How to download Form 26AS from TRACES?

Form 26AS is a consolidated annual statement, which provides a record of all tax-related informations for a financial year. It contains tax-related information of each taxpayer such as TDS deducted or TCS collected against his PAN, advance tax deposited by him, income tax refund, high value transactions reported in AIR etc. Form 26AS is PAN based i.e. a taxpayer can download his Form 26AS using his unique PAN allotted by Income Tax Department. Before filing ITR, it is advisable to view Form 26AS so that the details available in Form 26AS could be incorporated in the ITR and proper tax credit could be claimed.

Even NRIs can also view their Form 26AS if they have earned income in India and TDS has been deducted on it. But he must be having PAN allotted by Income Tax Department and also registered as user on the Income Tax Portal.

Form 26AS can be downloaded from TRACES website or by using net-banking facility of the authorized banks. In this article, we will discuss step by step “How you can download Form 26AS from TRACES”.

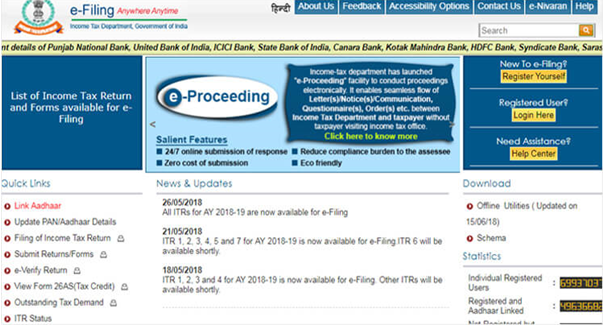

Step-1: -

Visit Income Tax India e-filing portal to download Form 26AS

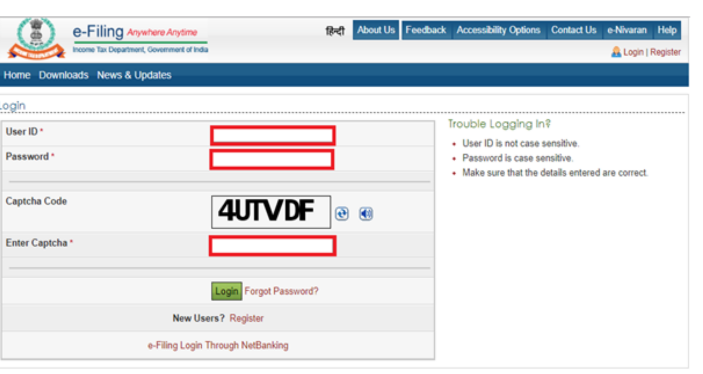

Step-2: - Enter User id (Your PAN number), Password, Captcha Code to login to your account

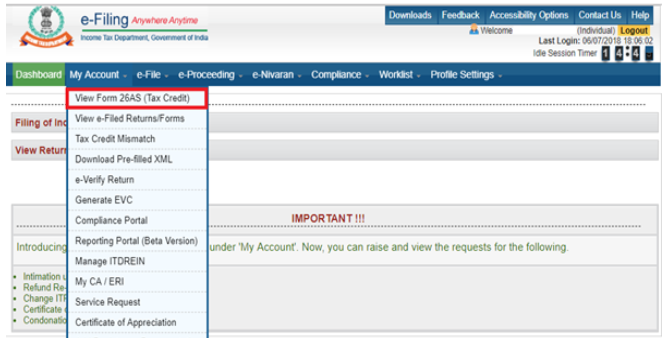

Step-3: - As you are logged in, the following screen will appear. Go to ‘My Account’ and click on ‘View Form 26AS’ in the dropdown menu

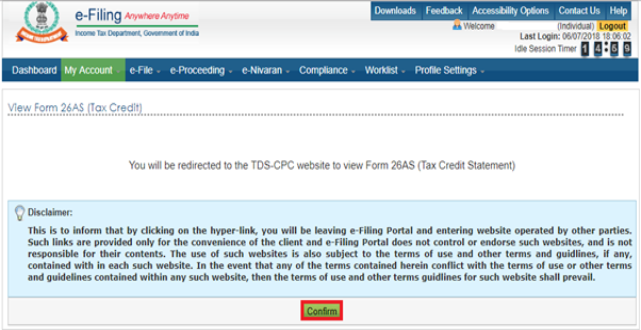

Step-4: - Click on ‘Confirm’. You will be redirected to the TRACES website. This is a Government website for management of TDS/ TCS activities.

