Non-Deduction of TDS on payment made to transporter u/s 194C (6)

Introduction:

The Finance Bill 2015 made an amendment in Section 194C (6) of the Income Tax Act, 1961 which relates to deduction of tax at source on payments made to transporters. The amendment has been made effective from 01st June, 2015. The amended sub-section provides for furnishing of a declaration by the transporter so as to allow exemption from deduction of tax at source from transport charges. This article not only discusses the section 194C (6) in details but also provides the format for declaration to be made for non-deduction of TDS u/s 194C (6).

|

Section 194C (6): “No deduction shall be made from any sum credited or paid or likely to be credited or paid during the previous year to the account of a contractor during the course of business of plying, hiring or leasing goods carriages, where such contractor owns ten or less goods carriages at any time during the previous year and furnishes a declaration to that effect along with his Permanent Account Number, to the person paying or crediting such sum.” |

Later, the Income Tax Department came out with a clarification for explaining the amended section 194C (6) vide Circular no. 19/2015 dated 27.11.2015. The major points explained by the Circular are given here below:

-

Conditions for non-deduction of TDS u/s 194C (6)

The relaxation under section 194C (6) for non-deduction of tax shall be available when the following conditions are satisfied:

(a) Payment has been made in the nature of transport charges (whether paid by a person engaged in the business of transport or otherwise)

(b) Payment has been made to a contractor who is engaged in the business of transport i.e. plying, hiring or leasing goods carriage

(c) Such contractor is eligible to compute income as per the provisions of section 44AE of the Act (i.e. a person who is not owning more than 10 goods carriages at any time during the previous year) and

(d) Such contractor furnishes a declaration to this effect along with his PAN, to the person paying such sum.

-

Who is eligible for exemption u/s 194C (6)

An important clarification given by this Circular is that “This exemption from TDS is applicable only in respect of transport charges received for plying, hiring or leasing of goods carriages owned by the transporter. Therefore, if a person receives payment in respect of plying, hiring or leasing of goods carriages which are not owned by him, he shall not be entitled to claim exemption from TDS in respect of these payments.

- The condition of not owning more than 10 goods carriages by the transporter is required to be fulfilled on the date on which the amount is credited or paid, whichever is earlier. In case, a transporter does not own ten goods carriages on the date on which the amount is credited or paid but becomes owner of ten goods carriages later in the previous year, the payer shall not be required to deduct tax from the payment made to the transporter during the period of the previous year when he was not owning more than ten goods carriages. However, the tax shall be required to be deducted from the payment made during that part of the previous year during which the transporter owned more than ten goods carriages.

-

How to compute limit of Rs. 1 Lakh for TDS deduction in case of transporters

For determining the aggregate amount of sum credited or paid for the purposes of computing limit of Rs. 1 Lakh, all the payments made during the financial year shall be taken into account including the amount credited or paid during the period of the financial year during which the transporter was not owning more than 10 goods carriages.

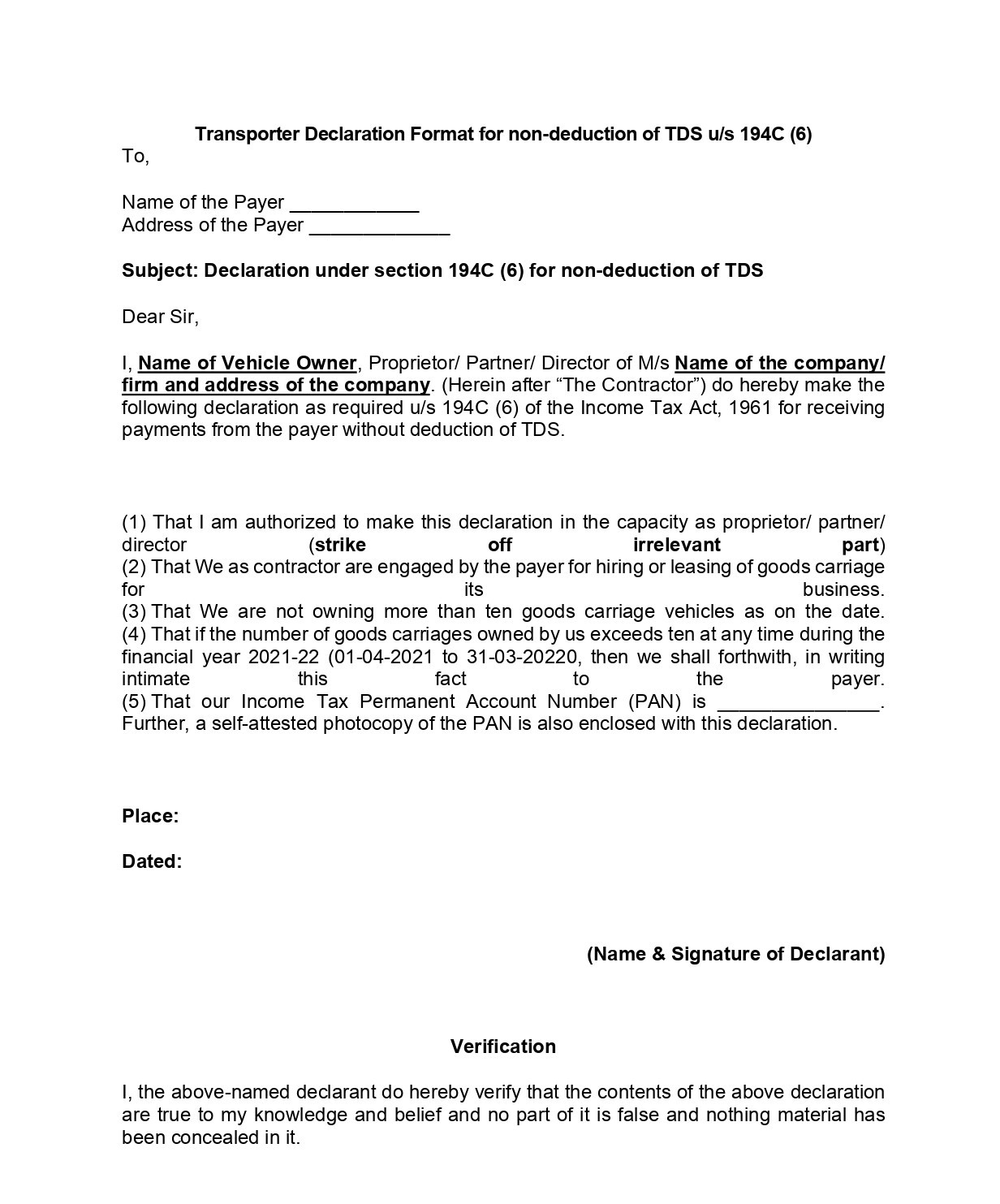

- The payer should obtain declaration from transporter along with his PAN for non-deduction of TDS u/s 194C (6). The format of declaration is given here below: