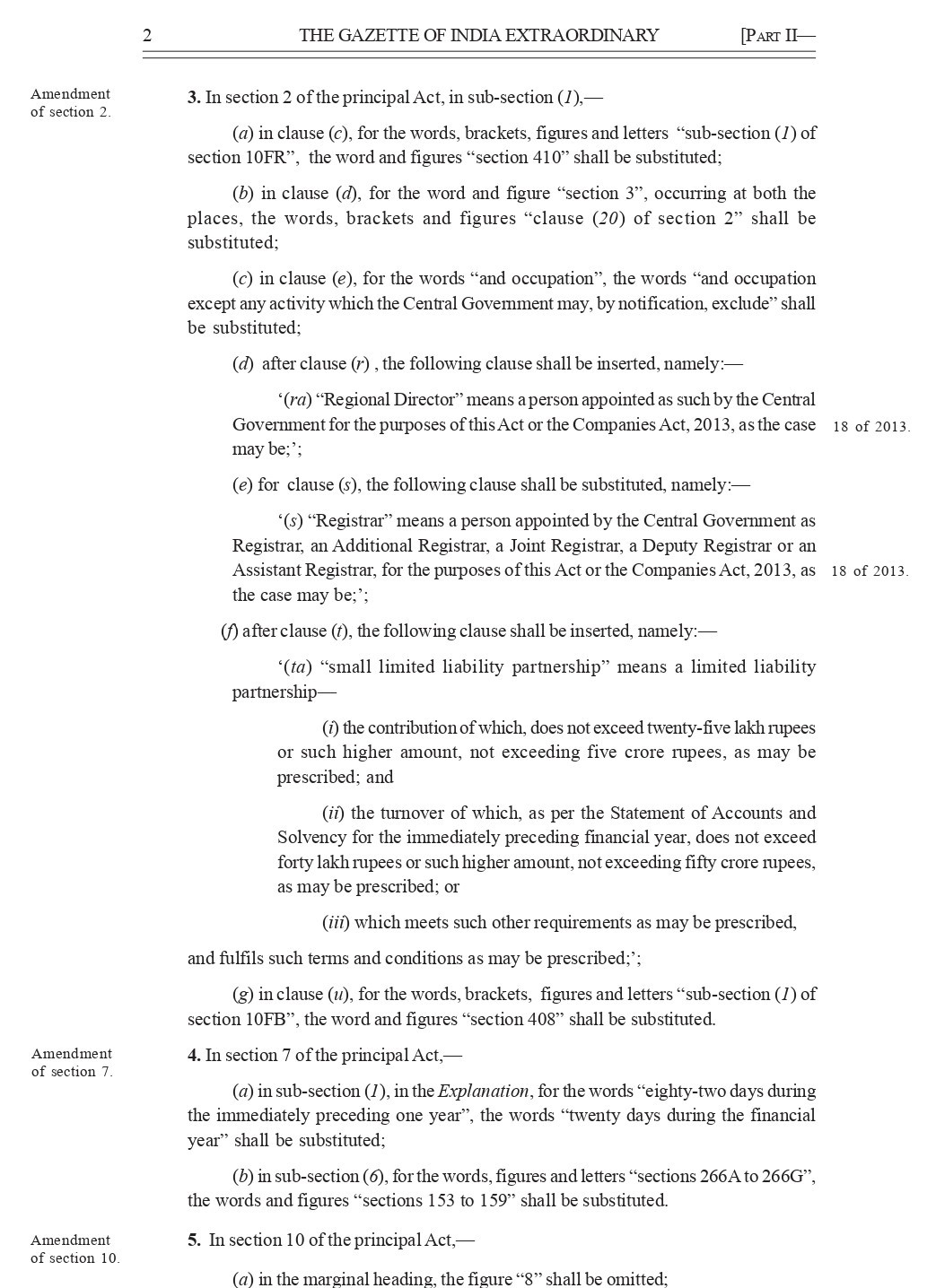

Key Features of Limited Liability Partnership (Amendment) Act, 2021

The Limited Liability Partnership (Amendment) Act, 2021 recently got the assent of the Hon’ble President of India. This Act seeks to amend the Limited Liability Partnership Act, 2008. The Act has been brought to ease the regulations in the case of Limited Liability Partnerships (LLP) by decriminalization of certain offences and introducing some new concepts & provisions in LLPs. In this article, we are discussing salient features of the Limited Liability Partnership (Amendment) Act, 2021.

