PAN & Address Details of Karnataka CM Relief Fund Covid-19 for 80G

In the wake of Covid-19 pandemic, the entire society has come together and made contributions to fight against the deadly virus. In the state of Karnataka also, the Government employees and other people have generously contributed to CM Relief Fund for Covid-19. The contribution so made by them is eligible for deduction under section 80G of the Income Tax Act. It is important to note that a deduction of 100% of the donation made to “Karnataka CM Relief Fund Covid-19” is available to the donor under section 80G while computing his taxable income under the Income Tax.

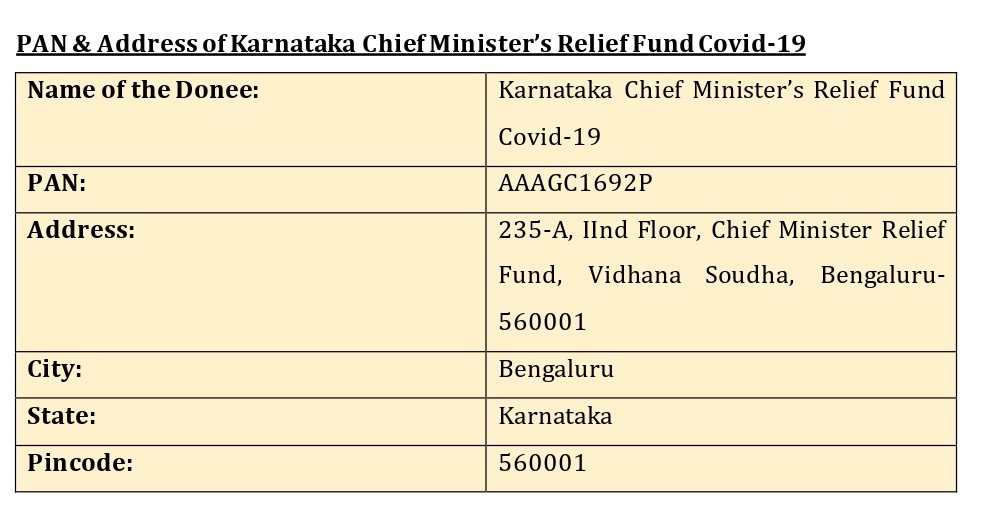

PAN & Address of Karnataka Chief Minister’s Relief Fund Covid-19

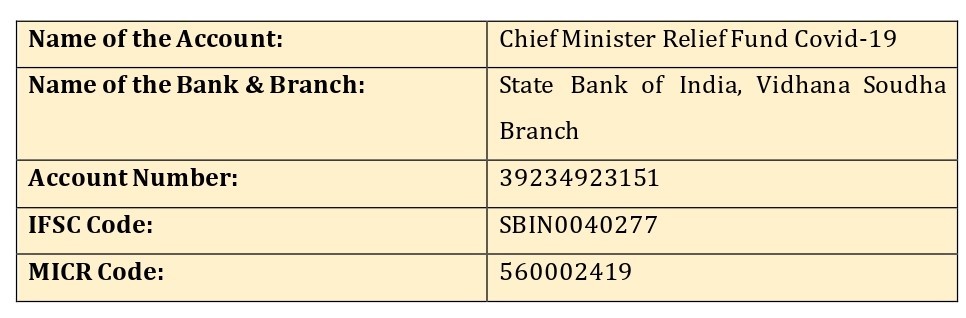

How to donate to Karnataka CM Relief Fund Covid-19

Donation to Karnataka CM Relief Fund Covid-19 can be made by Bhim UPI, Phonepe, Google Pay, Paytm, NEFT, RTGS or by cheque to the following account:

Please verify bank details before making any contributions. You may visit Official website of Karnataka CM Relief Fund at the following link to verify the bank details or to make payment directly from there:

cmrf.karnataka.gov.in/English/index.html