How to Download ITR-V Acknowledgement on new Income Tax Portal

We are all aware that the Government has launched new Income Tax Portal from 07th June, 2021 and various features have been improvised and new features have been added to the Income tax website. One of the most important functionalities of the Income Tax portal is "Downloading ITR-V Acknowledgement" which is required to each and every taxpayer on day-to-day basis. In this article, step by step guide is given to let you know "How you can download ITR-V Acknowledgement on new Income Tax Portal".

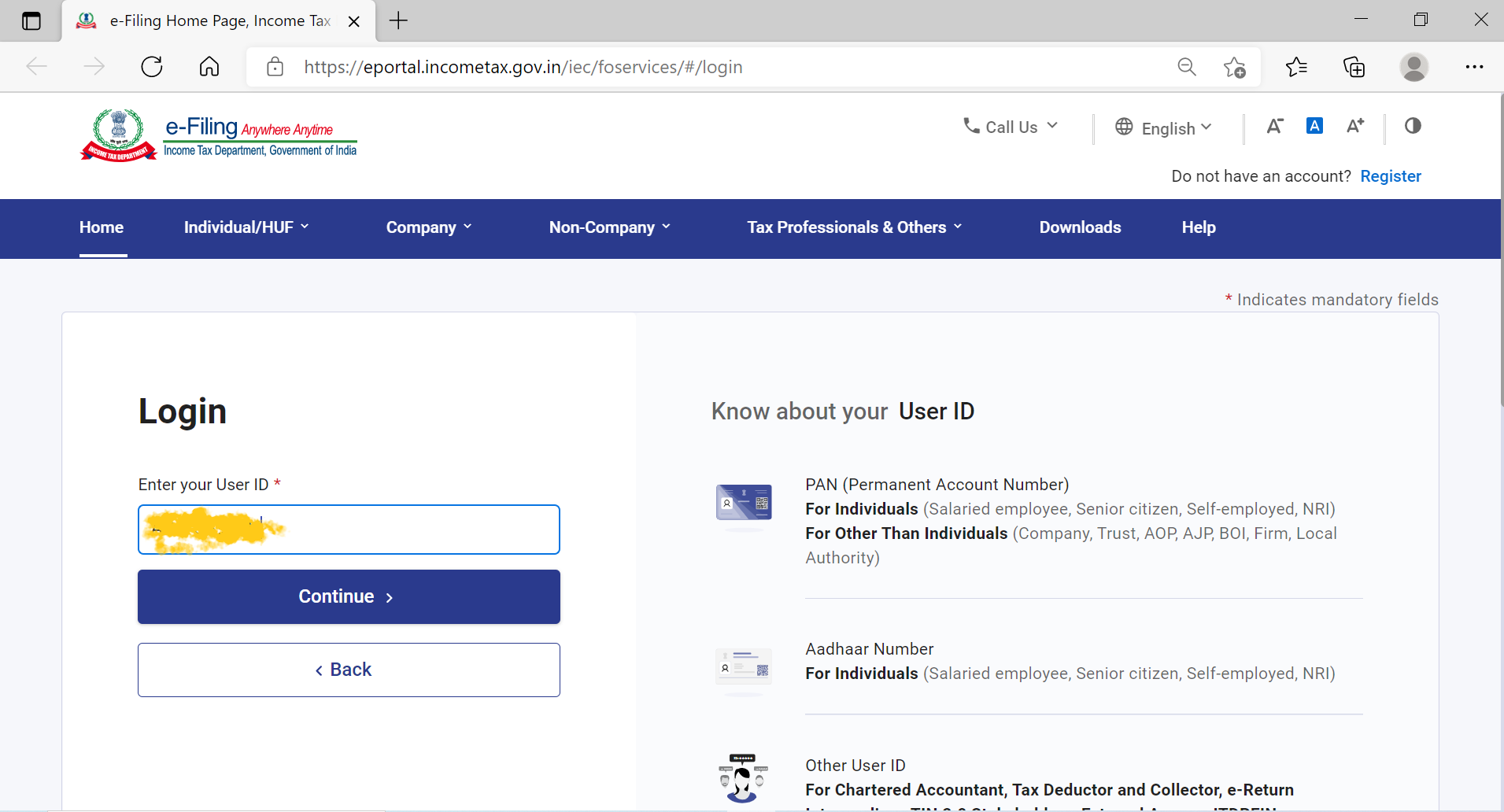

Step-I: Go to Income Tax Portal: www.eportal.incometax.gov.in and login by entering your PAN as your user-id and click on ‘continue’. One important feature has been added here- Now you can also login using your Aadhar numbers if PAN and Aadhar are linked