Objectives & key features of the LLP (Amendment) Act 2021

|

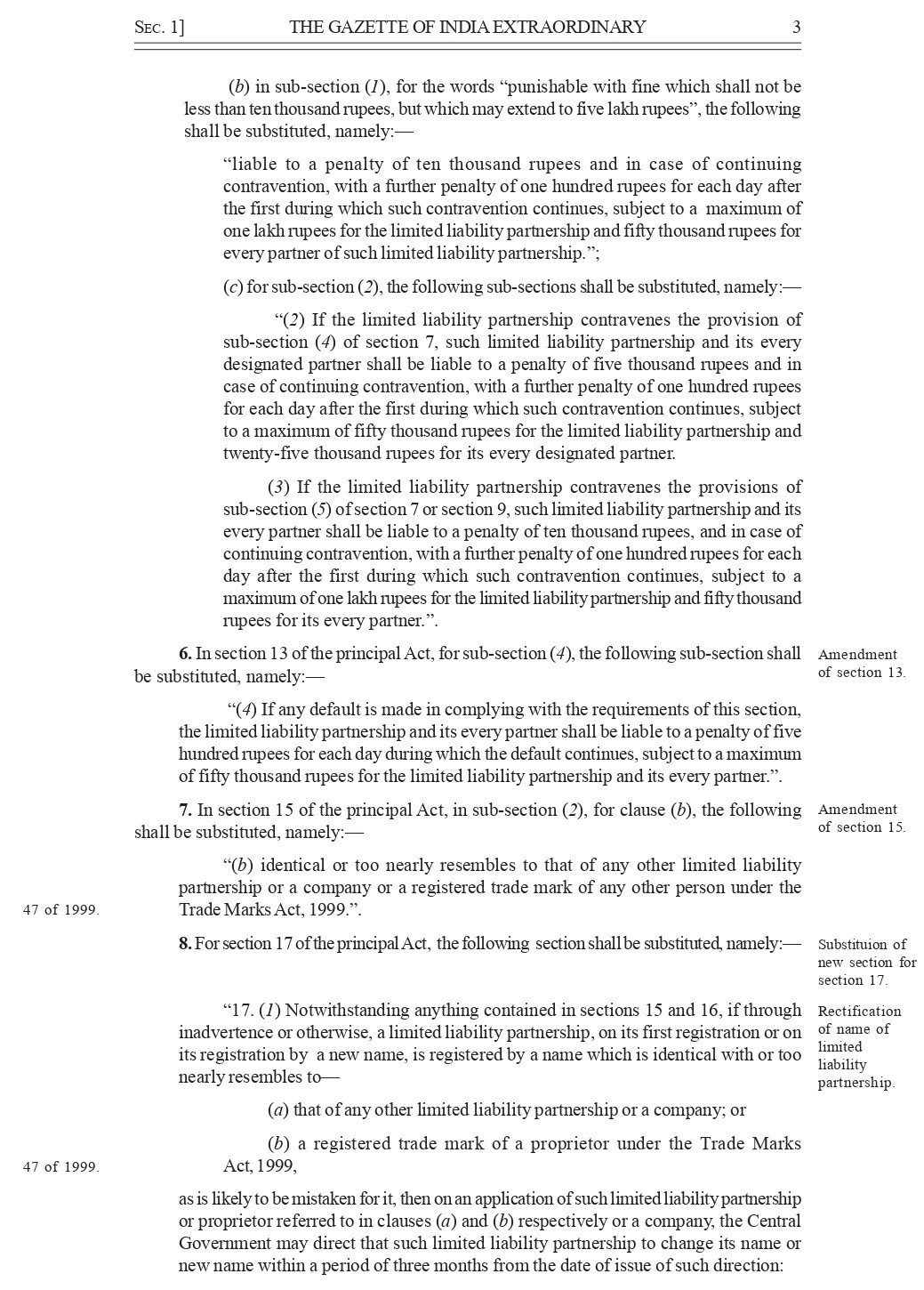

Decriminalization of certain offences |

|

|

Change in the name of LLP |

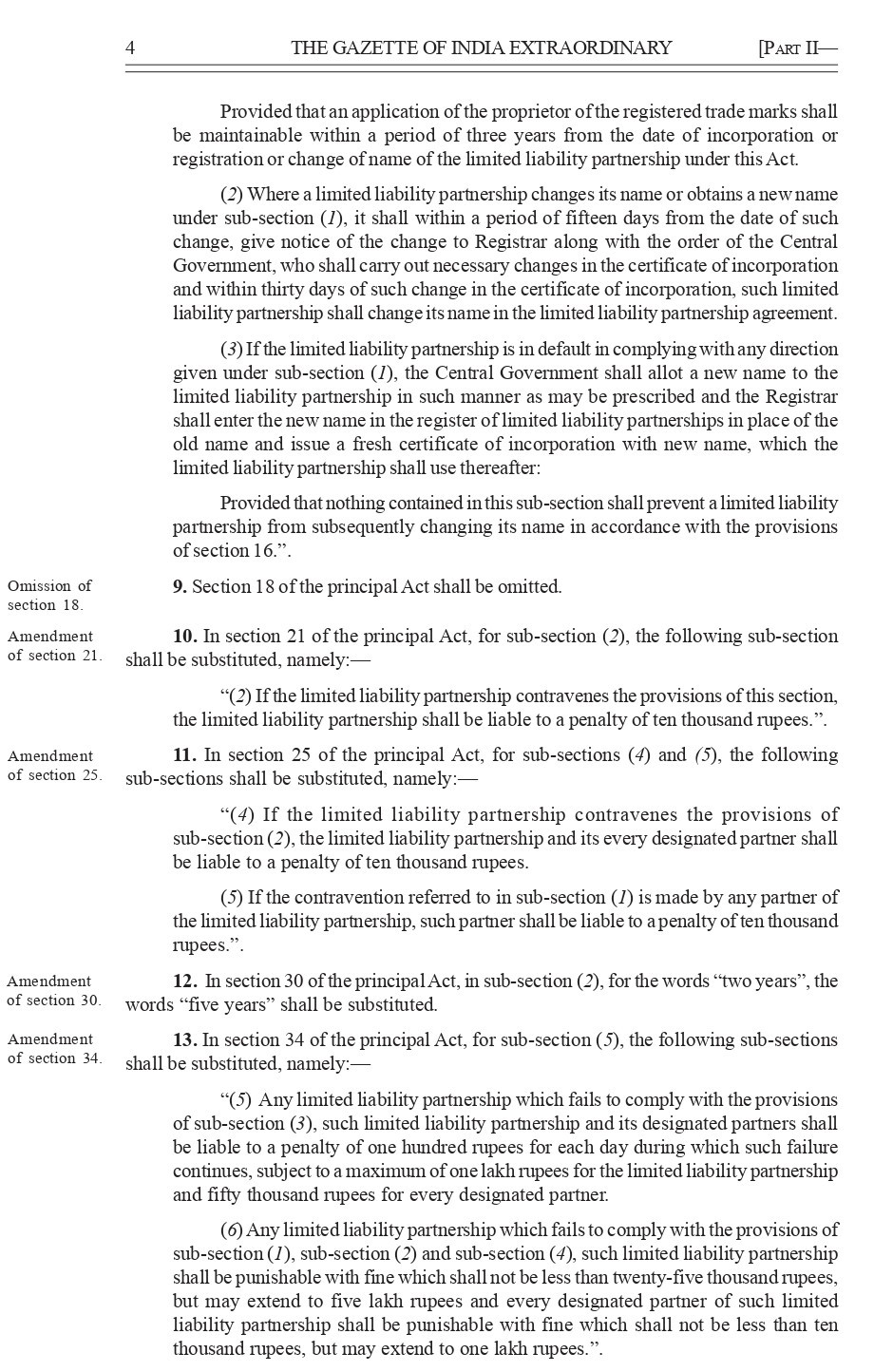

The LLP (Amendment) Act empowers the Central Government to direct an LLP to change its name if its name is undesirable or is identical to an existing LLP or a registered trademark, within a period of 3 months from the date of issue of such direction. If the company fails to comply with the direction, the Central Government shall allot a new name to the company in the prescribed manner and the Registrar of companies shall enter the new name in the register of LLP in place of the old name. |

|

Concept of Small LLP introduced like small companies |

The Central Government may also notify certain LLPs as start-up LLPs. Small LLPs would be subject to lesser compliances and lesser penalties in the event of defaults. |

|

Increase in punishment in case of fraud |

If an LLP or its partners act with an intention to defraud their creditors or for any other fraudulent purposes, every person who is knowingly party to it is punishable with imprisonment of up to 2 years in addition to fine. The Act is amended to increase the maximum imprisonment term from two year to five years. |

|

Prescribing Standards of Accounting & Standard of Auditing |

Section 34A of the LLP (Amendment) Act provides that the Central Government in consultation with National Financial Reporting Authority (NFRA)- (a) prescribe the Standards of Accounting and |

|

Compounding of Offences |

|

|

Special courts for speedy trial of offences |

