How to file ITR-1 Sahaj Form online for AY 2022-23

The new financial year has started and the time has now come to file ITR for the previous financial year 2021-22 or A.Y. 2022-23. The CBDT has also provided the updated ITR forms for the assessment year 2022-23 at the very beginning of this year. So, you can now proceed with your income tax return filing for A.Y. 2022-23. But do you know that there are seven forms prescribed for itr filing starting from ITR-1 to ITR-7? So, you must be interested in knowing the best ITR form which suits your purposes. Most the taxpayers use either ITR-1 or ITR-2 for filing their ITR. In this article, we are discussing Form ITR-1 in detail so that it may help you in choosing the right form while e filing of income tax return.

What is ITR 1 or Sahaj Form?

Income Tax Department has prescribed seven forms for different categories of taxpayers. ITR 1 is known to be the simplest form out of all these forms. It is the most commonly used ITR form and is meant for the small taxpayers with income from salaries and income from other sources.

Who is eligible to file ITR-1 Sahaj online for A.Y. 2022-23?

ITR 1 form can be filed by resident individuals who are having income not more than Rs. 50 Lakhs in the Financial Year 2021-22. Following incomes can be disclosed in ITR 1 form:

- Salary or Pension Income

- Income from other sources like interest income (saving interest or FDR interest), dividend income, interest on ITR refund, etc. but not including income from lottery winnings or from horse races

- Income from one house property. Please note that cases, where loss is brought forward from earlier years, are not included in ITR 1 form.

- Agricultural income up to Rs. 5,000.

Note:

- A non-resident is not allowed for e filing of income tax returns in ITR 1.

- If the income of a minor child or spouse is to be clubbed with your income, ITR 1 is allowed for clubbing of income from the above-mentioned sources only.

- ITR 1 is the most preferable ITR form for salaried individuals.

Who is not eligible to file ITR 1 form online for AY 2022-23?

As already discussed, if you are having total taxable income above Rs. 50 Lakhs, you are not eligible to fill ITR online in Form ITR-1. Further in the following cases, filing ITR 1 is not allowed:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A person in whose case payment or deduction of income tax has been deferred on ESOP |

|

How to file ITR 1?

A taxpayer can file his income tax return in form ITR-1 in either online or offline mode though filing itr return online is preferable.

-

Filing ITR 1 online: The individual taxpayer can log in to the Income Tax portal using his PAN as user id and password and fill itr online. Forms for filing ITR are available on the Dashboard of the IT portal. Use the appropriate ITR form and fill in the income & deductions details in the Form. You can also take the assistance of the Taxwink expert team for the smooth filing of your ITR.

After filling in the income & deduction details, you have to submit the income tax return and verify ITR using Aadhar OTP, net banking, or electronic verification code. In case you fail to e verify the return, you can also send the signed copy of ITR-V to CPC Bengaluru within 120 days of submitting the ITR. On successful verification of your ITR, a copy of ITR acknowledgment can be downloaded from the ITR portal itself.

-

Filing ITR 1 offline: Senior citizens above the age of 80 years or a taxpayer whose income is less than Rs. 5 Lakhs and does not claim any refund may file the ITR offline. But submitting ITR offline has many disadvantages namely processing of returns takes some extra time.

What are the due dates for Filing ITR 1 Sahaj online for AY 2022-23?

Income Tax Return in Form No. ITR 1 Sahaj can be submitted online for the A.Y. 2022-23 on or before 31st July 2022. In case of delay beyond the due date, you will be liable to pay late fees of up to Rs. 5,000.

What are the penalties for missing the income tax return filing deadline?

As per Section 234F of the Income Tax Act, you should submit ITR on or before the prescribed due date. If you are liable to file ITR 1, then the deadline in your case is 31st July 2022.