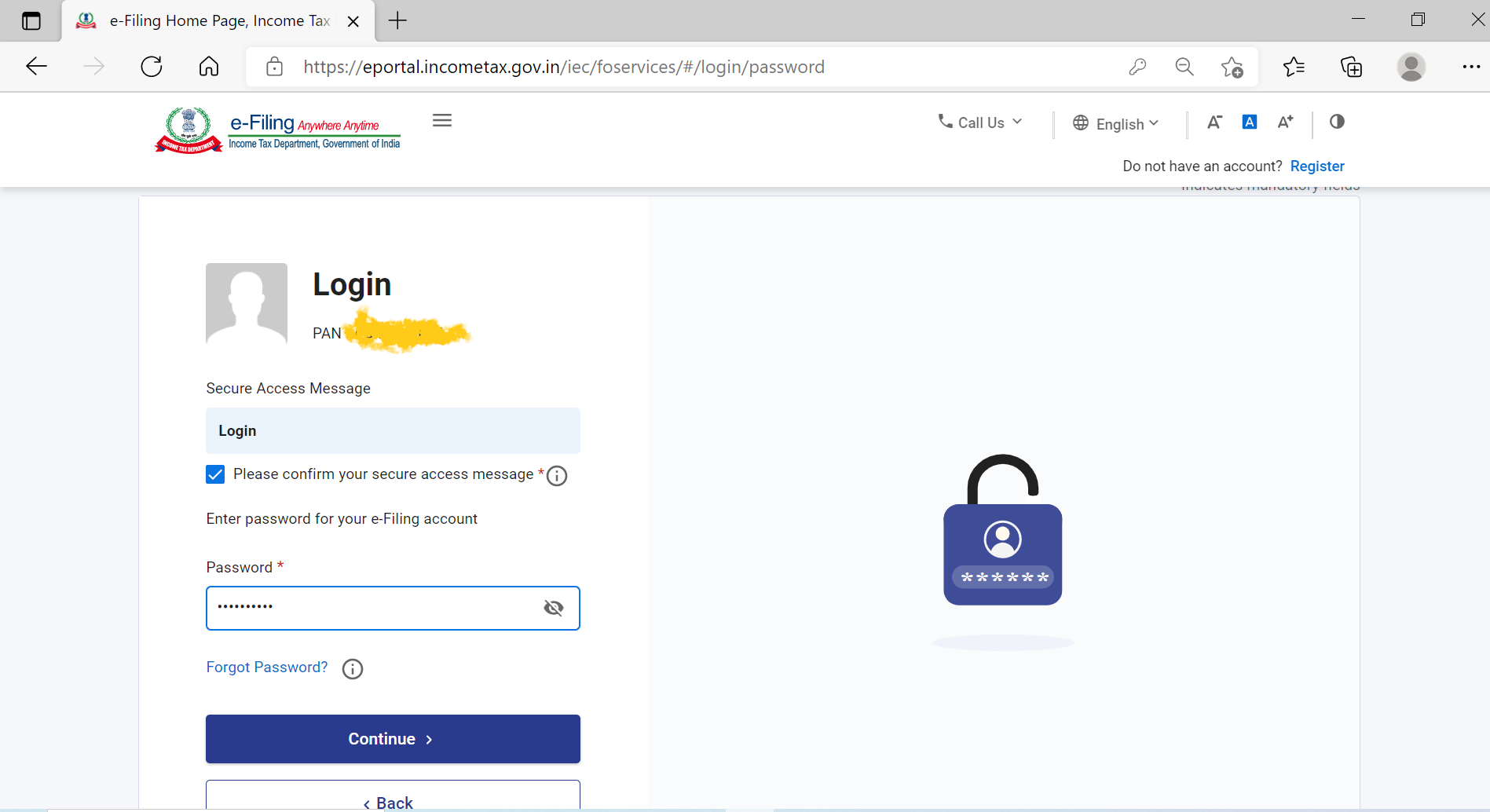

Step-2: Enter your login password and click on ‘continue’. Don’t forget to click on ‘Please confirm your secure access message’.

