Guide to MSME-1- Filing and Due dates

This article is written in the backdrop of the recent amendment in the definition of MSME made by the Central Government vide Circular No. 5/2(2)/2021-E/P&G/Policy dated 02-07-2021. The said amendment extends the definition of MSME to include wholesale and retail trade. The Ministry of Corporate Affairs (MCA) has made major changes in the Companies Act with an objective to protect the interest of Micro, Small or Medium Enterprises. If the companies procure goods or services from MSME enterprises and the payment to such MSMEs remains overdue for a period exceeding 45 days, such companies are required to report such overdue outstanding balances to MSMEs in half-yearly return in Form MSME-1. In this article, we will discuss about MSME-1 and the manner the form in submitted to ROC along with all questions related to it.

What is MSME-1 Form (MCA)

- The MSME-1 Form is a half yearly return to be filed by the specified companies with the Registrar of Companies (ROC) in respect of outstanding payments to Micro or Small Enterprises exceeding 45 days.

- Filing of MSME-1 with ROC is mandatory if the specified companies have outstanding payments to Micro or Small Enterprises exceeding 45 days.

Is filing of MSME-1 compulsory where outstanding payments to MSMEs are ‘Nil’

In case the outstanding payments to MSMEs are zero, it is not required to file MSME-1 Form.

What is Specified Companies for MSME-1 Form

According to the provisions of section 9 of the MSME Development Act, 2006, “Specified Companies” are those companies:

- Who receive the supply of goods or services from MSMEs (micro or small) and

- The payment against these supplies exceeds 45 days from the date of acceptance or deemed acceptance of the goods or services.

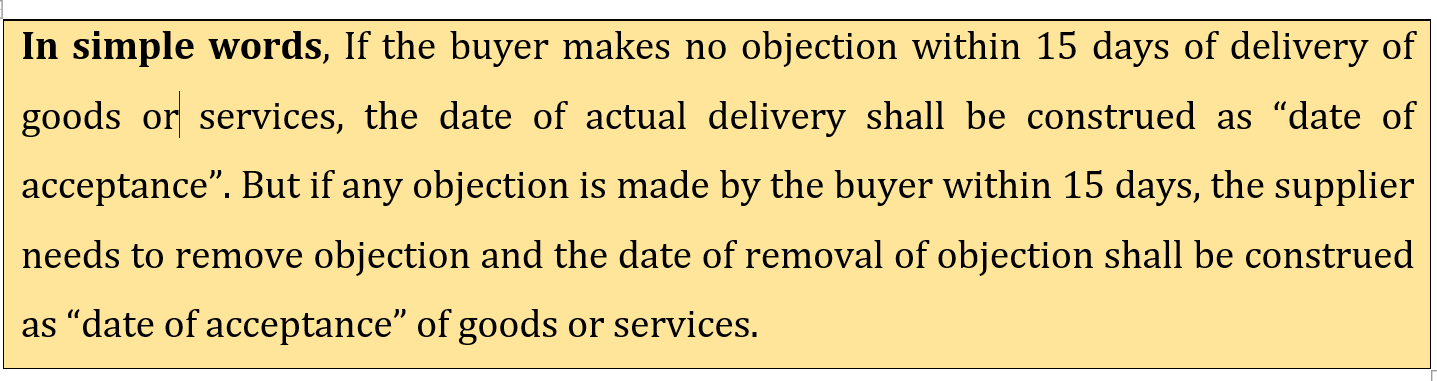

What is the meaning of ‘date of acceptance’ or ‘date of deemed acceptance’

- Date of Acceptance means:

(a) In case of no objection by buyer: The day of actual delivery of goods or rendering of services or

(b) In case of objection by buyer: Where any objection is made in writing by the buyer regarding acceptance of goods or services within 15 days of the delivery of goods or rendering of services, the day on which such objection is removed by the supplier.

- Date of Deemed Acceptance means:

The day of actual delivery of goods or rendering of services where no objection is made in writing by the buyer regarding acceptance of goods or services within 15 days from the day of delivery of goods or rendering of services.

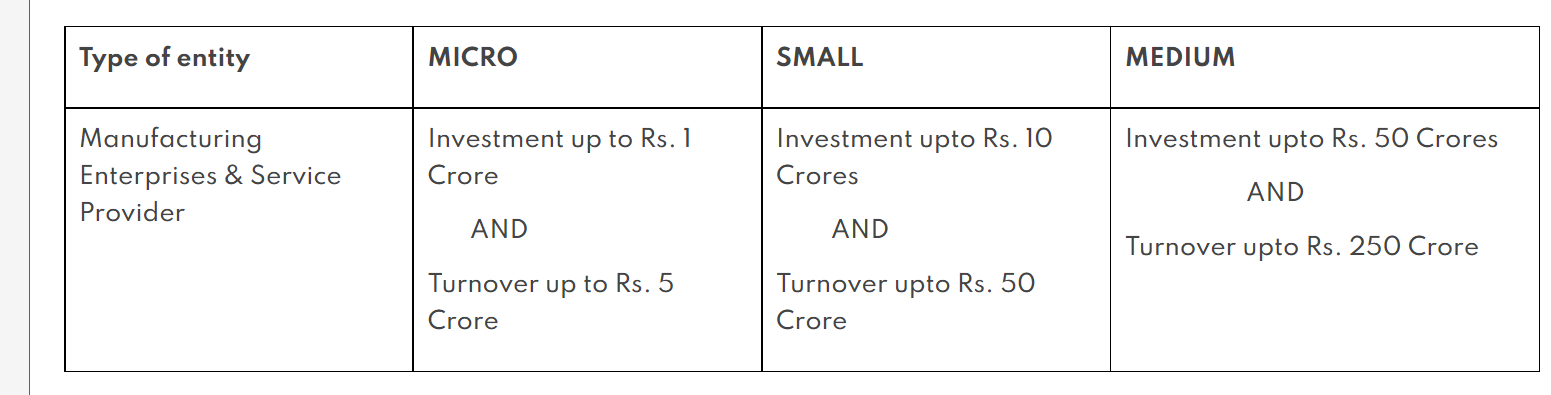

What is Micro and Small Enterprises

- Any category of enterprises such as proprietorship, Hindu Undivided Family (HUF), partnership firm, LLP, company, society or AOP is eligible to be classified as Micro or Small Enterprises.