If you miss the deadlines, the following are the penalties or late fees:

- Total Income below Rs. 2,50,000: - No Late Fees

- Total Income above Rs. 2,50,000 but up to Rs. 5 Lakhs: Rs. 1,000

- Total Income above Rs. 5 Lakhs: Rs. 5,000

For details: Penalty under Section 234F

Guide to File ITR 1 Step-by-Step

The Government of India has already notified the form for ITR 1. In this section, we will discuss how to file ITR 1 step by step:

ITR 1 Form is divided into five parts as below:

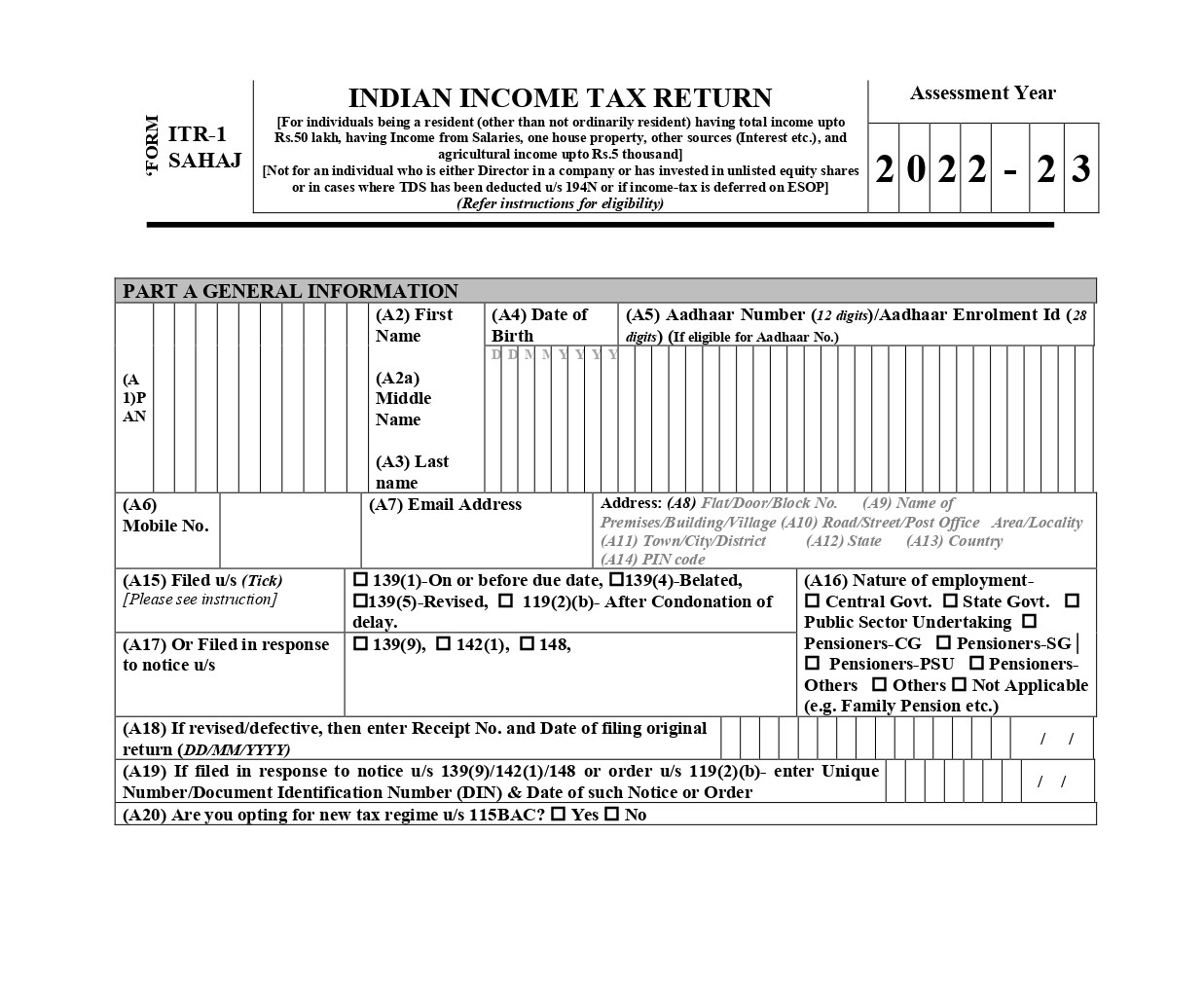

- PART-A: GENERAL INFORMATION

- PART-B: GROSS TOTAL INCOME

- PART-C: DEDUCTIONS AND TAXABLE TOTAL INCOME

- PART-D: COMPUTATION OF TAX PAYABLE

- PART-E: OTHER INFORMATION

PART-A: GENERAL INFORMATION:

In the PART-A, you are required to furnish the following details:

- PAN

- Name of the Assessee

- Date of Birth

- Aadhar Number

- Mobile Number

- Email Address

- Address with Pincode

- Section under which return is to be filed (Generally section 139(1))

- Nature of Employment (Government employee/ Pensioner) or Others

- Are you opting for the new tax regime u/s 115BAC

- Are you filing a return under the seventh proviso to section 139(1) which covers specific cases such as a deposit of more than Rs. 1 crore in current account/ foreign travel expenditure exceeding Rs. 2 Lakhs/ Electricity consumption exceeding Rs. 1 Lakh

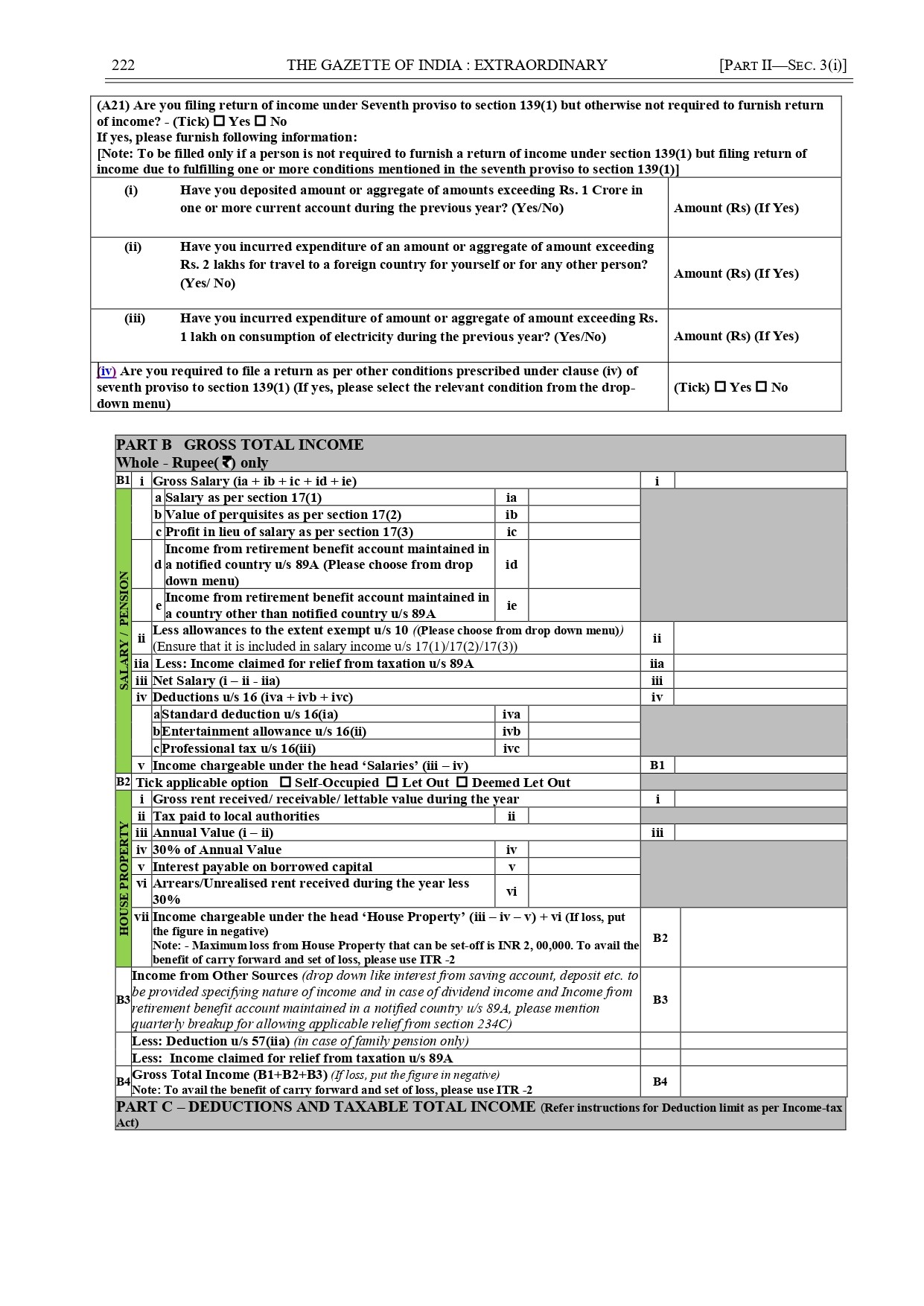

PART-B: GROSS TOTAL INCOME

Under this part, you are required to give your income details as below:

|

Part B1:

|

Part B2:

|

|

Part B3:

|

Part B4: Gross Total Income = B1+B2+B3 |

PART C: DEDUCTIONS AND TAXABLE TOTAL INCOME

- Following deductions can be claimed un Part C namely 80C, 80CCC, 80CCD(1), 80CCD(1B), 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80GG, 80GGC, 80U.