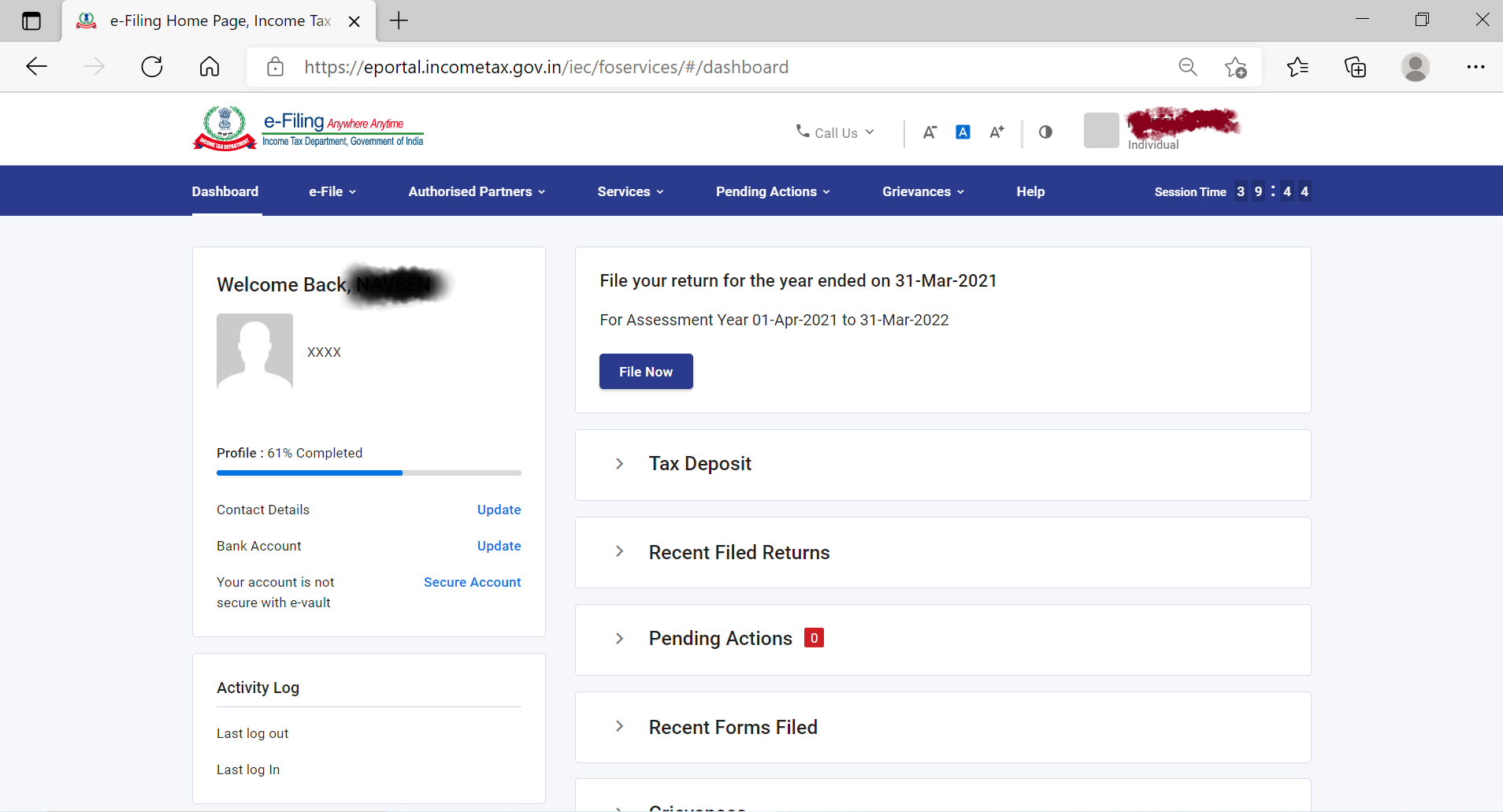

Step-3: Welcome Home Page will appear on your screen which will give snapshot of all pending actions on portal

