How to claim Unemployment allowance under "Atal Beemit Vyakti Kalyan Yojana”(ABVKY)

"Atal Beemit Vyakti Kalyan Yojana” is a welfare measure in the form of cash compensation for employees (Insured Persons) who have been in insurable employment for a minimum period of two years immediately before his/ her unemployment.

Eligibility

- Employee should be covered under Section 2(9) of the ESI Act 1948.

- The Insured Person (IP) should have been rendered unemployed during the period the relief is claimed.

- The Insured Person should have been in insurable employment for a minimum period of two years.

- The Insured Person should have contributed not less than 78 days during each of the preceding four contribution periods.

- The contribution in respect of him should have been paid or payable by the employer.

- The contingency of the unemployment should not have been as a result of any punishment for misconduct or superannuation or voluntary retirement.

- Aadhar and Bank Account of the Insured Person should be linked with insured person database

The relief amount:

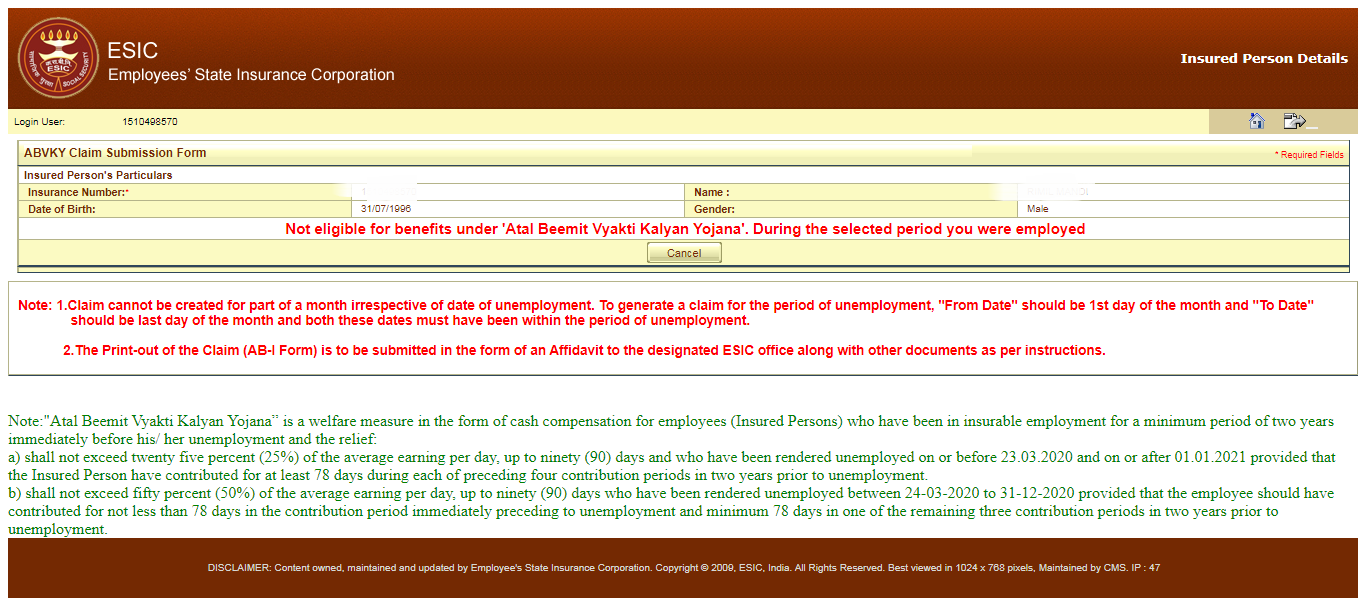

a) shall not exceed twenty five percent (25%) of the average earning per day, up to ninety (90) days and who have been rendered unemployed on or before 23.03.2020 and on or after 01.01.2021 provided that the Insured Person have contributed for at least 78 days during each of preceding four contribution periods in two years prior to unemployment.

b) shall not exceed fifty percent (50%) of the average earning per day, up to ninety (90) days who have been rendered unemployed between 24-03-2020 to 31-12-2020 provided that the employee should have contributed for not less than 78 days in the contribution period immediately preceding to unemployment and minimum 78 days in one of the remaining three contribution periods in two years prior to unemployment.

Please take care of following instructions while filing online claim form

ABVKY Claim cannot be created for part of a month irrespective of date of unemployment. To generate a claim for the period of unemployment, "From Date" should be 1st day of the month and "To Date" should be last day of the month and both these dates must have been within the period ofunemployment.

