PAN & Address Details of Odisha Chief Minister’s Relief Fund for 80G

In wake of Covid-19 pandemic, the entire society has come together and made contributions to fight against the deadly virus. In the State of Odisha, the Government employees has also contributed out of their salary to Odisha Chief Minister’s Relief Fund (OCMRF) for the noble cause. The contribution so made by them was deducted from their salary and deposited in OCMRF. Such contribution is shown in Form No. 16. The question before them is whether they could claim deduction for donations so made under section 80G and how they could claim the deduction.

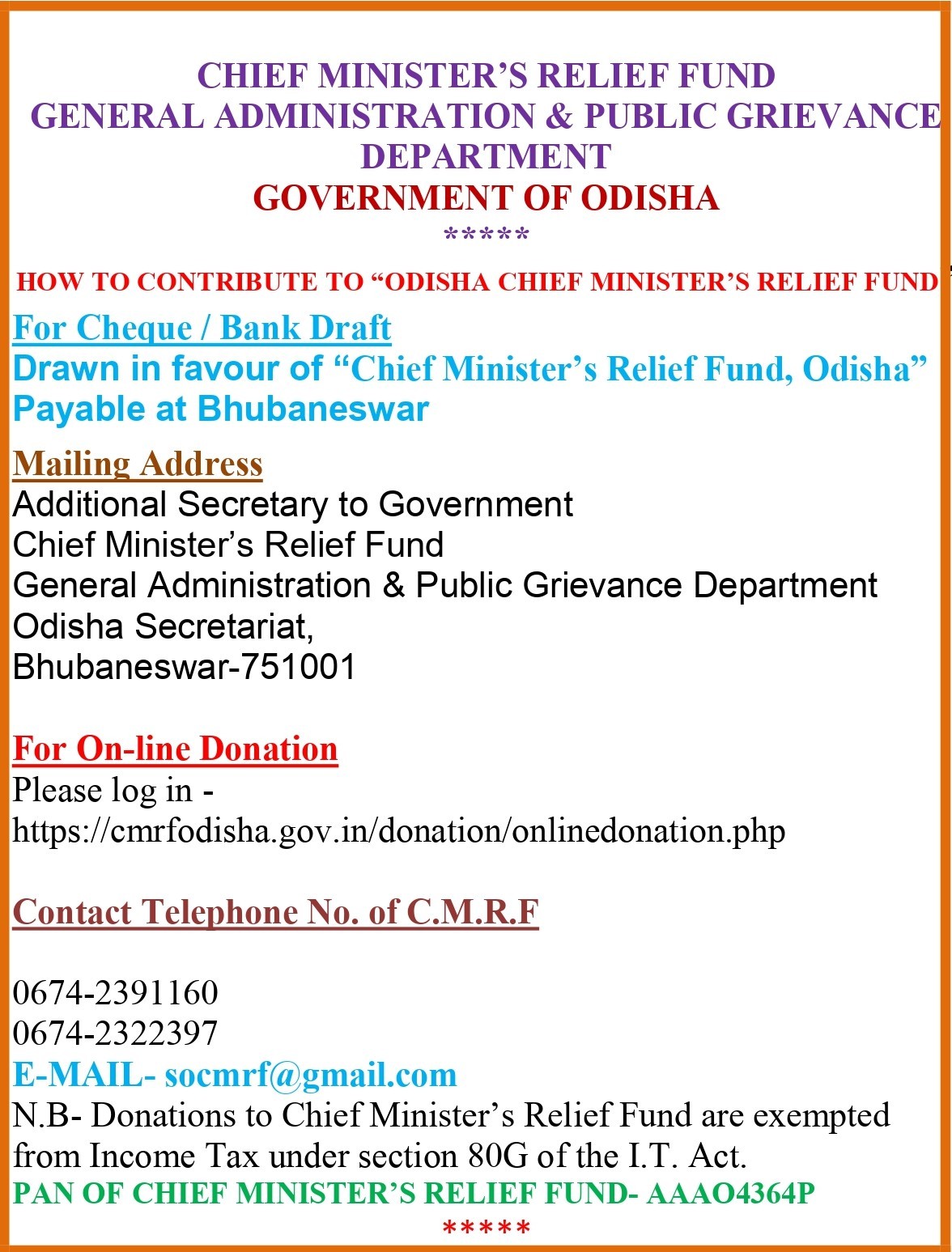

PAN & Address of Odisha Chief Minister’s Relief Fund

The contribution made to Odisha Chief Minister’s Relief Fund (OCMRF) is eligible for deduction under section 80G of the Income Tax Act, 1961. However, PAN and address details along with Pin code of OCMRF is required to be furnished in the Income Tax Return.

The details are as below:

|

Name of the Donee: |

Chief Minister’s Relief Fund |

|

PAN: |

AAATO4364P |

|

Address: |

General Administration & Public Grievance Department, Odisha Secretariat |

|

City: |

Bhubaneswar |

|

State: |

Odisha |

|

Pincode: |

751001 |

How to donate to Odisha CM Relief Fund

Donation to Odisha CM Relief Fund can be made online by clicking on the following link of official website of the Odisha Government: https://cmrfodisha.gov.in/donation/onlinedonation.php

Also See: cmrfodisha.gov.in/?q=node/27

Disclaimer: Readers are requested to donate to Odisha CM Relief Fund only through official website of the Odisha Government. The above information is only meant for informative purposes.