Gold Storage Limit-How much gold can I keep at home in India

Introduction: The present NDA government led by Sh. Narendra Modi is quite aggressive against black money & trying hard to cultivate cashless economy. A large volume of black money is hidden by tax evaders in the form of investment in properties and gold jewellery. Therefore, the Income Tax Department is ought to question the gold jewellery found at the time of income tax raids. So, naturally a question comes to our mind that whether there is any limit of holding gold jewellery which will go undoubted by the Income Tax Department at the time of raids or surveys. The answer to this question is “Yes”.

Firstly, there is no limit on the quantum of gold jewellery or ornaments a citizen of India can own and hold. However, he/she must be able to explain the source of investment in such gold jewellery when asked to do so. If you are having valid invoices or sources substantiating the investment in gold jewellery, the Income Tax Department can not take any coercive actions against you.

Now, the next question strikes to our mind “What if we are not able to explain the source of investment in gold jewellery and fails to produce invoices of gold jewellery?”

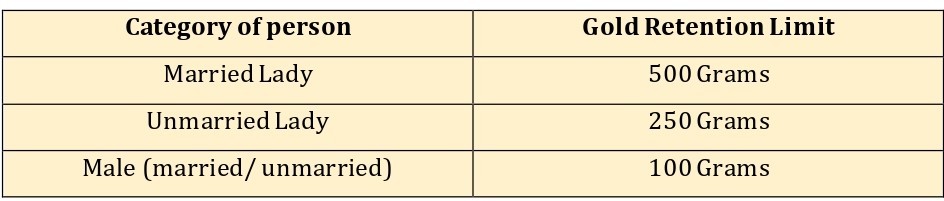

Even in this case, you are not required to be worried too much. CBDT has made clarification in this regard according to which any Indian citizen can hold the following quantity of gold jewellery and ornaments:

GOLD RETENTION LIMIT

CBDT has clarified that if any person is found to hold gold jewellery or ornaments up to the limits given above, it will not be seized even if prima facie it does not seem to be matching with the disclosed income records of that person. So, if you have gold jewellery/ ornaments to the extent of above limits, you need not be worried about the source of acquisition of such gold jewellery & need not be afraid of income tax raids.

Disclaimer: The above article is the opinion of the author and is meant only for informative purposes. The above information should not be construed as legal opinion and ‘Taxwink’ is not responsible for any loss or damage caused to any person on the basis of reliance on the above information.

Author: The author of the above article is CA Naveen Goyal who is having an experience of more than 15 years in the field of Income Tax, International Taxation & Indirect Tax (GST). He can be reached at: 09660930417