- Earlier the basis of classification into micro, small or medium enterprises was ‘investment in plant & equipment’. But now, the basis of classification has been changed to investment as well as turnover criteria.

- Earlier only manufacturers and service providers were eligible as MSMEs but now traders (wholesale or retail) have also been included in the definition of MSMEs.

- Section 7 of the MSME Development Act, 2006 defines the scope of micro, small and medium enterprises as below:

Note: Medium Enterprises are not covered for the compliances relating to MSME-1 Form.

What are the details to be furnished by specified companies in MSME-1 Form

Specified companies are required to furnish the following details in the MSME-1 Form as below:

- Name of Supplier and his PAN whose balance is outstanding

- Amount of Payment outstanding

- Reasons for delay

- Date from which the amount is due

Note: MSME-1 is required to be filed when outstanding payment to micro or small enterprises exceeds 45 days as on 31st March or 30th September.

What is the due date of filing Half Yearly return in MSME-1 Form

Due date of filing MSME-1 is mentioned below:

|

Filing Period – Half Year |

Due date of Filing |

|

April to September |

31st October |

|

October to March |

30th April |

|

Note: Owing to Covid-19 pandemic, due date of filing MSME-1 for ‘October 2020- March 2021’ has been extended to 31st August, 2021. |

Who are not required to file MSME-1 Form

- This Rule is not applicable upon all the companies. The Rule is applicable only on those specified companies whose dues to MSME suppliers (Micro or Small) exceed 45 days from the date of acceptance or deemed acceptance of goods or services.

- If the payment against supplies exceeds 45 days but the supplier gives a declaration to the effect that they do not fall under the category of Micro or Small Enterprises.

What is the statutory fees for filing of MSME-1 Form

- No fee is payable as filing fees for MSME-1 Form

- Further, there is no late fees for delayed filing of MSME-1 Form

What are the penalties for non-filing of MSME-1 Form

Non filing of MSME-1 Form shall lead to penalty and punishment under the provisions of the Companies Act, 2013.

- On defaulting company: Up to Rs. 25,000

- On directors, CFO and CS of defaulting company: Imprisonment up to 6 months or Fine not less than Rs. 25,000 and up to Rs. 3,00,000 per person

The payment terms as per the agreement is 20 days and the payment is outstanding for 25 days as on 31st March. Is it required to be reported in MSME-1 form

Yes, it will be treated as a ‘delayed payment’ and to be reported in MSME-1 Form.

If the payment terms as per agreement is 9 days and payment is outstanding for 48 days as on 31st March, is it required to be reported in MSME-1 form

Since, the payment is outstanding beyond 45 days, it need to be reported in MSME-1 Form.

What are the steps for filing of MSME-1 Form

Step-1: Download e-form MSME-1. After downloading the form, open the form and select whether form is filed as "Initial Return" or "Half Yearly Return"

Step-2: Enter CIN of the company and click on 'Pre-Fill' button. You are also required to enter the Global Location Number (GLN) and PAN of the company

Step-3: Enter the Basic Details of the company such as:

- Name of the company

- Address of the Registered Office and

- Email and other contact details of the company

Step-4: In case of 'Initial Return' you are required to enter the following details as below:

- Total amount outstanding as on the Notification date

- Financial Year

- Name of Supplier (Micro or small)

- Supplier's PAN details

- Outstanding Amount

- The date from which the amount is outstanding

Step-5: In case of regular 'Half Yearly Return', you are required to enter the following details as below:

- Financial Year Details i.e. "From - To"

- Name of Supplier (Micro or small)

- Supplier's PAN Details

- Outstanding Amount

- Date from which the amount is outstanding

Step-6: Enter the amount of due payments to micro and small enterprises and then submit the Form using Digital Signature

Who shall sign MSME-1 Form

MSME-1 Form shall be signed digitally using digital signature by Director or Manager or Secretary or CEO or CFO of the company.

| Conclusion: Every company who is procuring goods or services from micro or small enterprises should ensure that dues of such micro or small suppliers are cleared within 45 days or as per the terms of the agreement. In case the dues are not cleared within 45 days (irrespective of agreement terms), the same are to be compulsorily reported to RoC by filing half yearly return in MSME-1 Form along with reasons for non-payment. This compliance will certainly help in saving the interests of MSME enterprises who always face paucity of working capital. It will ensure that the companies clear the dues of micro and small enterprises timely. Otherwise, they would be required to pay the amount due along with interest equal to the three times the bank rate notified by the RBI. |

Disclaimer: The above article is based on the provisions of Companies Act, 2013 & MSME Development Act, 2006 and is meant for information purposes only. This should not be considered as a legal opinion or advice. Readers are requested to seek advice from professional before acting on the basis of the above information. Taxwink is in noway responsible for any loss or damage caused due to use or mis-interpretation of any information in this article.