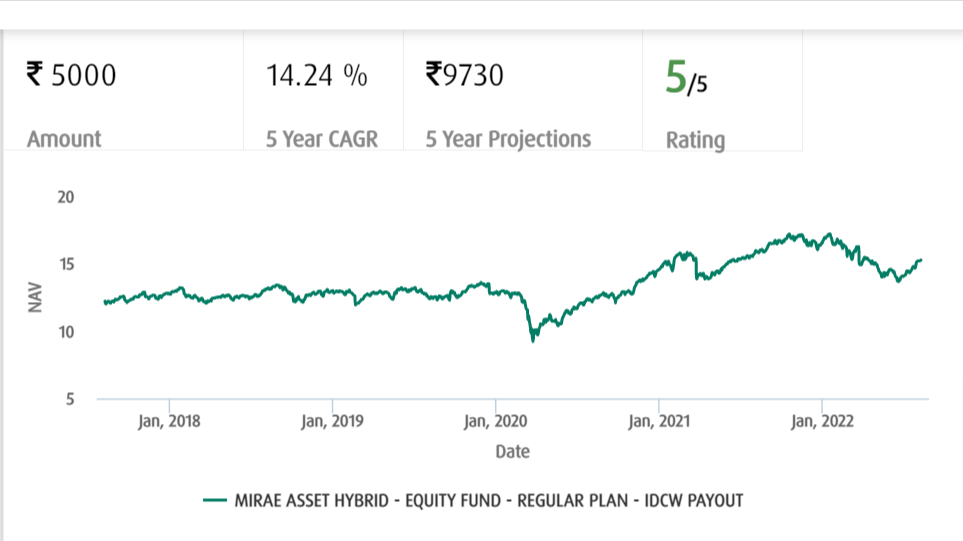

MIRAE Asset Hybrid Equity Fund- Growth IDCW Payout

(Note: Based on the data as of 8th August 2022)

Suitability

This scheme is targeted to generate moderate returns for the investors in the form of capital appreciation as well as current income by making investment in equity as well as debt and money market instruments. The investors may assume a moderate to high risk on investments made under this scheme.

Scheme Details

|

Scheme Launch Date |

July 2015 |

|

Scheme Type |

Open Ended Fund |

|

Minimum Investment Amount |

Rs. 5,000 (Initial); Rs. 1,000 (Additional) |

|

Minimum SIP Amount |

Rs. 1,000 |

|

Expense Ratio |

1.88% |

|

Fund Managers |

Vrijesh Kasera, Mahendra Jajoo, Harshad Borawake |

|

Exit Load |

Entry Load: Nil & Exit Load: 1% of sales value if sold before 365 days |

|

Risk |

Moderate to High |

|

AUM (in Cr.) |

Rs. 5355.57 |

|

Investment Horizon |

Long Term |

About Fund Managers:

The Fund is managed by the following fund managers:

|

Virjesh Kasera |

He is MBA (Finance) and CFA (ICFAI). He was earlier associated with Axis Capital Limited as an Equity Research Analyst. He also worked with Edelweiss Broking Limited |

|

Mahendra Kumar Jajoo |

He is a CA, CS and CFA. Earlier, he was director with AUM Capital Markets Limited and also associated with organisations like PGIM India Mutual Fund, Tata Asset Management Company, BNP Paribas Asset Management India Pvt. Ltd., ABN Amro Securities India Pvt. Ltd. and ICICI group |

|

Harshad Borawake |

He is MBA (Finance) and BE (Polymers). He has also worked with Motilal Oswal Securities Limited as V.P. and Capmetrics & Risk Solutions Private Limited as Research Analyst- Equity |

Trailing Returns (%)

|

|

YTD |

1-Day |

1-W |

1-M |

3-M |

6-M |

1-Y |

3-Y |

5-Y |

7-Y |

10-Y |

|

MIRAE Asset Hybrid Equity Fund- Growth |

-0.48 |

0.38 |

0.35 |

5.46 |

5.57 |

0.31 |

3.95 |

15.00 |

10.92 |

11.68 |

- |

Benchmark Returns:

|

|

1 Year Return |

3 Year Return |

5 Year Return |

10 Year Return |

Returns since inception |

|

CRISIL Hybrid 35+65 Aggressive TRI |

37.86 |

14.27 |

13.62 |

NA |

12.73 |

Peer Comparison

|

Mutual Fund |

Rating |

NAV |

1 Yr Return |

3 Yr Return |

5 Yr Return |

10 Yr Return |

Return Since Inception |

|

Kotak Equity Hybrid Fund- Regular Plan IDCW Payout |

4 |

23.70 |

7.76 |

18.63 |

11.47 |

12.92 |

14.31 |

|

Canara Robeco Equity Hybrid Fund- Regular Plan |

4 |

|

4.32 |

16.58 |

11.52 |

- |

- |

|

DSP Equity and Bond Fund- IDCW Payout |

4 |

24.89 |

43.77 |

15.39 |

13.89 |

12.69 |

14.99 |

|

SBI Equity Hybrid Fund Regular IDCW Payout |

4 |

43.34 |

6.76 |

15.12 |

11.52 |

15.32 |

15.70 |

|

MIRAE Asset Hybrid Equity Fund- Regular Plan – IDCW Payout |

5 |

15.27 |

42.75 |

14.63 |

14.24 |

NA |

12.73 |

Fund Allocations: The fund has approx. 73.36% investment in domestic equities of which 46.65% is in large cap, 10.22% in mid cap stocks, 3.18% in small cap stocks. The fund also has investment of 22.35% in debt of which 12% is in Government securities, 10.36% in low risk securities.

Top 10 Companies in Portfolio

|

Company Name |

Sector |

P/E |

% Assets |

|

Reliance Industries Ltd. |

Energy |

26.16 |

5.46 |

|

ICICI Bank |

Financial |

20.99 |

5.35 |

|

Infosys |

Technology |

30.58 |

5.01 |

|

HDFC Bank |

Financial |

20.45 |

4.90 |

|

5.63% GOI 2026 |

GOI Securities |

- |

3.12 |

|

State Bank of India |

Financial |

13.15 |

3.03 |

|

Axis Bank |

Financial |

14.19 |

3.00 |

|

TCS |

Technology |

31.82 |

2.57 |

|

6.18% GOI 2024 |

GOI Securities |

- |

2.24 |

|

HDFC |

Financial |

19.00 |

2.19 |

Sector-wise Allocation of Fund

|

Sector |

Allocation of Assets (%) |

|

Basic Materials |

8.60 |

|

Consumer |

10.26 |

|

Financial Services |

33.99 |

|

Real Estate |

0.00 |

|

Communication Services |

2.68 |

|

Energy |

8.61 |

|

Industrials |

7.71 |

|

Technology |

12.98 |

|

Consumer Defensive |

5.73 |

|

Healthcare |

6.58 |

Disclaimer: Mutual Funds investments are subject to market risk. Therefore, it is advised to read the scheme documents carefully before making any investment. The above figures are based on the market data of the various mutual funds over the period and should not be solely made the basis of investment. Taxwink shall not be responsible for any loss caused to any person in any manner on any investment made on the basis of the above information.