PAN & Address details of Rajasthan Chief Minister’s Relief Fund for 80G

In wake of Covid-19 pandemic, the entire society has come together and made contributions to fight against the deadly virus. In the State of Rajasthan, the Rajasthan Government employees has also made contribution out of their salary to Rajasthan Chief Minister’s Relief Fund (RCMRF). The contribution so made by them was deducted from their salary and deposited in RCMRF. Such contribution is shown in Form No. 16 but no receipt was given to the employees for such contribution.

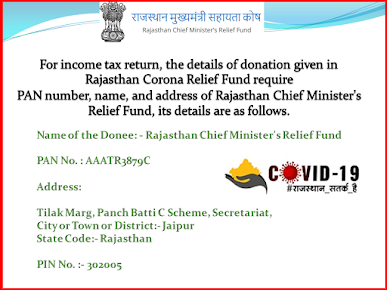

PAN & Address of Rajasthan Chief Minister’s Relief Fund

The contribution made to Rajasthan Chief Minister’s Relief Fund (RCMRF) is eligible for 100% deduction under section 80G of the Income Tax Act, 1961. But it is compulsory to furnish details of PAN and address along with Pin code of RCMRF in the Income Tax Return.

The details are as below:

|

Name of the Donee: |

Rajasthan Chief Minister’s Relief Fund |

|

PAN: |

AAATR3879C |

|

Address: |

Tilak Marg, C-Scheme, Secretariat |

|

City: |

Jaipur |

|

State: |

Rajasthan |

|

Pincode: |

302005 |

How to donate to Rajasthan CM Relief Covid-19 Mitigation Fund

Donation to Rajasthan CM Relief Covid-19 Mitigation Fund can be made by directly depositing to following bank as below:

|

Name of Bank & Branch: |

State Bank of India, Secretariat Branch, Jaipur |

|

Saving Account No.: |

39233225397 |

|

IFSC Code: |

SBIN0031031 |

|

BSR Code: |

0028331 |

Please verify bank details before making any contribution. You may visit Rajasthan Government official site at following link: http://cmrelief.rajasthan.gov.in/Static_AApkaYogdaanKovid19.aspx