- Total Income will be B4- Deductions in Part C

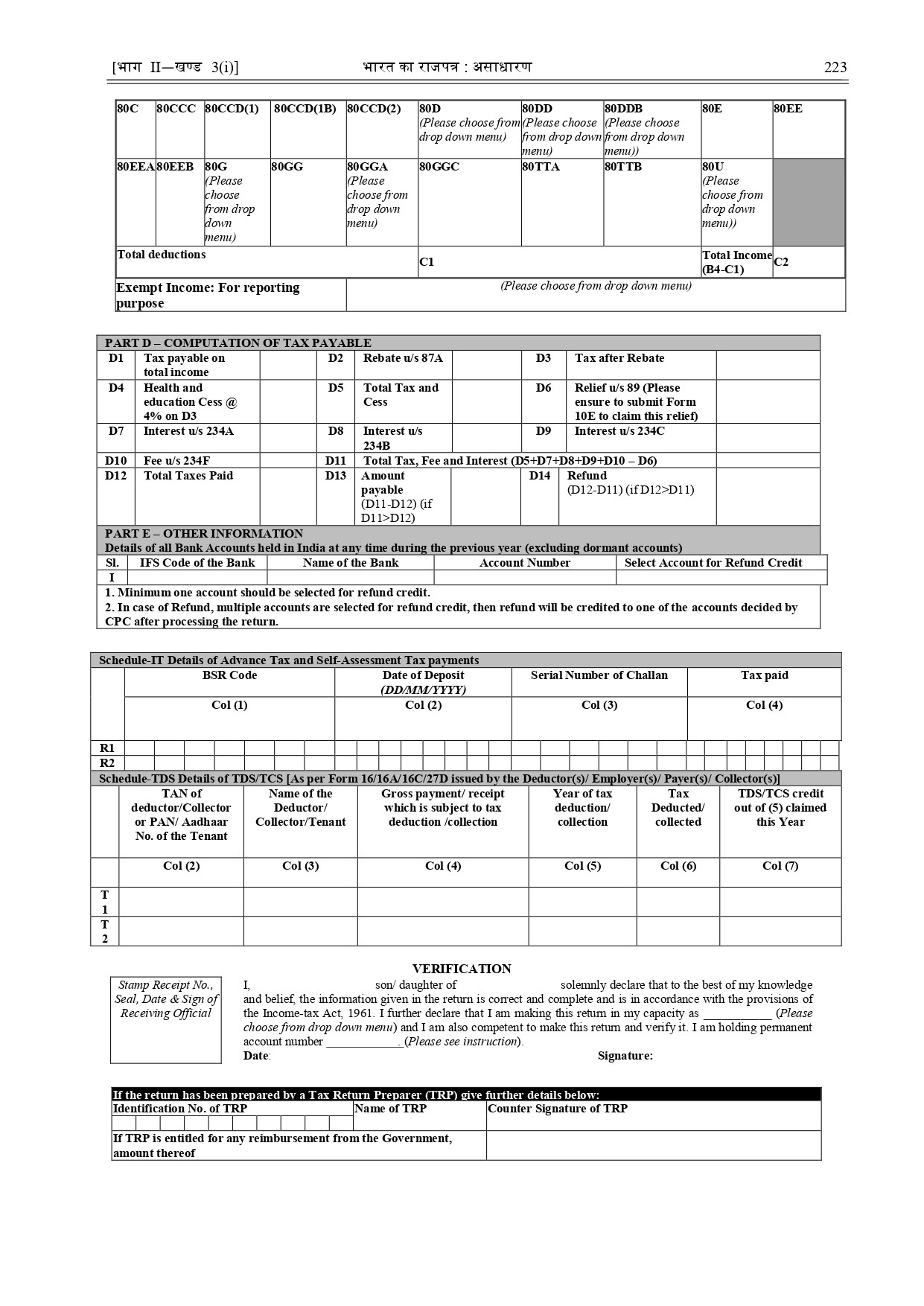

PART D: COMPUTATION OF TAX PAYABLE

This part includes the following details:

- Tax payable on total income

- Rebate u/s 87A

- Tax after rebate

- Cess on Tax after rebate

- Total Tax and Cess

- Interest u/s 234A/ 234B/ 234C

- Fees u/s 234F

- Total tax, fee, and interest

- Total Taxes paid

- Amount Payable

- Refund

- Exempt Income

PART E: OTHER INFORMATION

This part primarily covers the details of bank accounts as follows:

- IFSC Code of the bank

- Name of the Bank

- Account Number

- Select Account for the Refund credit

Then, there are 2 schedules in the ITR 1 form as below:

Schedule-IT: IT Details of advance tax and self-assessment tax payments

- BSR Code

- Date of deposit

- Serial number of challan

- Tax Paid

Schedule-TDS: Details of TDS/TCS

- TAN of deductor/ PAN of tenant

- Name of the deductor

- Gross Payment

- Year of tax deduction

- Tax deducted

- TDS/TCS credit

Verification:

After filing all the parts and schedules of ITR, you need to proceed to the verification part of form ITR 1. Here, you are required to fill in your name, fathers’ name, capacity, and PAN and verify the return.

Frequently asked questions

Can ITR 1 be filed for agricultural income?

Yes, you can file ITR-1 in case of agricultural income. However, if you have an agricultural income of more than Rs. 5,000, you should use ITR 2 for income tax e filing.

Is dividend income taxable?

Yes, Income earned in the form of dividends from shares or mutual funds is taxable. You should declare dividend income earned during the year in “Income from Other Sources” in ITR 1.

Is giving bank details in ITR 2 compulsory?

Yes, as per the income tax rules, it is mandatory to declare all the savings or current accounts including overdraft or CC accounts maintained by you while filing ITR online. However, if the account is dormant or inactive for over 3 years, it may be excluded.

What documents are to be submitted while filing ITR 1 online?

No documents are required to be submitted along with ITR 1 form online. But you should keep documents such as Form 16, Form 26AS, AIS, Bank Statements, and Proof of deductions in safe custody as the Income Tax Department may approach you to verify your income and deduction claims.

Is it necessary to file income tax return in case of income not more than Rs. 2,50,000?

No, it is not compulsory for you to file an income tax return if your annual income is not more than Rs. 2,50,000. But it is advisable to file ITR in this case also as you might need ITR in the future for a loan or foreign travel purposes.

Can ITR-1 be filed if I have a house property loan?

Yes, you can file ITR-1 if you have a housing loan and claim a deduction for interest on the housing loan under section 24(b) of the Income Tax Act.