, Uniform Allowance, Leave Encashment, Reimbursement of medical expenditure, Daily Allowance, Entertainment Allowance, Professional Tax, Standard Deduction u/s 16 |

|

Interest on Housing Loan in respect of self-occupied property |

|

Deductions under Chapter VIA:

|

In addition to above, there are some other ineligible deductions if the taxpayer opts for new tax regime which are not discussed as of lesser relevance.

What are the eligible deductions & exemptions available in the new tax regime?

The taxpayer can choose the following deductions & exemptions if he opts for new tax regime:

|

From when the new tax regime is applicable?

The ‘New’ tax regime is applicable for F.Y. 2020-21 and subsequent years. It means that the taxpayers can opt for new tax regime for Assessment Year 2021-22 and onwards. Please note that new tax regime can be opted before ITR filing.

Who is eligible to opt new tax regime?

- Only Individual and Hindu Undivided Family (HUF) assesses are eligible to opt for new tax regime.

- If you want to opt for ‘New’ tax regime, you will have to communicate to Income Tax Department by filing intimation in Form No. 10IE.

How to intimate Income tax Department about opting ‘New’ tax regime?

- As discussed above, the taxpayer needs to file Form No. 10IE online on Income Tax portal to intimate the department about his/her choice to opt for new tax regime.

- Form 10IE is to be submitted before filing the income tax return for the relevant financial year.

What is the due date of filing Form 10IE?

The due date of filing Form 10IE are:

- Assessee having business income: Before the due date of filing ITR (generally 31st July unless extended)

- Other assessees: Before or at the time of filing ITR online (even after due date where ITR is filed belated)

Does the taxpayer have option to switch between the ‘old’ and ‘new’ tax regime every year?

|

Taxpayers having business income |

Taxpayer having no business income |

|

|

What are the information to be funrished in Form 10IE?

The following details are required to be entered in Form 10IE:

- Name of the individual or HUF

- Address & PAN

- Date of Birth/ Date of Incorporation

- Confirmation as to whether the assessee is having any income under head “Profits & Gains from Business or profession”.

- Nature of business or profession

- Confirmation whether the taxpayer has any unit in International Financial Services Centre (IFSC)

- Details of previous form 10IE filed (if applicable)

- Declaration

Important Note:

- Form 10IE shall be signed by the individual/ Karta of the HUF or authorised representative

- Form 10IE is to be verified by digital signature or Electronic Verification Code (EVC)