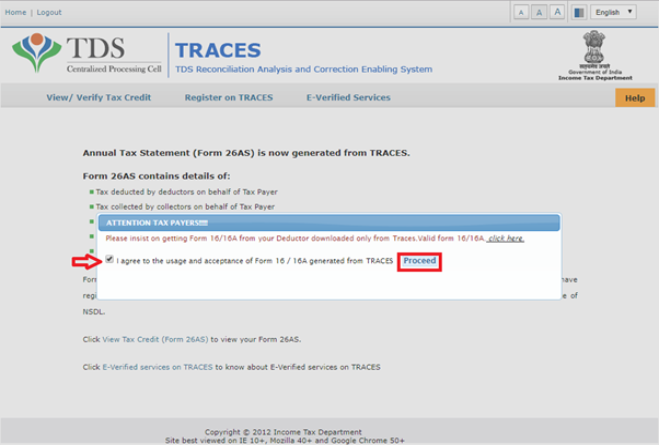

Step-5: - Now you are in TRACES website. Here, you have to agree to terms of usage and acceptance of Form 16/16A generated from TRACES and click on ‘Proceed’

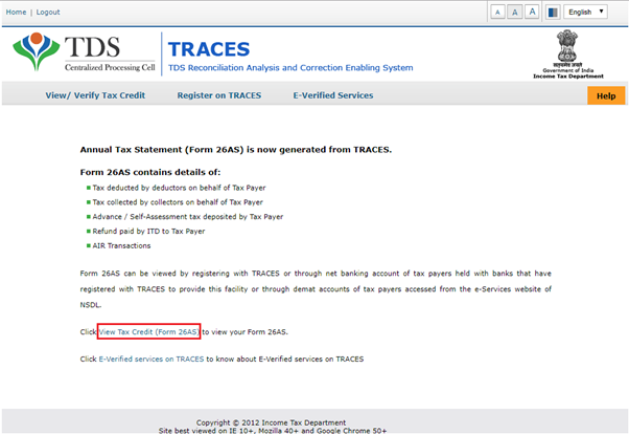

Step-6: - Click on ‘View Tax Credit (Form 26AS)’ to view your 26AS

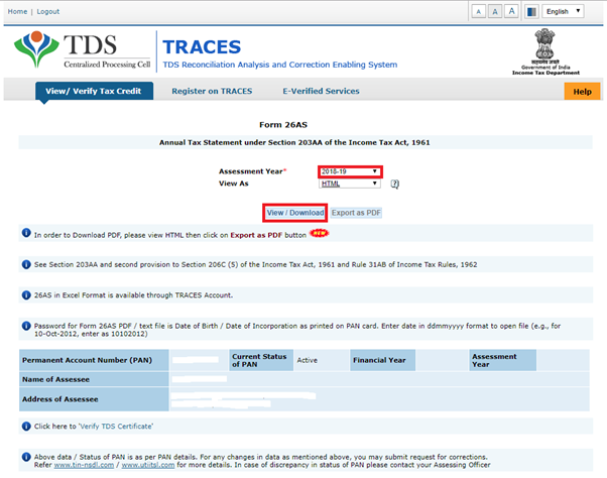

Step-7: - Select the Assessment year from the dropdown menu and the format (HTML/text) in which you want to see Form 26AS. You can also download Form 26AS in PDF format. After selecting the format (HTML/text), click on button ‘View/Download’

Step-8: - After download, you can open the Form 26AS. You will be required to enter password to open it. The password is your ‘Date of Birth’ in DDMMYYYY format. For example, if your date of birth is 14th January 1993 then your password will be 14011993.