Is GST registration compulsory for inter-state supply of services

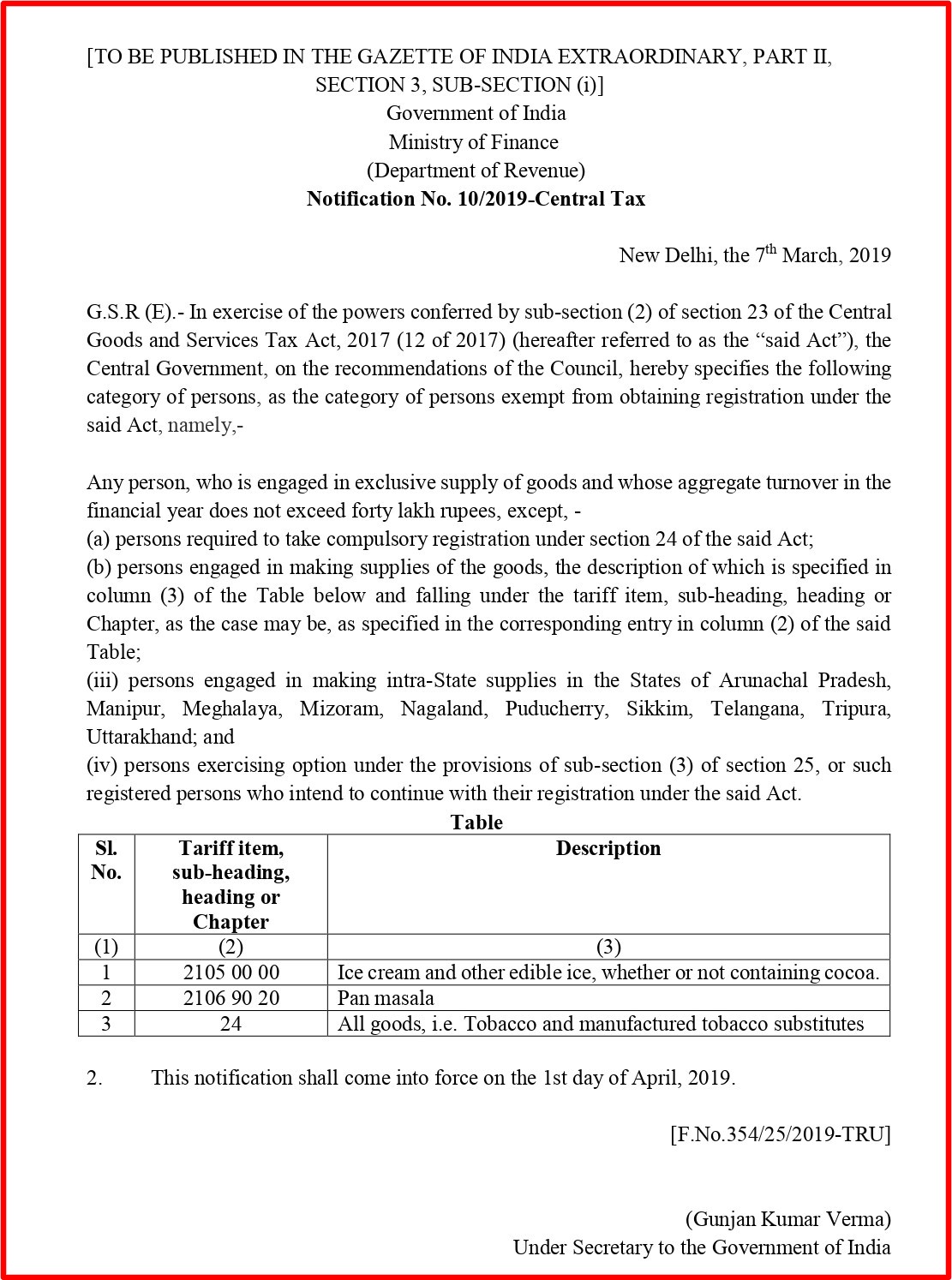

Goods & Services Tax (GST) has been implemented with effect from 1st July, 2017 subsuming almost all the indirect taxes prevailing in the country. The threshold limit for registration under GST was Rs. 20 Lakhs (Rs. 10 Lakhs in special category states) for both suppliers of goods & services initially. However, the threshold limit was later increased to Rs. 40 Lakhs for those suppliers who are exclusively engaged in supply of goods vide Notification No. 10/2019 dated 07.03.2019.

But following the said notification read with section 24 of CGST Act, the supplier of taxable goods making inter-state supply are still liable for compulsory registration under section 24 irrespective of turnover threshold.

Persons required to obtain compulsory GST Registration

|

Section- 24 lists following categories of persons who are required to obtain GST registration compulsorily:

|

Analysis of Section 24:

Analysis of section-24 from perspective of our topic makes clear two points:

- Firstly, if a person is making inter-state supply of goods or services, he is required to obtain GST registration compulsorily. The threshold limit of Rs. 40 Lakhs is not applicable in this case.

