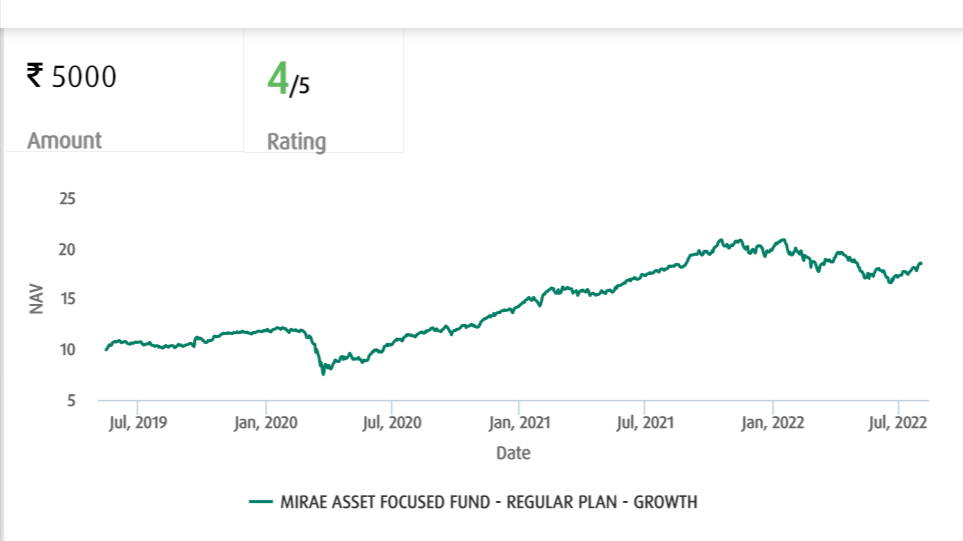

MIRAE Asset Focused Fund Regular Plan-Growth

(Note: Based on the data as of 2nd August 2022)

Suitability

This fund is suitable for those investors who desire a higher return as compared to other equity funds. Further, the investors should assume a risk of moderate to high losses in their investments.

Scheme Details

|

Scheme Launch Date |

May 2019 |

|

Scheme Type |

Open Ended Fund- Equity |

|

Minimum Investment Amount |

Rs. 5,000 (Initial); Rs. 1,000 (Additional) |

|

Minimum SIP Amount |

Rs. 1,000 |

|

Expense Ratio |

1.92% |

|

Fund Managers |

Gaurav Misra |

|

Exit Load |

Entry Load: Nil & Exit Load: 1% if sold before 365 days |

|

Risk |

Moderate to High |

|

AUM (in Cr.) |

Rs. 8061.75 |

|

Investment Horizon |

Mid Term to Long Term |

About Fund Managers:

The Fund is managed by the following fund managers:

|

Gaurav Misra |

Gaurav Misra is BA Eco (Hons), MBA (IIM Lucknow). He has over 24 years of experience in investment management and equity research functions. He has also worked with ASK Investment Managers Limited |

Trailing Returns (%)

|

|

YTD |

1-Day |

1-W |

1-M |

3-M |

6-M |

1-Y |

3-Y |

5-Y |

7-Y |

10-Y |

|

MIRAE Asset Focused Fund Regular Plan- Growth

|

-7.57 |

-0.44 |

3.97 |

7.07 |

-0.23 |

-7.78 |

2.42 |

21.81 |

- |

- |

- |

Benchmark Returns:

|

|

1 Year Return |

3 Year Return |

5 Year Return |

10 Year Return |

Returns since inception |

|

S&P BSE 500 TRI |

9.42 |

20.17 |

- |

- |

- |

Peer Comparison

|

Mutual Fund |

Rating |

NAV |

1 Yr Return |

3 Yr Return |

5 Yr Return |

10 Yr Return |

Return Since Inception |

|

Quant Active Fund Regular Plan- Growth |

4 |

416.30 |

6.50 |

34.60 |

21.30 |

20.90 |

19.05 |

|

MIRAE Asset Focused Fund- Regular Plan- Growth |

4 |

18.49 |

42.77 |

- |

- |

- |

29.53 |

|

Mahindra Manulife Multi Cap Badhat Yojana Regular- Growth |

5 |

20.06 |

5.48 |

24.73 |

13.70 |

- |

14.24 |

|

ICICI Prudential Midcap Fund- Growth |

4 |

162.88 |

-1.49 |

9.66 |

9.00 |

14.32 |

14.13 |

Fund Allocations: The fund has 98.41% investment in domestic equities of which 42.59% is in large cap stocks, 23.35% in mid cap stocks and 11.64% in small cap stocks.

Top 10 Companies in Portfolio

|

Company Name |

Sector |

P/E |

% Assets |

|

HDFC Bank Ltd. |

Banking |

- |

9.09 |

|

Infosys Limited |

Computer- Software |

26.04 |

8.76 |

|

ICICI Bank Limited |

Banking |

20.66 |

8.52 |

|

Reliance Industries |

Refinery |

23.09 |

5.84 |

|

Axis Bank Limited |

Banking |

- |

4.37 |

|

State Bank of India |

Banking |

13.16 |

4.11 |

|

Bharti Airtel Ltd. |

Telecommunications |

26.32 |

3.91 |

|

Orient Electric Ltd. |

Electrical Appliances |

- |

3.59 |

|

SKF India Ltd. |

Bearings |

- |

3.44 |

|

SBI Cards & Payments |

NBFC |

- |

3.40 |

Sector-wise Allocation of Fund

|

Sector |

Allocation of Assets (%) |

|

Basic Materials |

3.02 |

|

Consumer |

6.84 |

|

Financial Services |

40.29 |

|

Real Estate |

0.00 |

|

Communication Services |

4.09 |

|

Energy |

8.12 |

|

Industrials |

11.88 |

|

Technology |

13.25 |

|

Consumer Defensive |

3.00 |

|

Healthcare |

7.43 |

Disclaimer: Mutual Funds investments are subject to market risk. Therefore, it is advised to read the scheme documents carefully before making any investment. The above figures are based on the market data of the various mutual funds over the period and should not be solely made the basis of investment. Taxwink shall not be responsible for any loss caused to any person in any manner on any investment made on the basis of the above information.