Reverse Charge Mechanism is not a new concept in the Indian Indirect Tax system. In pre-GST regime, it was also prevalent under the service tax law. Under current GST regime, the provisions of reverse charge have been taken from service tax provisions to some extent. In this article, we will discuss about reverse charge and answer to the intricacies of GST law in relation to reverse charge.

What is Reverse Charge?

Normally, it is the liability of supplier of goods or services to collect the GST from the recipient of goods or services and deposit the same to Government exchequer. But, under reverse charge, the liability to pay GST is on the recipient directly to the Government. The provisions of reverse charge have been brought in case of specified goods and services to avoid tax evasion and to increase tax base. Reverse charge mechanism has been introduced in many cases like transport services, cab services, import etc. Section-9(3) & 9(4) of CGST Act or Section- 5(3) or 5(4) of IGST Act specifies the goods or services on supply of which GST is payable under reverse charge.

What is section- 9(3) of CGST Act?

Section-9(3) of CGST Act/ 5(3) of IGST Act: -

- Under this section, those goods and services are notified on which the recipient of goods or services is liable to pay tax under reverse charge.

- In this section, it does not matter whether the supplier is registered or not under GST.

- The liability to pay GST will always be upon the recipient of goods or services on the goods and services specified u/s 9(3) and corresponding section 5(3) of IGST Act.

What are the goods or services liable for RCM under GST?

List of goods under RCM in GST

|

Sr. No. |

Description of supply of Goods |

Supplier of Goods |

Recipient of Goods |

|

1 |

Cashew nuts (not shelled or peeled) |

Agriculturist |

Any registered person |

|

2 |

Bidi Wrapper Leaves (tendu), Tobacco Leaves |

Agriculturist |

Any registered person |

|

3 |

Silk Yarn |

Manufacturer of silk yarn from raw silk or silk worm cocoons |

Any registered person |

|

4 |

Lottery |

State Government, Union Territory or local authority |

Lottery distributor or selling agent |

|

5 |

Raw Cotton |

Agriculturist |

Any registered person |

|

6 |

Used vehicles, seized and confiscated goods, old and used goods, waste and scrap |

Central Government, State Government, Union Territory or local authority |

Any registered person |

|

7 |

Purchase of priority sector lending certificate |

Registered person |

Any registered person |

List of services under RCM in GST

|

Sr. No. |

Description of supply of services |

Supplier of services |

Recipient of services |

GST Rates |

|

1 |

Goods Transport Agency (GTA) services by road |

Goods Transport Agency |

Any factory, society, cooperative society, registered person under GST, body corporate, partnership firm including AOP, casual taxable person located in the taxable territory |

5% |

|

Note:

|

||||

|

2 |

Legal services provided directly or indirectly, by advocate including a senior advocate or firm of advocates |

An individual advocate including a senior advocate or firm of advocates |

Any business entity located in the taxable territory shall be liable under reverse charge @ 18%. |

18% |

|

Note: -

|

||||

|

3 |

Services provided by an arbitral tribunal to a business entity |

An Arbitral Tribunal |

Any business entity located in the taxable territory. |

18% |

|

||||

|

4 |

Sponsorship services provided to any Body corporate or partnership firm |

Any person |

Any Body Corporate or partnership firm located in taxable territory. |

18% |

|

5 |

Services supplied by the Central Government, State Government, Union Territory or local authority to a business entity excluding:

|

Central or State Government, Union Territory, Local Authority |

Any Business Entity located in the taxable territory. |

18% |

|

5A |

Renting of immovable property services by Central Government, State Government, Union Territory or Local Authority to a person registered under GST |

Central or State Government, Union Territory, Local Authority |

Any person registered under GST |

18% |

|

5B |

Transfer of development rights or Floor Space Index (FSI) (including additional FSI) for construction of a project |

Any Person |

Promoter |

18% |

|

Note: Notification No. 6/2019- CT (Rate): - GST on development rights/ FSI to be paid by promoter w.e.f. 01-04-2019 under reverse charge @ 18%. |

||||

|

5C |

Long Term Lease (30 years or more) by any person against consideration in the form of upfront amount (called as premium, salami, cost, price, development charges or by any other name) and/ or periodic rent for construction of a project by a promoter. |

Any Person |

Promoter |

18% |

|

Note: Notification No. 6/2019- CT (Rate): - GST on long term lease by any person for construction project by a promoter shall be payable under reverse charge w.e.f. 01-04-2019 @18%. |

||||

|

6 |

Services supplied by a director of a company or a body corporate to the said company or body corporate |

A director |

The company or body corporate located in the taxable territory. |

18% |

|

7 |

Services by an insurance agent to any person carrying on insurance business |

Insurance Agent |

Any person carrying on insurance business |

18% |

|

8 |

Recovery Agent Services to a bank or financial institution or NBFC |

Recovery Agent |

Bank or Financial Institution or NBFC |

18% |

|

9 |

Copyright services by a music composer, photographer, artist or like relating to original dramatic, musical or artistic works to a music company, producer or the like |

Music Composer, Photographer, artist or the like |

Music Company, producer or the like located in the taxable territory |

12% |

|

9A |

Supply of services by an author by way of transfer or permitting the use or enjoyment of a copyright covered under the Copyright Act, 1957 relating to original literary works to a publisher |

Author of original literary work |

Publisher located in the taxable territory. |

12% |

|

Note: -

|

||||

|

10 |

Supply of services by the members of Overseeing committee to RBI |

Members of Overseeing Committee constituted by RBI |

Reserve Bank of India |

18% |

|

11 |

Supply of services by individual Direct Selling Agents (DSA) other than a body corporate, partnership or LLP to a bank or NBFC |

Individual DSA other than a body corporate, partnership or LLP to a bank or NBFC |

Banking company or NBFC located in taxable territory |

18% Inserted by Notification No. 15/2018- CT (Rate) dated 26.07.2018 |

|

12 |

Services provided by a business facilitator to a banking company |

Business Facilitator |

Banking company located in taxable territory |

18%

|

|

13 |

Services provided by an agent of business correspondent to business correspondent |

An agent of business correspondent |

Business Correspondent located in taxable territory |

18% Inserted by Notification No. 29/2018- CT (Rate) dated 31.12.2018 |

|

14 |

Security services (by way of supply of security personnel) |

Any person other than body corporate |

Registered Person |

18% Inserted by Notification No. 29/2018- CT (Rate) dated 31.12.2018 |

|

Note: Nothing contained in this entry shall apply to: -

|

||||

|

15 |

Services provided by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient |

Any person other than body corporate, who supplies the service to a body corporate and does not issue an invoice charging CGST @ 6% plus SGST to the service recipient |

Any body corporate located in the taxable territory |

5% |

|

Note: The above entry has been inserted by Notification No. 22/2019- CT (Rate) dated 30.09.2019. It has been further amended Notification No. 29/2019- CT (Rate) dated 31.12.2019 . |

||||

|

16 |

Services of lending of securities under Securities Lending Scheme, 1997 of SEBI |

Lender i.e. a person who deposits the securities registered in his name or in the name of any other person duly authorised on his behalf with an approved intermediary for the purpose of lending under the scheme of SEBI |

Borrower i.e. a person who borrows the securities under the scheme through an approved intermediary of SEBI |

18%

Inserted by Notification No. 22/2019- CT (Rate) dated 30.09.2019 |

All the goods and services notified for RCM purposes have also been notified under IGST Act. Further, the following additional services are also notified under IGST Act for levy of IGST under reverse charge: -

|

Nature of supply of services |

Supplier of services |

Recipient of services |

|

Services supplied by a person located in non-taxable territory by way of transportation of goods by vessel from a place outside India up to the customs station of clearance in India |

A person located in the non-taxable territory |

Importer located in the taxable territory |

|

Any service supplied by any person located in a non-taxable territory to any person other than non-taxable online recipient |

Any person located in a non-taxable territory |

Any person located in the taxable territory other than non-taxable online recipient |

What is section-9(4) of CGST Act?

- According to this section, in case of receipt of goods or services by a registered person from an unregistered supplier, GST will be payable by the recipient on the specified goods or services.

- It should be noted that this section is applicable only where specified goods or services are procured from an unregistered supplier.

- Till today, the Central Government has specified only certain transactions related to real estate projects.

In which cases RCM is applicable under GST?

Reverse Charge Mechanism is applicable in the following cases: -

- In case of goods or services notified under section 9(3) of CGST Act, the recipient of goods or services shall be liable to pay GST under RCM irrespective of the fact whether the supplier is registered or not.

- In case of goods or services notified under section 9(4) of CGST Act, the recipient of goods or services shall be liable to pay GST under RCM if such purchase is made from unregistered supplier.

When is e-commerce operator liable for payment of GST?

If an e-commerce operator (aggregator) supplies services, then reverse charge is applicable. He will be liable to pay GST under RCM. For example, UrbanClap takes services from beauticians, plumbers, electricians etc. to be provided such services to their customers. In such cases, UrbanClap will be liable to pay GST instead of such beauticians, plumbers, electricians etc.

If the e-commerce operator does not have a physical presence in the taxable territory, then its representative will be liable to pay tax. If there is no representative, the operator will have to appoint a representative.

When is RCM applicable in case of purchase from unregistered suppliers?

Read our article on the related topic:- RCM on purchases from unregistered suppliers under GST

What is ‘Time of Supply’ in Reverse Charge under GST?

‘Time of Supply’ is the point of time at which the supply of goods or services is liable for tax under GST laws.

Time of Supply in case of Goods |

Time of Supply in case of Services |

|

Earliest of the following: -

|

Earliest of the following: -

|

How an invoice is made for RCM supplies?