- Secondly, if a person is making any taxable supplies of goods or services through electronic commerce operator such as Amazon, Meesho, Urbanclap etc., GST registration is compulsory.

However, above scenario is quite harsh for small service providers as services are provided by a large number of freelancers, software professionals crossing the state boundaries. The GST Council recognised the concern of small service providers and allowed suitable exemptions for service providers from obtaining GST registration.

Inter-state supply of services up to Rs. 20/10 Lakhs allowed without GST registration

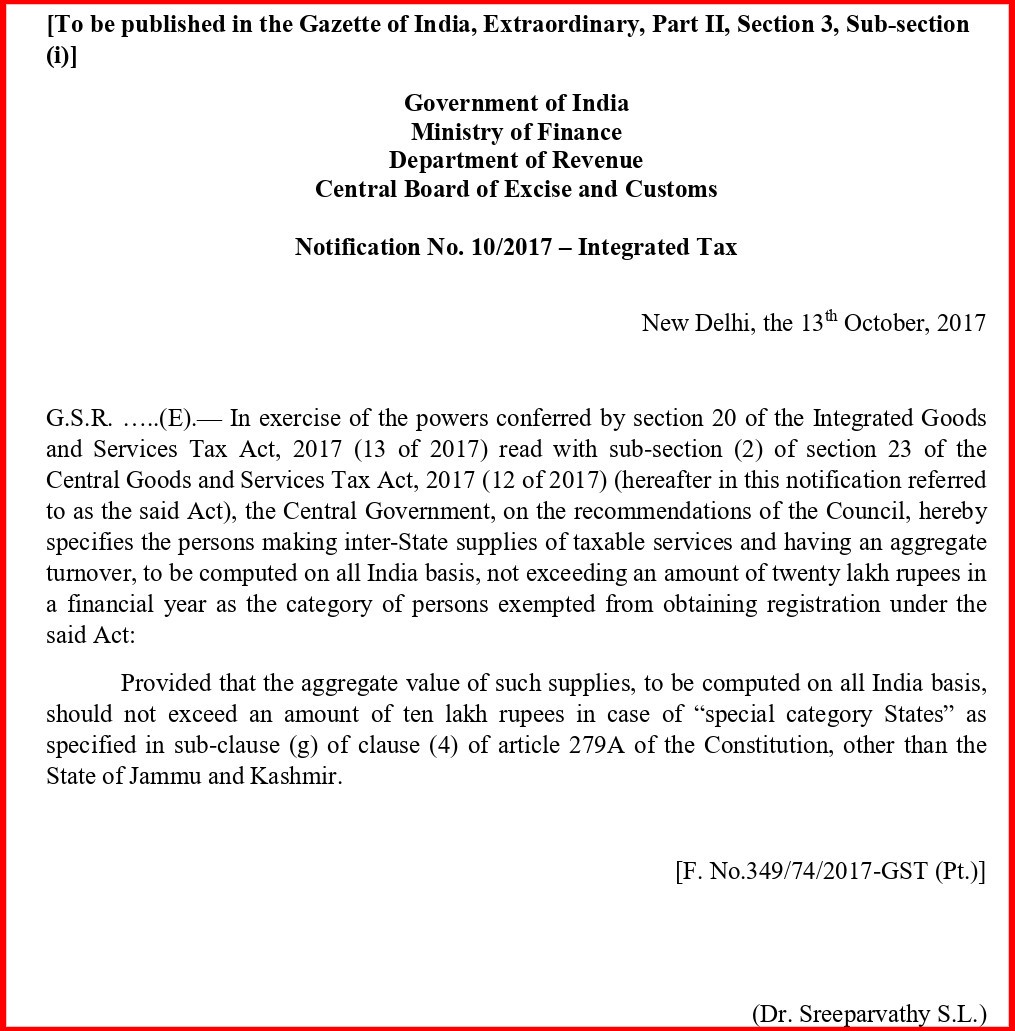

To address the concern of small service providers, CBIC issued Notification No. 10/2017- Integrated Tax dated 13/10/2017. This notification exempts service providers from obtaining GST registration in case of inter-state supply of services.

The important features of this Notification are as below:

- Persons making inter-state supply of taxable services and having all India PAN basis turnover up to Rs. 20 Lakhs in a financial year is exempted from obtaining GST registration.

- However, in the special category states, the turnover limit for exemption from compulsory GST registration in case of inter-state supply of services will be Rs. 10 Lakhs instead of Rs. 20 Lakhs.

- Following are the special category states where exemption limit is Rs. 10 Lakhs:

|

Arunachal Pradesh |

Assam |

Manipur |

|

Meghalaya |

Mizoram |

Nagaland |

|

Sikkim |

Tripura |

Himachal Pradesh |

|

Uttarakhand |

|

|

- Jammu & Kashmir has opted for threshold limit of Rs. 20 Lakhs.

Is inter-state supply of services through e-commerce operator liable for GST registration?

