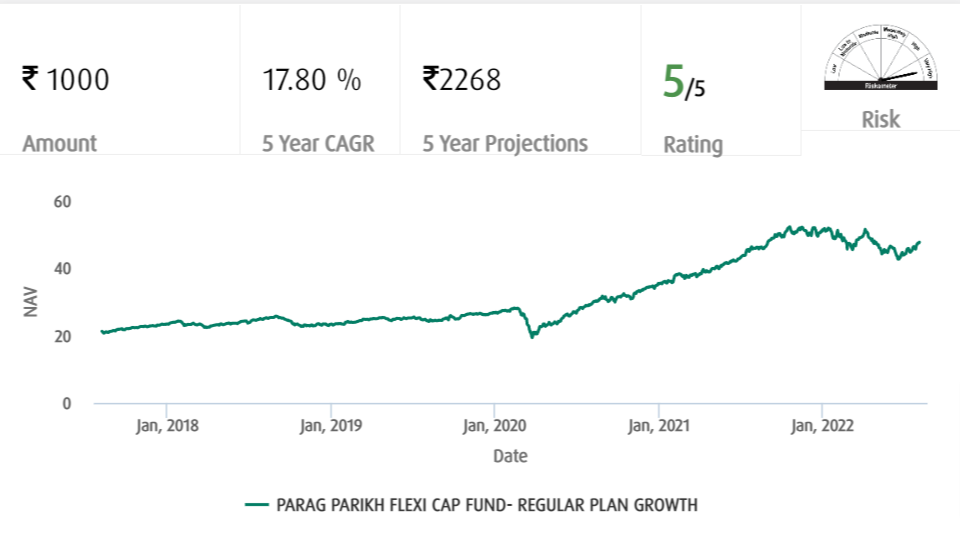

Parag Parikh Flexi Cap Fund Regular Plan- Growth

(Note: Based on the data as of 4th August 2022)

Suitability

This fund is suitable for investors who are looking for high returns over an investment horizon of 3-4 years. Further, the investor should assume a risk of moderate loss in their investments.

Scheme Details

|

Scheme Launch Date |

Sep. 2014 |

|

Scheme Type |

Open Ended Fund- Equity |

|

Minimum Investment Amount |

Rs. 1,000 (Initial); Rs. 1,000 (Additional) |

|

Minimum SIP Amount |

Rs. 1,000 |

|

Expense Ratio |

1.88% |

|

Fund Managers |

Rajeev Thakkar, Rukun Tarachandani, Raj Mehta |

|

Exit Load |

Entry Load: Nil & Exit Load: 2% of sales value if sold before 365 days,1.0% if sold after 365 days |

|

Risk |

Moderate |

|

AUM (in Cr.) |

Rs. 25,162.66 |

|

Investment Horizon |

Mid Term to Long Term |

About Fund Managers:

The Fund is managed by the following fund managers:

|

Rajeev Thakkar |

He is a Chartered Accountant, Cost Accountant, CFA and CFP. He has been associated with this fund AMC since 2013. |

|

Rukun Tarachandani |

He is B-tech. (IT), PGPM (Finance), CFA and CQF. He has also worked with Kotak Mutual Funds, Goldman Sachs, Unnati Investment Management & Research Group. |

|

Raj Mehta |

He is a Chartered Accountant & CFA. He started his career as intern with PPFAS Fund in 2012 and has grown since then to this position. |

Trailing Returns (%)

|

|

YTD |

1-Day |

1-W |

1-M |

3-M |

6-M |

1-Y |

3-Y |

5-Y |

7-Y |

10-Y |

|

Parag Parikh Flexi Cap Regular Plan- Growth |

-7.14 |

0.62 |

2.44 |

7.77 |

2.21 |

-3.74 |

4.09 |

24.88 |

17.80 |

15.66 |

- |

Benchmark Returns:

|

|

1 Year Return |

3 Year Return |

5 Year Return |

10 Year Return |

Returns since inception |

|

S&P BSE 500 TRI |

8.10 |

20.19 |

12.70 |

- |

- |

Peer Comparison

|

Mutual Fund |

Rating |

NAV |

1 Yr Return |

3 Yr Return |

5 Yr Return |

10 Yr Return |

Return Since Inception |

|

JM Flexicap Fund Growth Option |

5 |

52.11 |

9.51 |

19.09 |

11.33 |

16.37 |

12.64 |

|

SBI Focused Equity Fund |

4 |

|

4.29 |

18.40 |

14.17 |

- |

- |

|

PGIM India Flexi Cap Fund- Growth Option |

5 |

24.70 |

-2.49 |

25.28 |

13.85 |

NA |

12.95 |

|

UTI Flexicap Regular Plan Growth |

5 |

241.11 |

-2.03 |

21.85 |

14.36 |

15.88 |

12.83 |

|

DSP Flexicap Regular Plan Growth |

5 |

63.36 |

-10.07 |

11.10 |

9.76 |

13.73 |

18.40 |

Fund Allocations: The fund has approx. 70.85% investment in domestic equities of which 57.52% is in large cap stocks, 2.75% in mid cap stocks and 9.71% in small cap stocks.

Top 10 Companies in Portfolio

|

Company Name |

Sector |

P/E |

% Assets |

|

ITC Limited |

Consumer |

21.98 |

9.18 |

|

Bajaj Holdings and Investment Limited |

Financial |

- |

7.42 |

|

HDFC Limited |

Financial |

- |

7.28 |

|

Alphabet Inc Class A |

Services |

22.22 |

7.10 |

|

Microsoft Corp. |

Technology |

28.09 |

6.56 |

|

ICICI Bank Ltd. |

Banking |

20.83 |

5.76 |

|

Hero Motocorp Ltd. |

Automobile |

17.83 |

5.10 |

|

Coal India Limited |

Materials |

6.42 |

5.02 |

|

Axis Bank Limited |

Banking |

- |

4.97 |

|

Power Grid Corp. |

Energy |

11.21 |

4.95 |

Sector-wise Allocation of Fund

|

Sector |

Allocation of Assets (%) |

|

Basic Materials |

7.94 |

|

Consumer |

12.67 |

|

Financial Services |

32.47 |

|

Real Estate |

0.31 |

|

Communication Services |

4.69 |

|

Energy |

6.35 |

|

Industrials |

8.91 |

|

Technology |

12.18 |

|

Consumer Defensive |

5.88 |

|

Healthcare |

6.89 |

Disclaimer: Mutual Funds investments are subject to market risk. Therefore, it is advised to read the scheme documents carefully before making any investment. The above figures are based on the market data of the various mutual funds over the period and should not be solely made the basis of investment. Taxwink shall not be responsible for any loss caused to any person in any manner on any investment made on the basis of the above information.