Steps to file Form 10IE online on the new Income Tax Portal

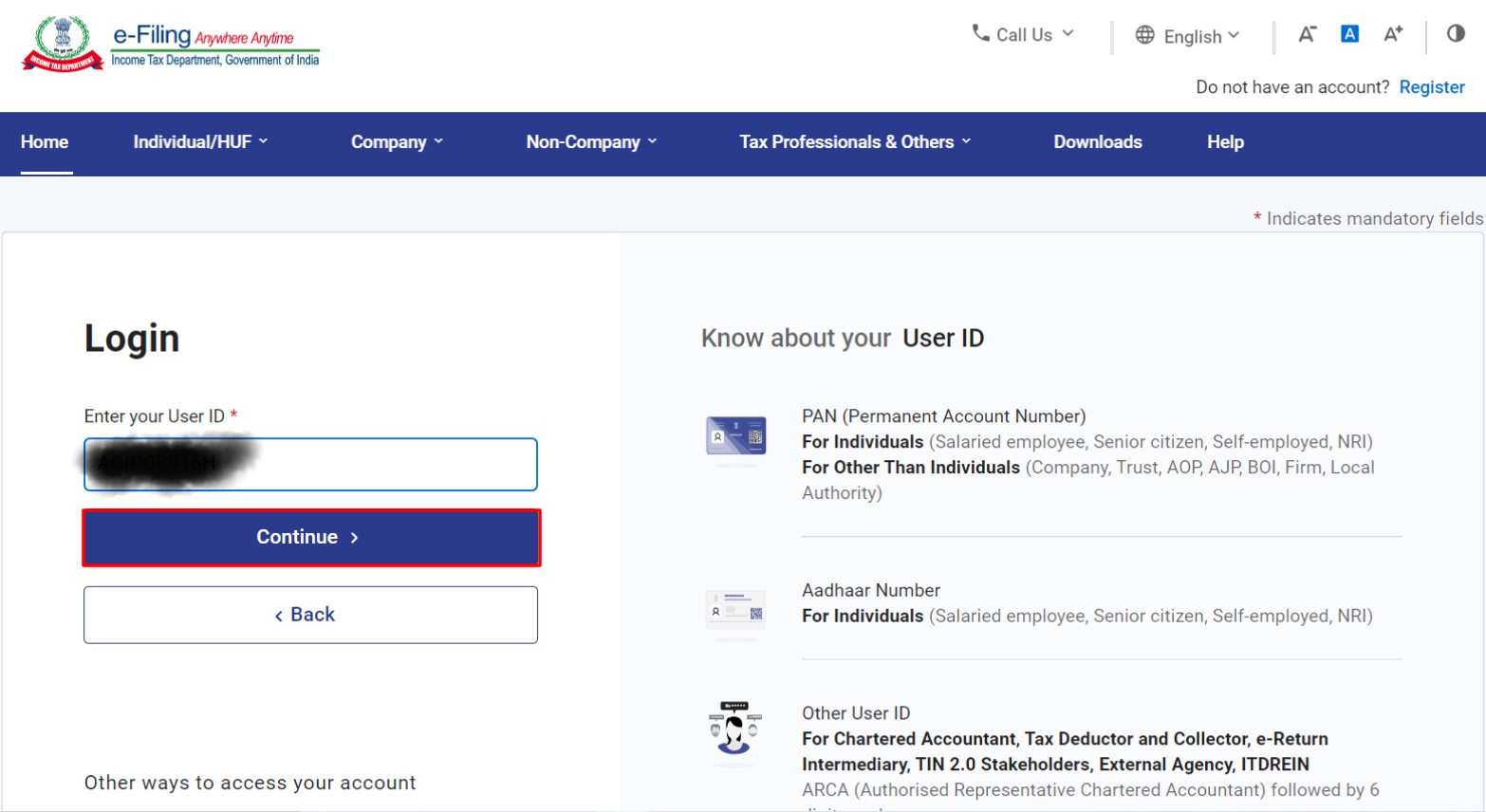

Step-I: Click on the following link to access Income Tax Login Account: https://eportal.incometax.gov.in/iec/foservices/#/login and enter your User Id (PAN) and click on ‘Continue’

