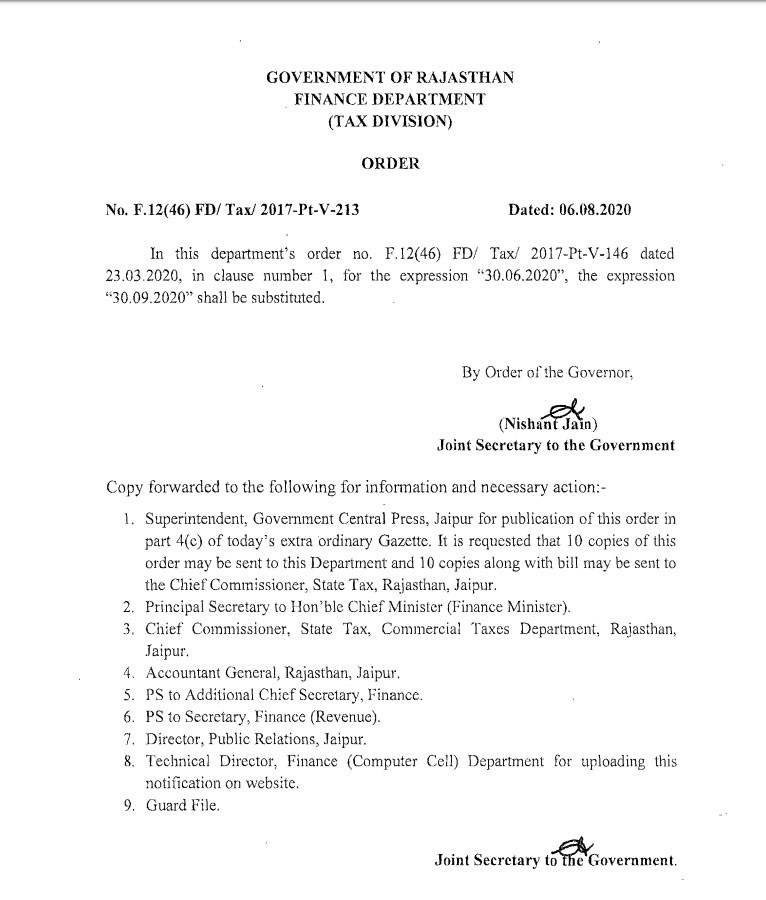

There has been unprecedented effect of Covid-19 pandemic all across the world especially hotel and travel industry which is striving for its survival. Hotel industry has been demanding relief packages from both State and Central Government. The Rajasthan Government had announced a major relief measure for hotel industry by allowing reimbursement of SGST due and deposited to hotel and tour operators till 30-06-2020. Such relief was announced vide Order No. F.12(46)FD/Tax/2017-Pt-V-146 dated 23-03-2020. Now, the Government has further extended the benefit of reimbursement of SGST due and deposited till 30-09-2020 vide Order No. F.12(46)FD/Tax/2017-Pt-V-213 dated 06-08-2020.

The original order dated 23-03-2020 is given hereunder:-

It has been decided to provide reimbursement of State Tax due and deposited by hotels and tour operators (referred as beneficiary) registered under Rajasthan Goods & Service Tax Act, 2017 on the following conditions:-

1. Operative Period:- This shall come into effect from 01-04-2020 and shall remain in force upto 30-06-2020 (now extended to 30-09-2020).

2. Definition- State Tax Due & Deposited:- means the amount of SGST paid through debit in the electronic ledger account maintained by the enterprise in terms of sub-section (1) of section-49 of the Rajasthan State Goods & Service Tax Act, 2017 after complete utilization of the available amount of ITC of the SGST and IGST.

3. Applicability:- This order shall be applicable for registered taxable persons in the category of hotels, heritage hotels, resorts and tour operators. This order shall not be applicable for stand-alone restaurants and clubs.

4. Reimbursement of State Tax due and deposited:- The beneficiary shall be entitled for reimbursement of State Tax due and deposited in the operative period in the manner as may be prescribed. Provided that no reimbursement under this order shall be available for SGST leviable and paid on rental or leasing services including own or leased residential property (SAC 997212).

5. Non-entitlement of reimbursement:- If any beneficiary is found guilty of any kind of evasion in the preceding financial year i.e. 2019-20, he shall not be entitled for reimbursement under this order.

6. Wrong availment of reimbursement:- If at any time, it is found that a beneficiary has wrongly availed the reimbursement under this order, the same shall be recovered as an arrear of State Tax along with interest 18% p.a. and penalty equal to the amount wrongly availed.

7. Beneficiary availing benefits under RIPS:- If entitlement certificate is issued to any beneficiary under RIPS-2003 and/or RIPS-2010 and/or RIPS-2019, the reimbursement shall stand reduced to the extent of benefits available under the said schemes.

8. Power to issue guidelines and clarifications for reimbursement:- Chief Commissioner, State Tax shall issue guidelines for application and procedure for reimbursement of State Tax due and deposited.

9. Review or modification of the order:- The State Government may review or modify order, in full or in part, prospectively or retrospectively.