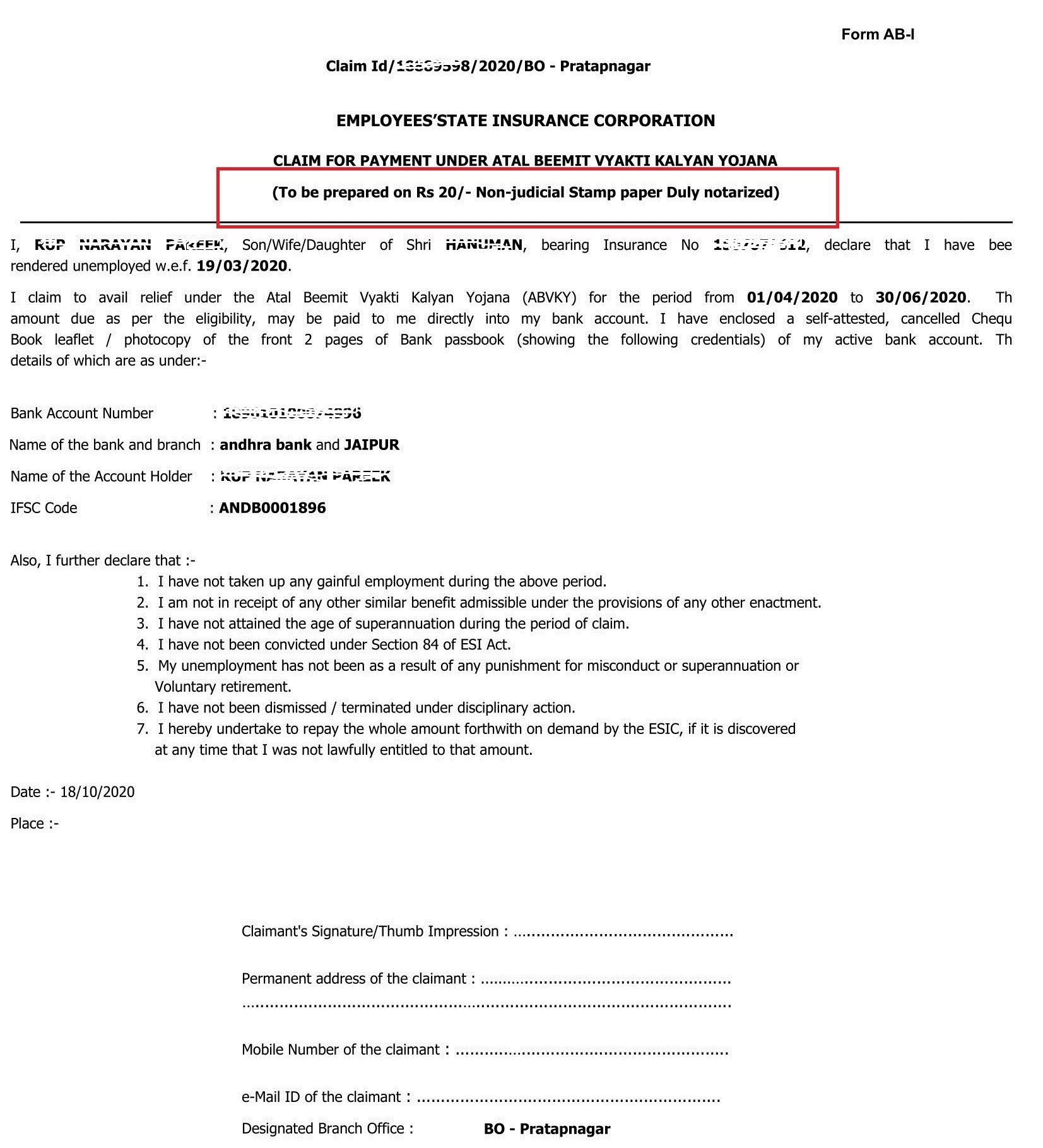

The Print-out of the Claim (AB-I Form) is to be submitted in the form of an Affidavit to the designated ESIC office along with other documents as per instructions.

For ABVKY claim creation follow steps given below

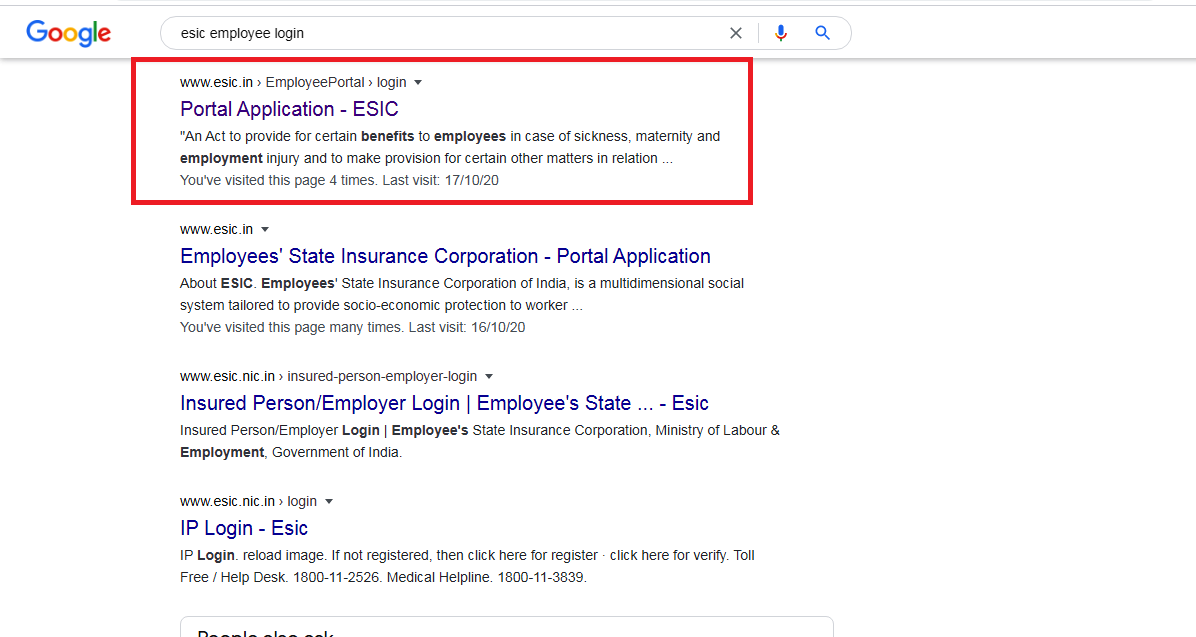

I Search “ESIC Employee Login” on web browser. Following Screen will appear

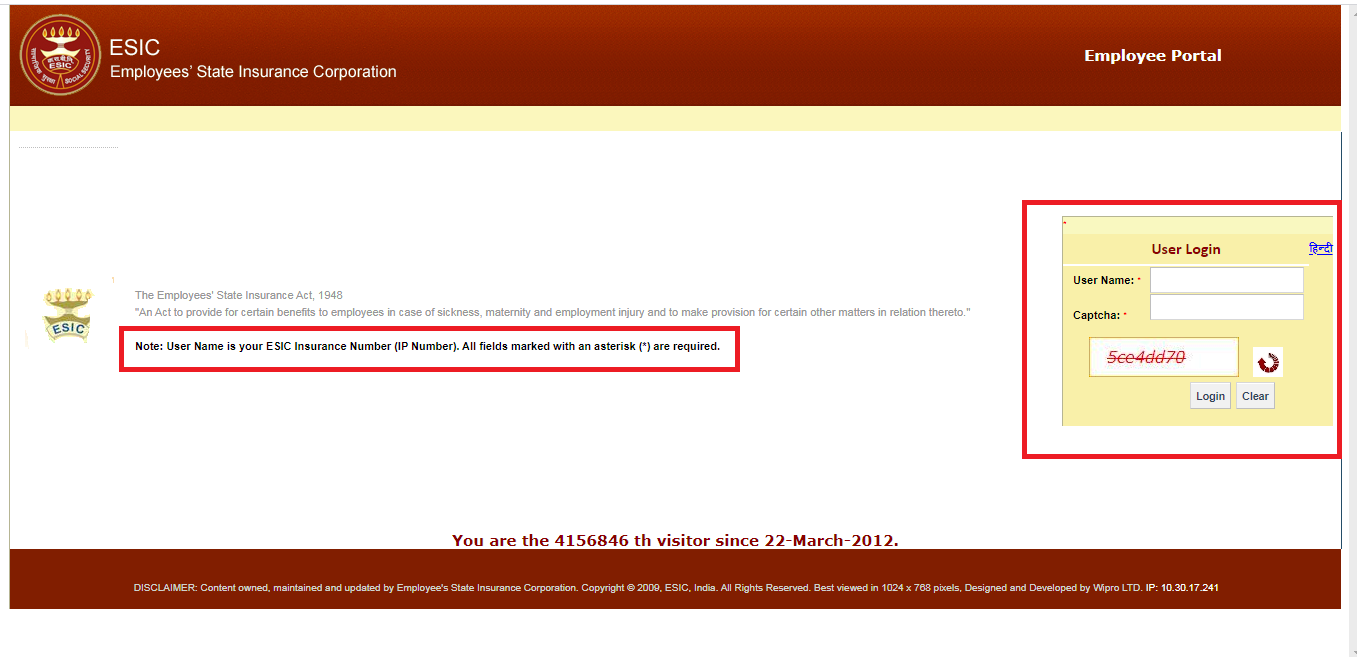

Click on the link shown in above picture and login using your IP no. commonly known as ESIC no.