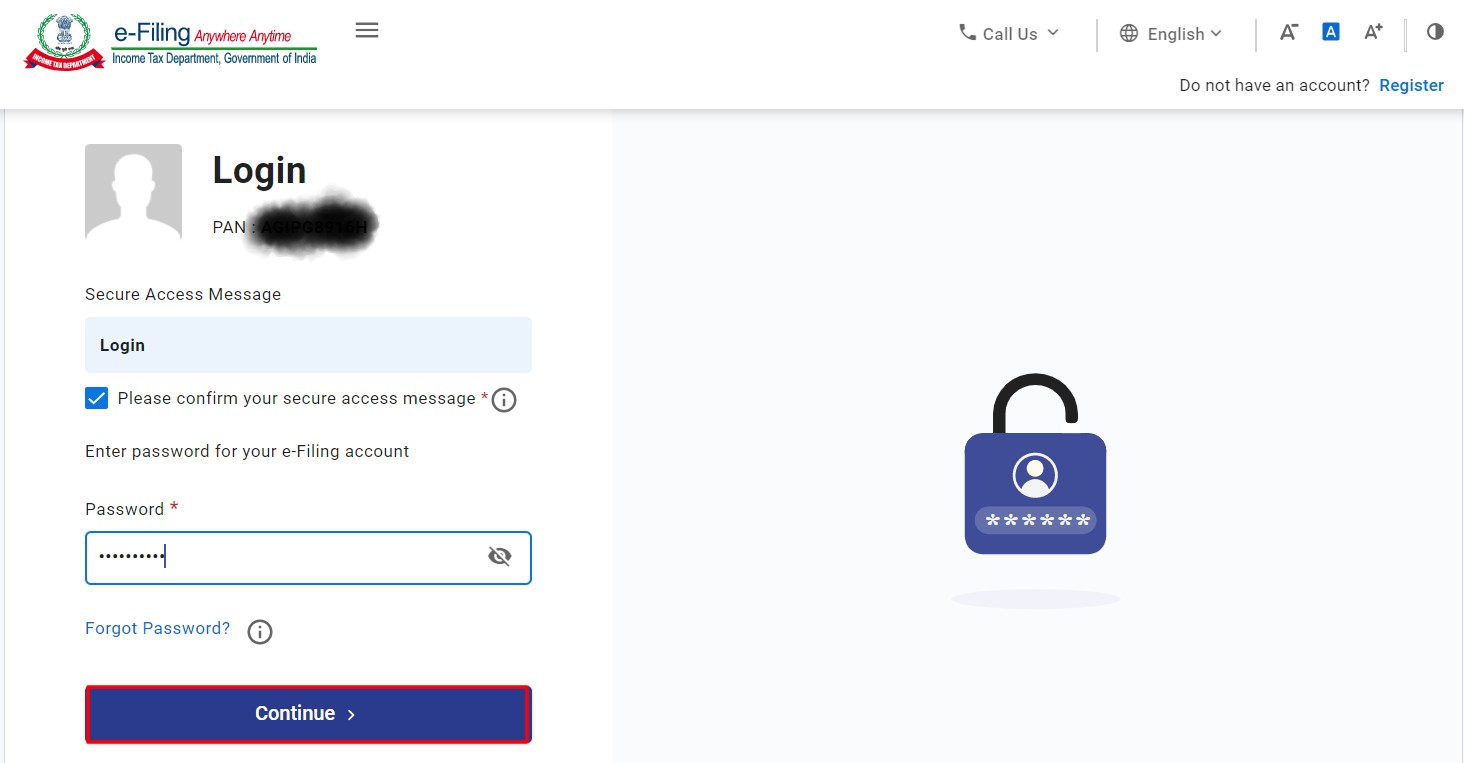

Step-II: Click on “Please confirm your secure access message” and enter login password and click on ‘Continue’ to enter Main Dashboard