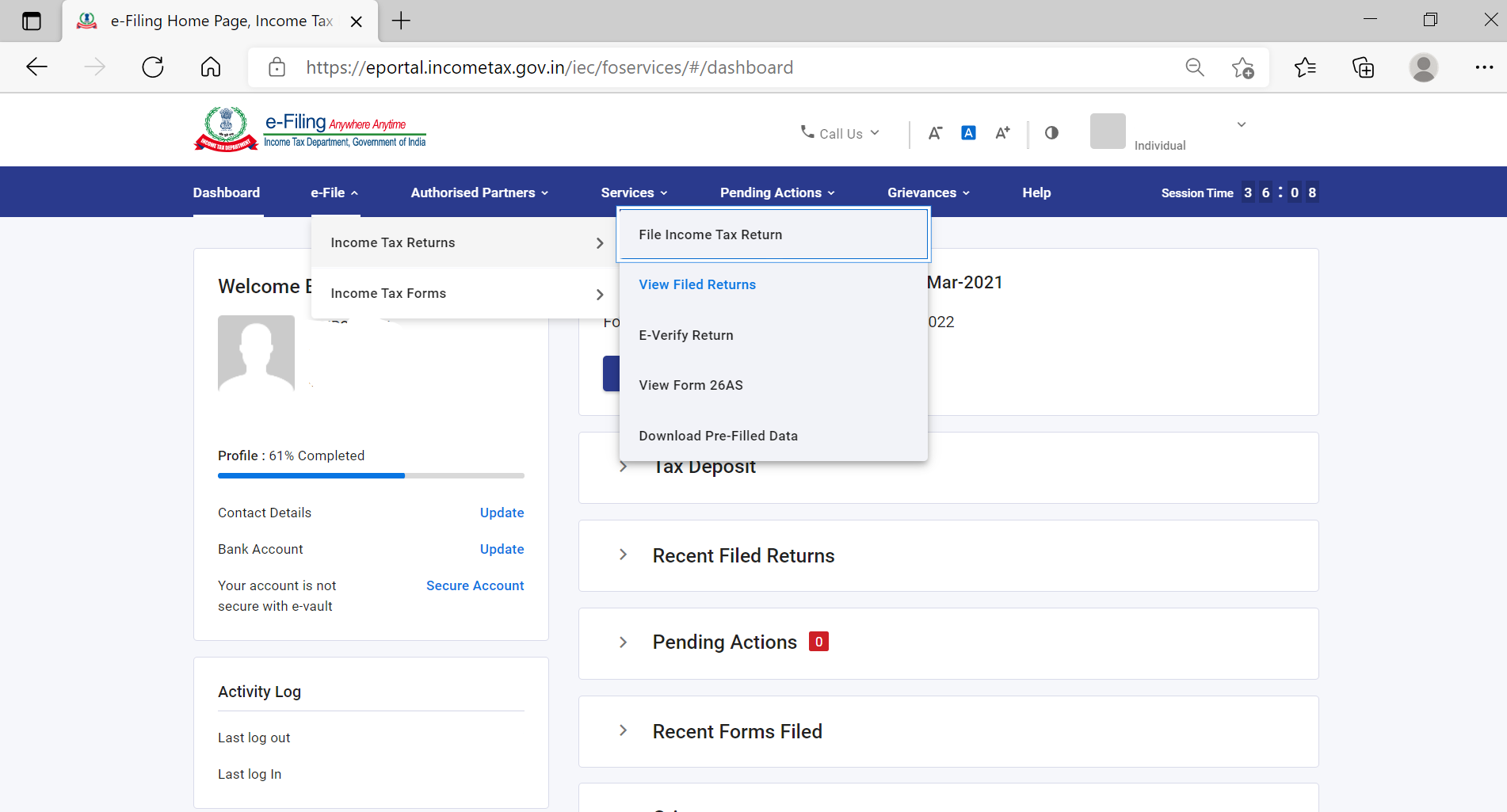

Step-4: In the ‘E-file’ tab a drop-down will appear in which choose >>Income Tax Returns>>View Filed Returns and click on it