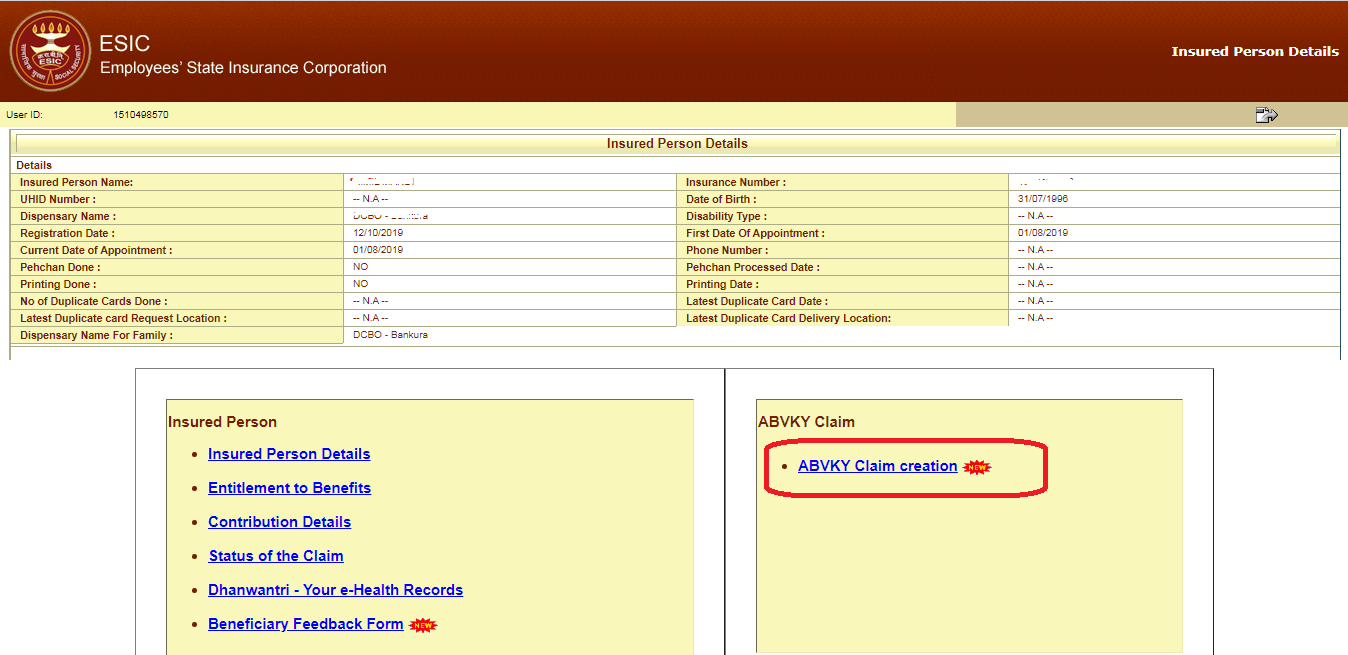

Step-3 After login you will be directed to home page of Employee login. Click on ABVKY Claim creation Tab as shown in picture

Step-4 If employee is not eligible for unemployment allowance under ABVKY Scheme then following screen will appear.