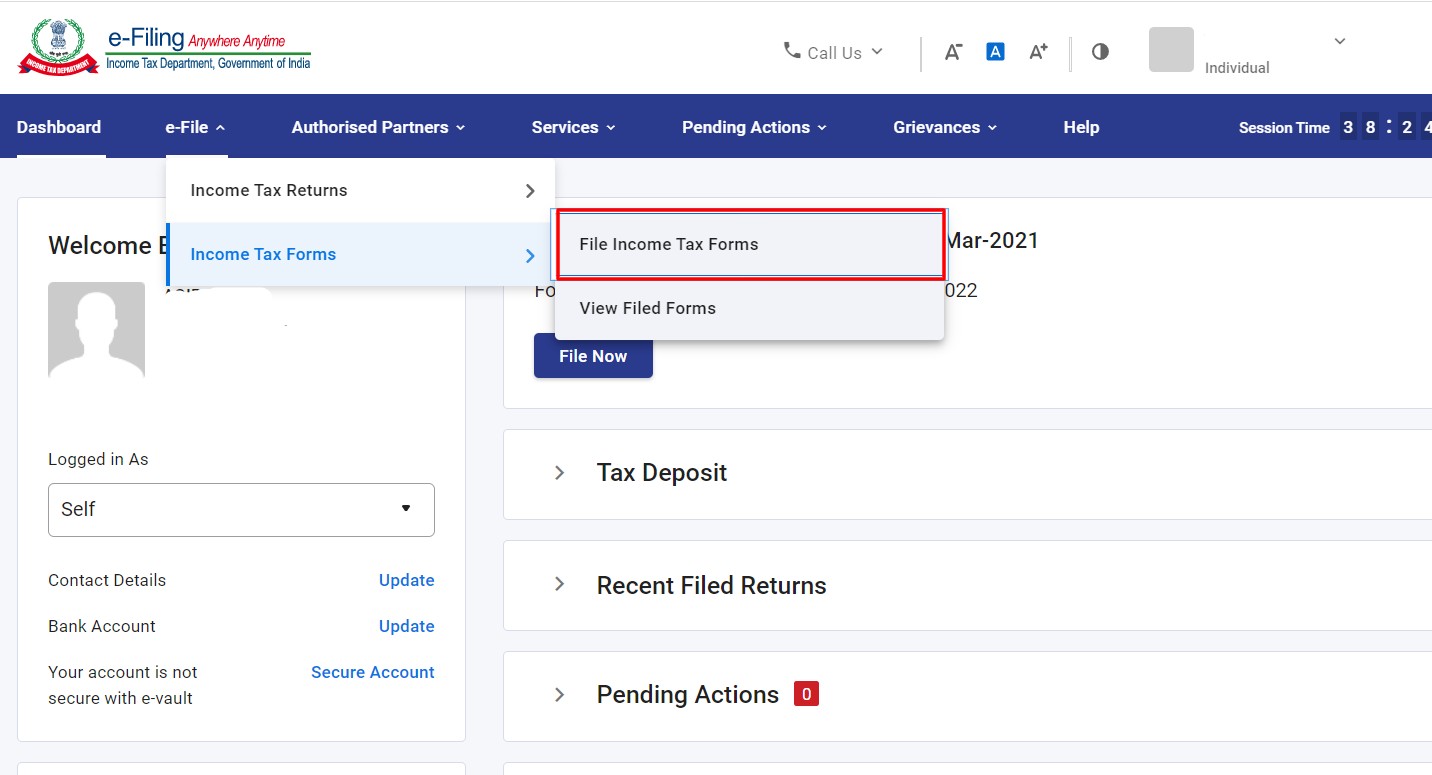

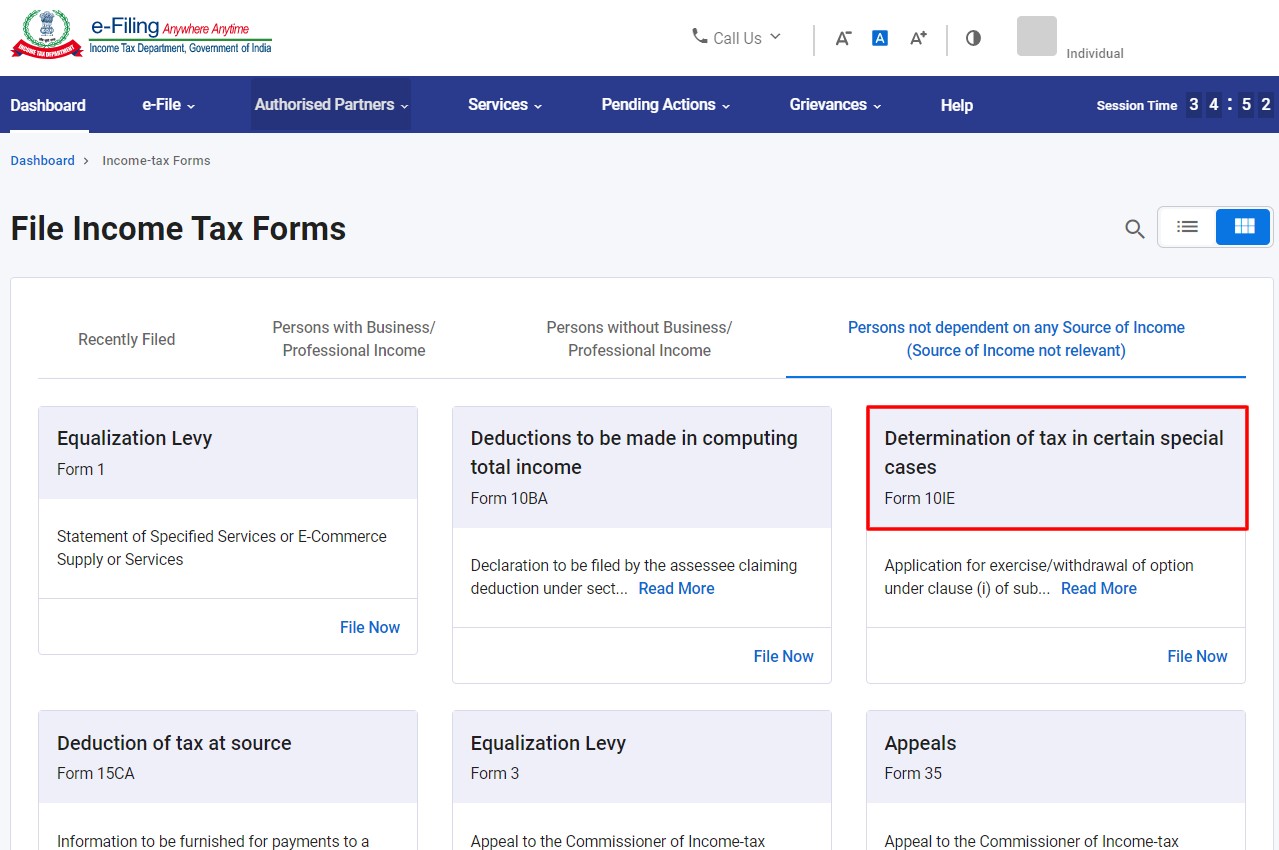

Step-III: Go to “E-file” tab<< Income Tax Forms<< File Income Tax Forms