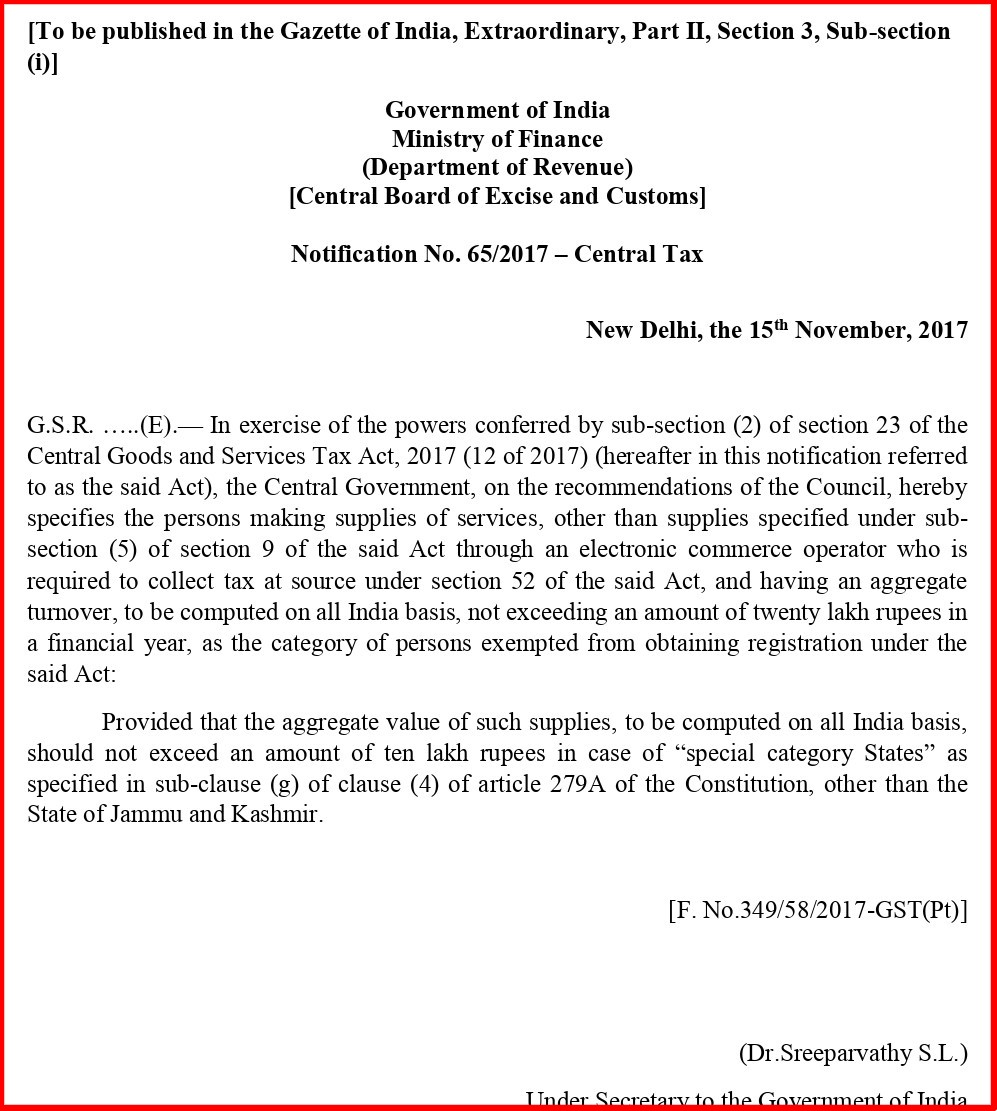

Vide Notification No. 65/2017- Central Tax dated 15/11/2017, if a person is making taxable supply of services (except notified supplies u/s 9(5)) through e-commerce operator and having aggregate turnover up to Rs. 20 Lakhs (Rs. 10 Lakhs for special category states) in a financial year has been exempted from obtaining compulsory GST registration. However, this relaxation is not available for supply of goods through e-commerce operators.

To conclude:

- Persons making inter-state supply of services are exempted from obtaining GST registration up to a turnover limit of Rs. 20 Lakhs (Rs. 10 Lakhs in special category states)

- Persons making taxable supply of services through e-commerce operators are not required to obtain compulsory GST registration up to aggregate turnover of Rs. 20 Lakhs (Rs. 10 Lakhs in special category states)

- Persons making inter-state supply of goods either directly or through e-commerce operator are liable for compulsory GST registration without any threshold limit.

Disclaimer: The above article is based upon the views of the author and the same should not be construed as the opinion of the ‘Taxwink’. This article is only for informative purposes and readers therefore, are requested to be diligent before acting on the basis of the above information. Taxwink is not liable for any loss or damage caused due to reliance upon the above article.

About Author: The Author is a Chartered Accountant practising for more than last 15 years with experience in the field of Income Tax, International Taxation and Indirect taxes. He can be reached at: 09660930417