|

|

Reduction of Additional Fee u/s 69 |

A reduced additional fee will lead to ease of doing business for start-up LLPs and small LLPs and help to reduce compliance pressure on them. |

|

Appeal to Appellate Tribunal |

Under LLP Act, appeals against the orders of the Tribunal lies with the National Company Law Appellate Tribunal (NCLAT). The LLP (Amendment) Act further provides that appeals cannot be made against an order that have been passed with the consent of the parties. Further, appeals must be filed within 60 days (or further extended period of 60 days) of the receipt of the order. |

|

Appointment of Adjudicating Officers |

Section 76A has been inserted to the LLP Act to provide that the Central Government may appoint adjudicating officers (not below the rank of Registrar) for the purpose of awarding penalties in the matters of non-compliance or defaults under the LLP Act. Any person aggrieved by the order of Adjudicating Officer may prefer an appeal to jurisdictional Regional Director. |

About Author: The author of the article is CA Naveen Goyal who is a practising Chartered Accountant in Jaipur. He specialises in the field of Income Tax, International Taxation and Indirect Taxes (GST). He can be reached at: 09660930417

Disclaimer: The article is based upon the LLP (Amendment) Act, 2021 and is summarised for informational purposes only. Readers are requested to act diligently and consult any expert before relying upon the information as given in the article. Taxwink is not responsible for any loss or damage caused to any person on the basis of reliance upon the content.