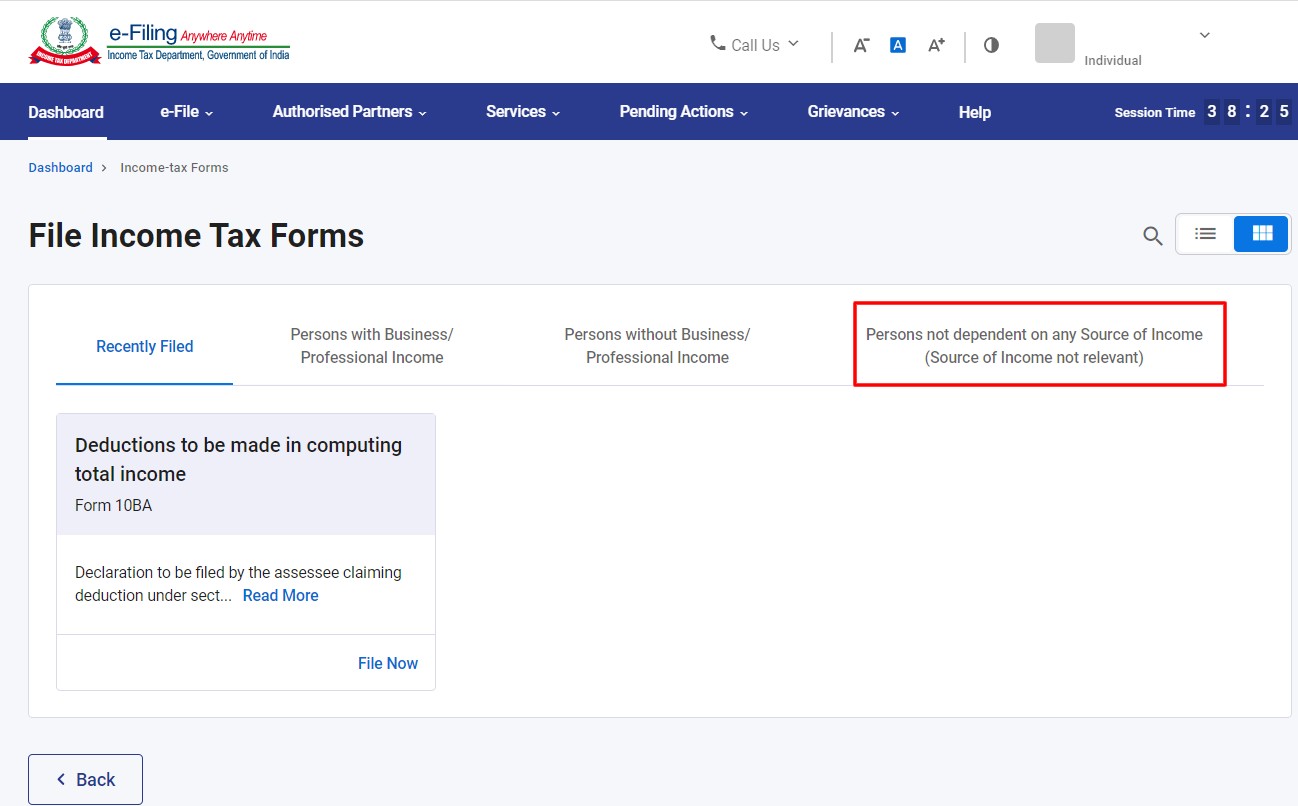

Step-IV: Under “File Income Tax Forms” select “Persons not dependent on any source of Income”