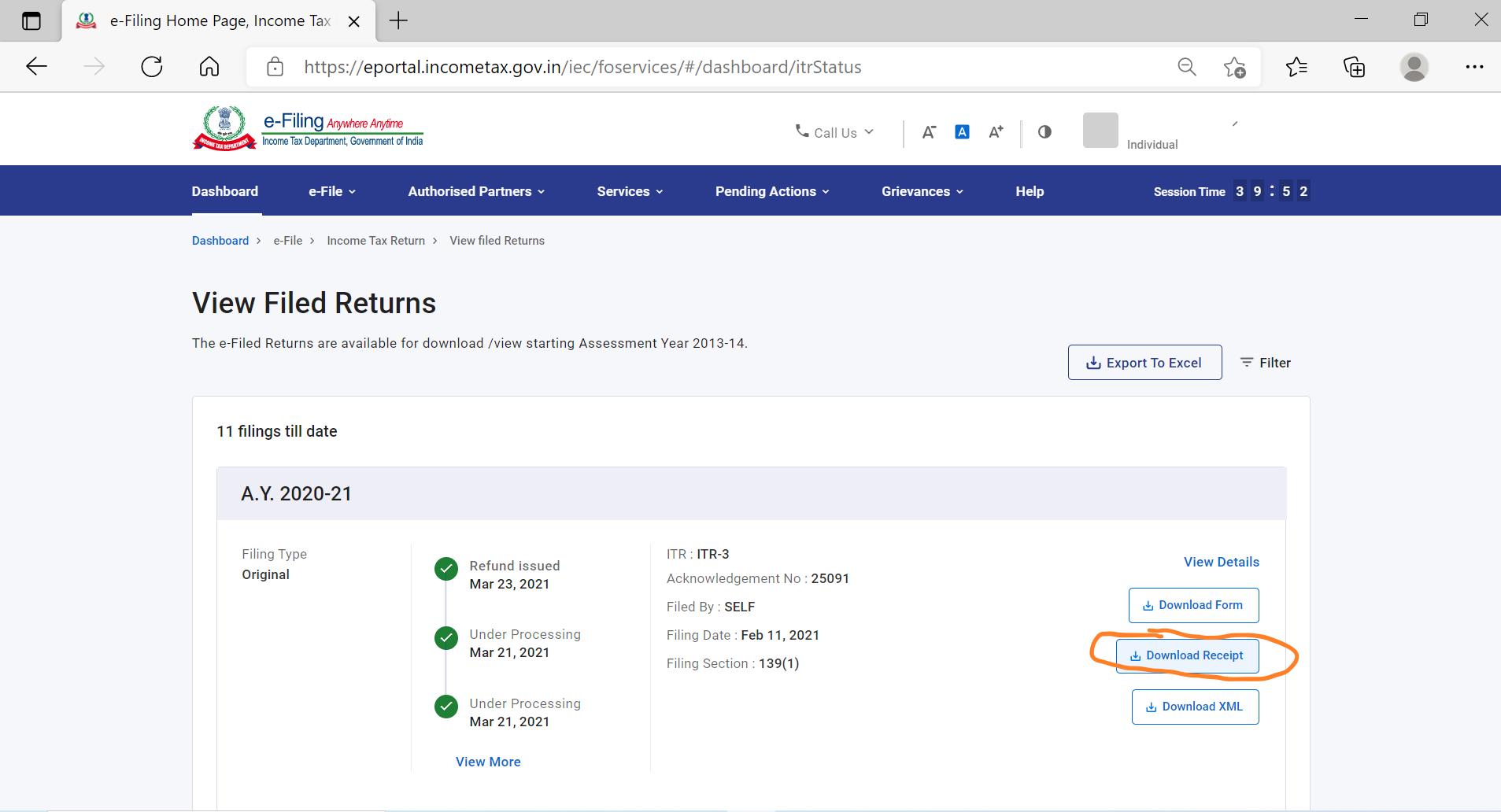

Step-5: New window will open “View Filed Returns” which will display details of all the ITRs filed by you. Scroll down the year of which ITR-V you need to download and click on “Download Receipt”

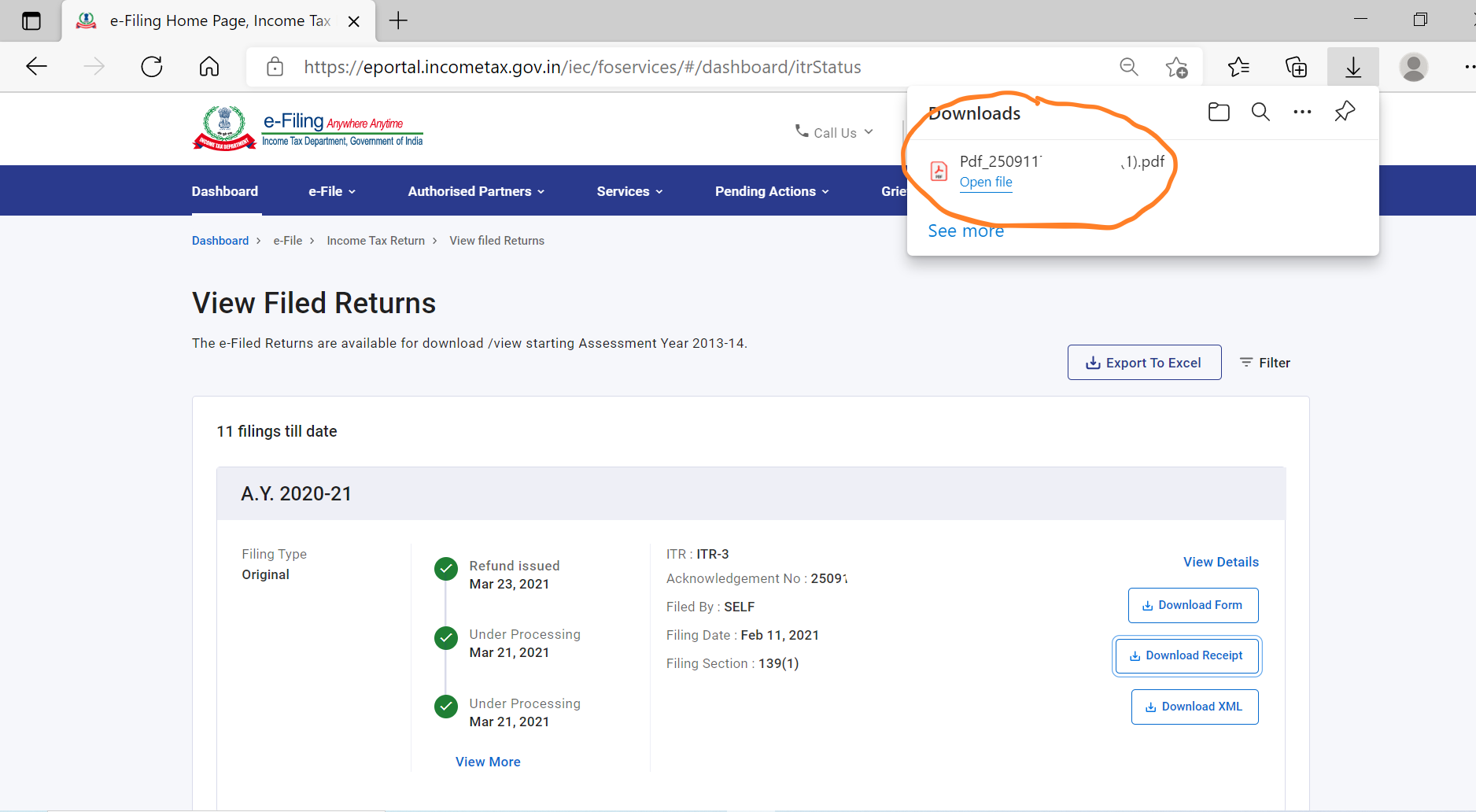

Step-6: On clicking “Download Receipt”, ITR-V will be downloaded in “PDF” format like this:

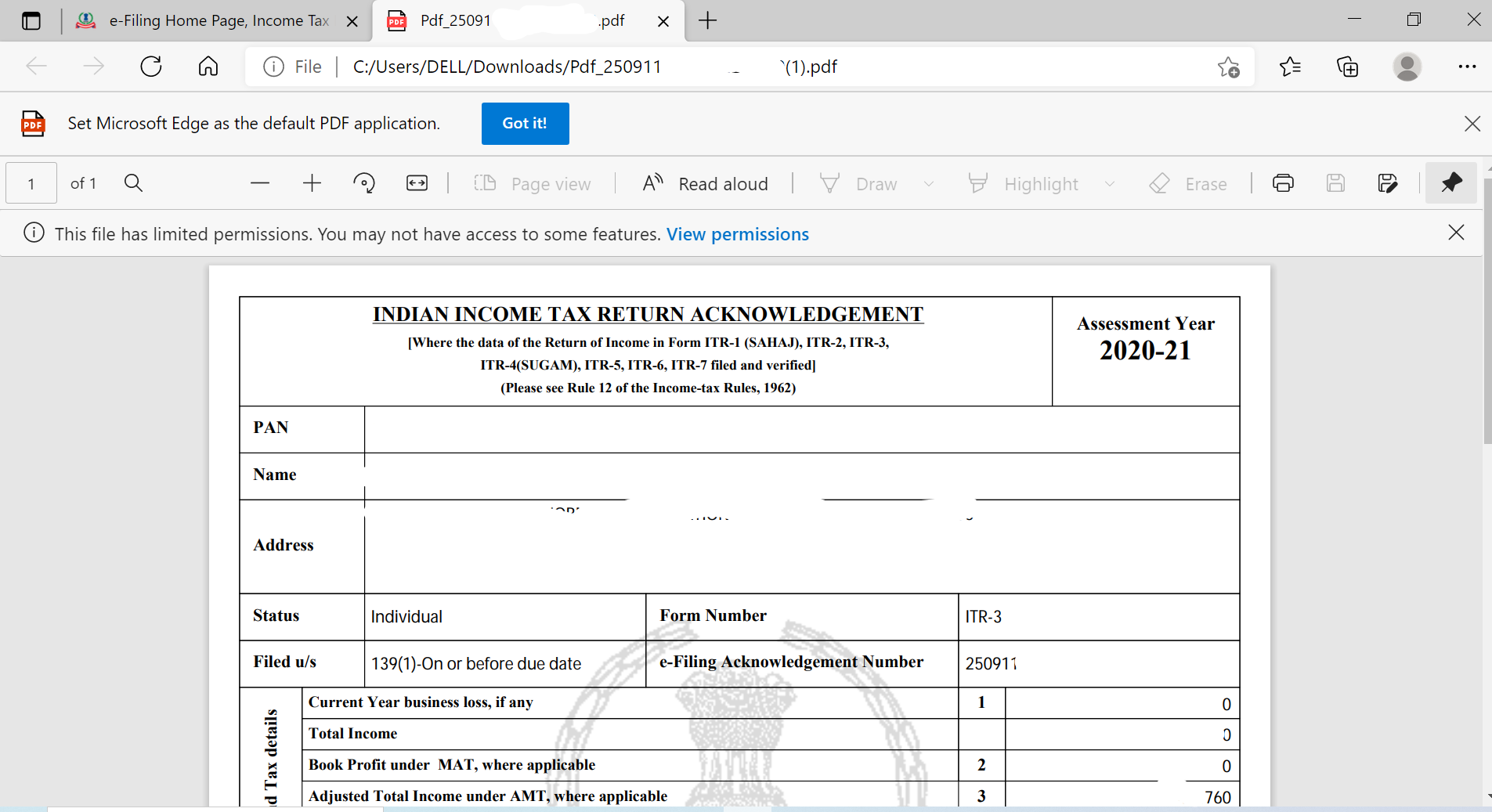

Step-7: Open the “PDF” file showing the ITR-V Acknowledgement

Now print the ITR-V Acknowledgement. If You have not e-verified your ITR by OTP validation, you may send a copy of ITR-V to CPC Bengaluru within 120 days of e-filing.