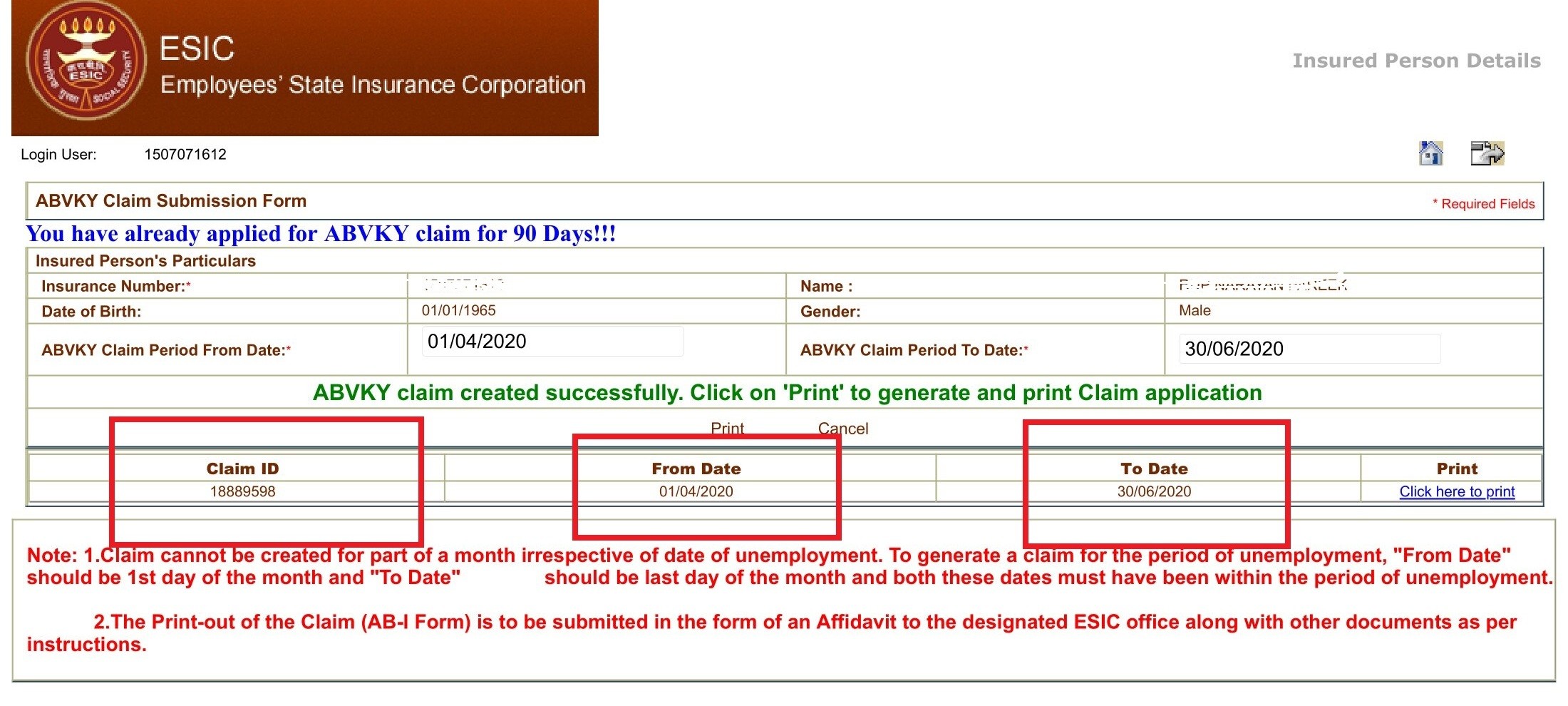

If employee is found eligible as per contributory and employment consition of scheme then he have to select and apply for claim. Please note that ABVKY Claim cannot be created for part of a month irrespective of date of unemployment. To generate a claim for the period of unemployment, "From Date" should be 1st day of the month and "To Date" should be last day of the month and both these dates must have been within the period of unemployment. After submitting claim following screen will appear.

Step-6 After clicking on Print Button as shown in below picture a prefilled claim will appear. Employee has to print that form on Rs. 20 Non judicial stamp paper and get that notarized and sign that form and have to attach self attested copy of Aadhar card, Bank passbook or Cancelled Cheque. Prefilled form will look like as under.

The Relief under ABVKY shall be paid/ payable by Branch Office to IPs directly in their bank account electronically only. In the event of death of IP, the amount of Relief under ABVKY shall be paid/ payable to his/her nominee/legal heir.

The bank account details of the claimant in the ESIC Database is a pre-condition for claiming this relief, but in case the bank account details of the claimant are not available in the ESIC Database or the IP has changed his bank account then the same may be authenticated by the Branch Manager on the basis of the canceled cheque leaf or the passbook of the bank account having name of the claimant on it, which the claimant will provide along with the claim for this relief.