Step-V: Select “Determination of tax in certain special cases- Form 10IE”

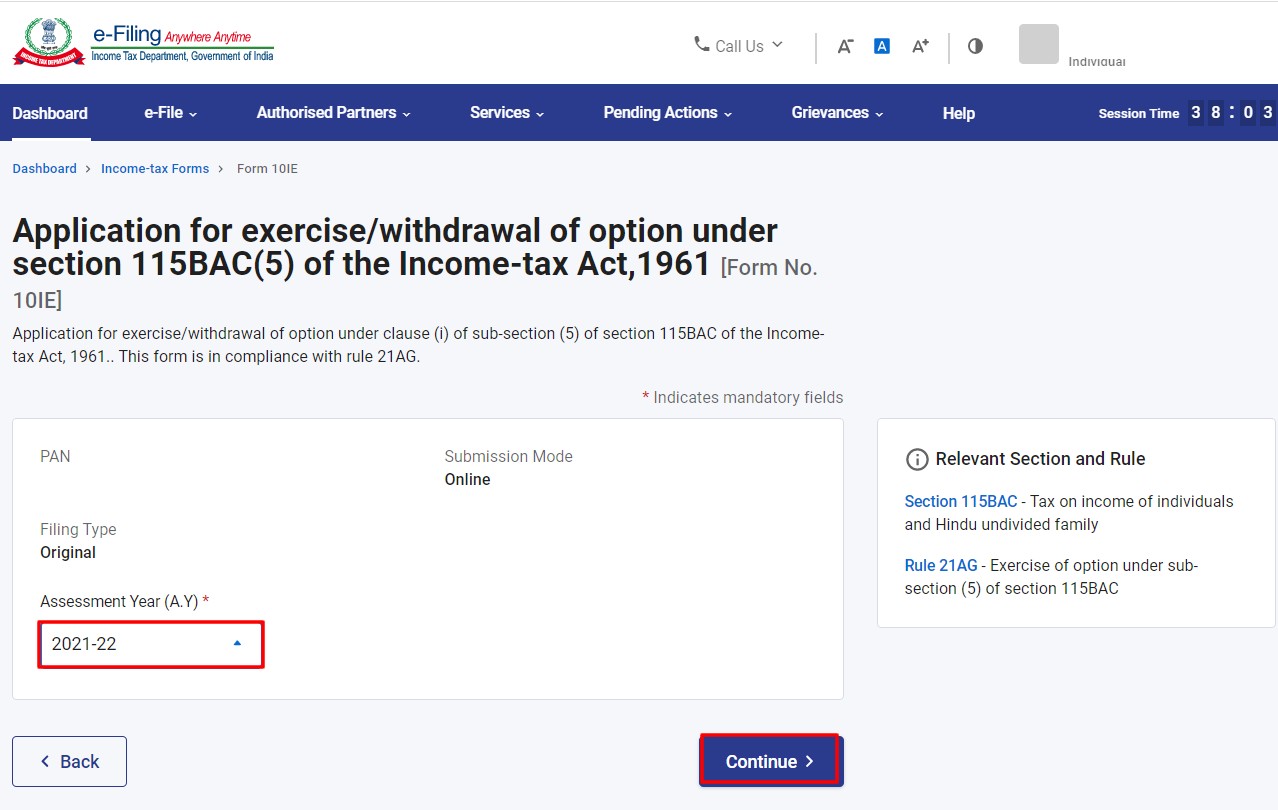

Step-VI: Under “Application for exercise/withdrawal of option under section 115BAC (5) of the Income Tax Act, 1961” select “Assessment Year” and click on “Continue”

Step-VII: Click on “Lets get started”. On clicking “Lets get started”, Form 10IE will open where you are required to submit the required information (also discussed above)

Step-VIII: After filling the form, ‘Submit’ the form using digital signature or electronic verification code.

Disclaimer: The information given above is only meant for informative purposes. Readers are therefore requested to act diligently and take advice of any expert before relying on the above information. Taxwink is not responsible for any loss or damage caused to reader acting on the basis of above article.