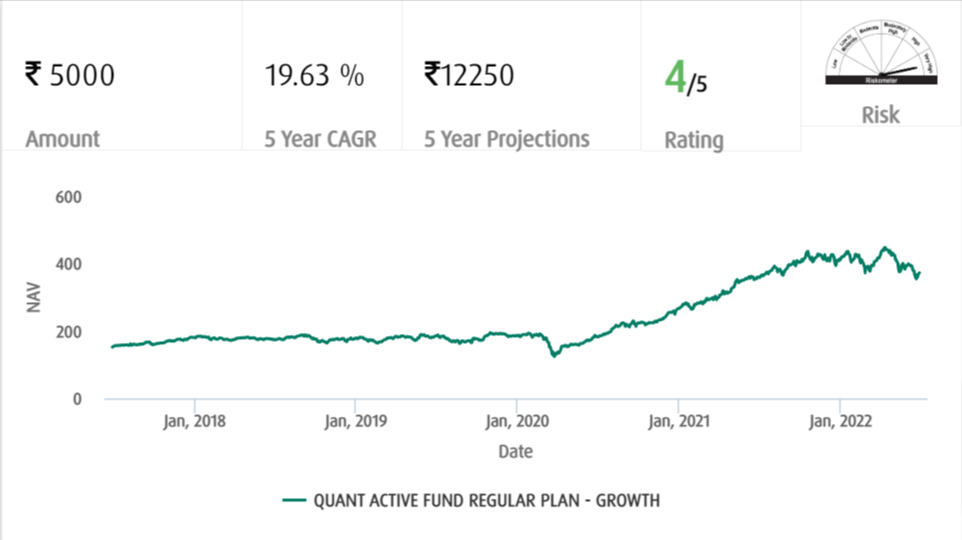

Quant Active Fund Regular Plan- Growth (Equity Multi Cap)

(Note: Based on the data as of 27th June 2022)

Objective of scheme

The objective of the scheme is to generate capital appreciation & provide long-term growth opportunities by investing in a portfolio of Large Cap, Mid Cap and Small Cap companies.

Suitability

Suitable for the investors who are looking to invest money for at least 3-4 years and looking for high returns with a possibility of moderate losses in their investments.

Scheme Details

|

Scheme Launch Date |

March 2001 |

|

Scheme Type |

Open Ended Equity Fund Scheme investing across large cap, mid cap, small cap stocks |

|

Minimum Investment Amount |

Rs. 5000 (Initial); Rs. 1,000 (Additional) |

|

Minimum SIP Amount |

Rs. 1,000 |

|

Expense Ratio |

1.98% (as on 26-06-2022) |

|

Fund Managers |

|

|

Exit Load |

Entry Load & Exit Load: Nil |

|

Risk |

Moderate |

|

AUM (in Cr.) |

Rs. 2329.31 (as on 27-06-2022) |

|

Investment Horizon |

Mid Term to Long Term |

About Fund Managers:

The Fund is managed by the following fund managers:

|

Ankit Pande |

Ankit Pande has done CFA & MBA. Prior to joining Quant Mutual Fund, he has worked with Infosys Finacle. He began his career in equity research in 2011. |

|

Sanjeev Sharma |

Sanjeev Sharma is a commerce graduate and PGDBA (Finance). He has work experience of 17 years including 13 years in the financial market. |

Trailing Returns (%)

|

|

YTD |

1-Day |

1-W |

1-M |

3-M |

6-M |

1-Y |

3-Y |

5-Y |

7-Y |

10-Y |

|

Quant Active Fund Regular Plan- Growth |

-10.20 |

1.24 |

5.11 |

-4.26 |

-10.56 |

-8.85 |

3.42 |

26.45 |

19.63 |

17.24 |

19.83 |

|

S&P BSE 500 TRI |

-9.41 |

0.90 |

3.82 |

-2.94 |

-7.62 |

-7.76 |

0.62 |

13.17 |

11.71 |

11.49 |

14.12 |

|

Equity: Multicap |

-10.89 |

1.05 |

4.40 |

-2.15 |

-7.82 |

-9.25 |

0.53 |

- |

- |

- |

- |

Peer Comparison

|

Mutual Fund |

Rating |

NAV |

1 Yr Return |

3 Yr Return |

5 Yr Return |

10 Yr Return |

Return Since Inception |

|

4 |

372.85 |

3.42 |

26.45 |

19.63 |

19.83 |

18.53 |

|

|

4 |

146.47 |

-1.49 |

9.66 |

9.00 |

14.32 |

14.13 |

|

|

MIRAE Asset Focused Fund- Regular Plan- Growth |

4 |

17.33 |

42.77 |

NA |

NA |

NA |

29.53 |

|

5 |

16.98 |

NA |

NA |

NA |

NA |

NA |

|

|

5 |

18.15 |

1.06 |

17.78 |

12.52 |

NA |

12.32 |

Fund Allocations

The fund has 98.33% investment in domestic equities of which 44.69% is in large stocks, 12.66% in mid-cap stocks, 23.06% in small cap stocks.

Top 10 Companies in Portfolio

|

Company Name |

Sector |

P/E |

% Assets |

|

ITC Limited |

Consumer |

21.81 |

8.12 |

|

Vedanta |

Mining |

4.50 |

5.97 |

|

State Bank of India |

Financial- Banking |

11.64 |

5.60 |

|

Ruchi Soya Industries |

Consumer |

48.83 |

3.91 |

|

L&T |

Construction |

24.89 |

3.72 |

|

Adani Ports & SEZ |

Services |

30.70 |

3.39 |

|

Adani Enterprises |

Services |

320.23 |

3.35 |

|

Linde India |

Chemicals |

97.74 |

3.26 |

|

Fortis Healthcare |

Healthcare |

31.36 |

2.94 |

|

IRB Infrastructure Dev. |

Construction |

35.36 |

2.85 |

Sector-wise Allocation of Fund

|

Sector |

Allocation of Assets (%) |

|

Basic Materials |

20.35 |

|

Consumer |

6.54 |

|

Financial Services |

14.04 |

|

Real Estate |

1.48 |

|

Communication Services |

7.90 |

|

Energy |

9.19 |

|

Industrials |

14.06 |

|

Technology |

1.41 |

Disclaimer: Mutual Funds investments are subject to market risk. Therefore, it is advised to read the scheme documents carefully before making any investment. The above figures are based on the market data of the various mutual funds over the period and should not be solely made the basis of the investment. Taxwink shall not be responsible for any loss caused to any person in any manner on any investment made on the basis of the above information.