- If purchase liable for reverse charge is made from a registered supplier: - In this case, the registered supplier will issue invoice but he is not liable to pay tax. Hence, he will mention in the invoice that the tax is payable under RCM. Similarly, this is also required to be mentioned in receipt voucher as well as refund voucher.

- If purchase liable for reverse charge is made from an unregistered supplier: - the recipient is liable to issue an invoice himself. It is also called as ‘Self-Invoicing’. He can prepare a single consolidate monthly invoice.

Can tax payable under RCM be paid from electronic credit ledger?

No, tax which is payable under RCM cannot be paid from electronic credit ledger. Tax in this case has to be deposited only through electronic cash ledger.

Can we take input tax credit for tax paid under RCM in the same month?

Yes, you can claim the input tax credit for tax paid under RCM in the same month, when you pay the GST under RCM.

Is GST payable on advances received for supplies liable for GST under reverse charge mechanism?

Yes, advances paid for reverse charge supplies are also liable for GST. The person who makes advance payment will have to pay tax on reverse charge basis.

How to show RCM amount in the GST Return?

Supplies received and liable for tax under RCM has to be shown as follows:-

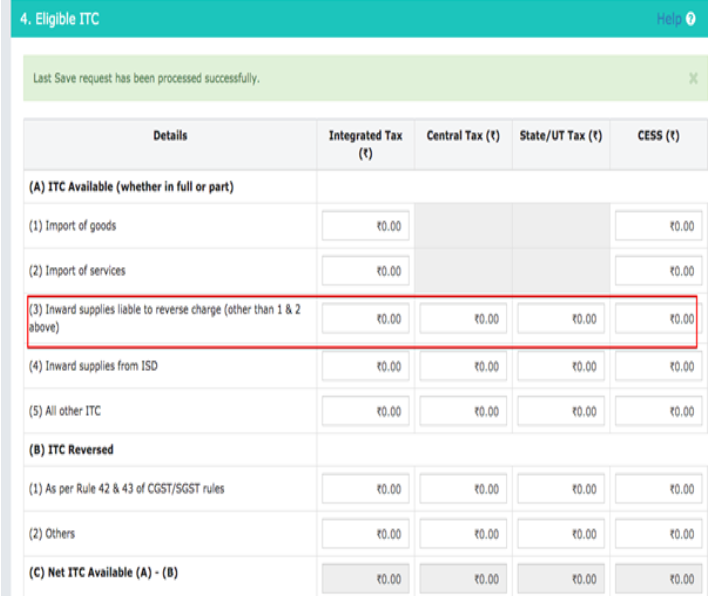

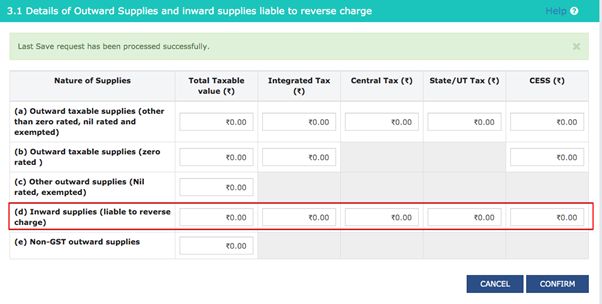

- In GSTR-3B, it is shown at two places: -

In table 3.1.d: - Under Inward Supplies (liable to reverse charge)

Secondly, it is shown in table no. 4.3 as ITC.

- In GSTR-1: - It is shown in Table-4B.

Are provisions of RCM u/s 9(4) applicable on supplies made to TDS deductors u/s 51 of CGST Act, 2017?

The provisions of section 9(4) of CGST Act will not be applicable to supplies made to a TDS deductor in terms of notification no. 9/2017- CT (Rate) dated 28.06.2017. Therefore, the Government entities who are TDS deductors u/s 51 of the CGST Act need not pay GST under RCM on supplies received from unregistered suppliers.

Is registration compulsory if we are receiving supplies liable for tax under RCM?

A person who is required to pay tax under reverse charge has to compulsorily register under GST and the threshold limit of turnover of Rs. 20 Lakhs/ 40 Lakhs (Rs. 10 Lakhs for special category states) is not applicable to them.

I am engaged in supply of exempted or non-taxable goods. I also receive goods or services which are liable for GST under RCM. Do I need to register under GST?

Section 23 of CGST Act provides for exemption from registration to those who are exclusively engaged in the supply of goods or services which are either non-taxable or wholly exempted. Thus, if you are not required to register under GST then you are not required to pay GST under reverse charge.

I am supplier of Goods Transport services by road. In my case, GST is always payable by my customers under reverse charge. Do I need to register under GST?

No, you need not register under GST. As per Notification No. 5/2017 – CT dated 19-06-2017, a person who is making supplies of goods or services where the total tax is payable by recipient of goods or services are exempt from registration under GST.

Can an Input Service Distributor (ISD) make purchases liable to reverse charge?

An ISD cannot make purchases liable to reverse charge under GST. If he wants to do so, he will have to register as normal taxpayer to claim ITC.