How to claim Tax relief on Salary arrears under section 89?

Introduction:

Arrears of salary received by the employees are taxable in the year in which it is received by the employee. Generally, the amount of salary arrears is significant which increases the tax liability of the employee but many of you might not be aware that the Income Tax Department allows tax relief under section 89 of the Income Tax Act against the salary arrears. Please note that claiming relief under section 89 is not that easy and certain conditions need to be fulfilled for making a tax relief claim.

What is relief on arrear salary?

The Income Tax on the total income of the taxpayers is calculated at the rates of tax in force in that year. Sometimes, it happens that the salary income of the employee was taxed at lower rates in the earlier years but the arrears of salary in respect of such years is received by him in the year when he is liable to pay tax at higher rates. Thus, the taxpayer is obliged to pay higher tax though the salary arrears belonged to the past years.

To avoid this situation, the Income-tax law has given a provision for computation of tax relief in respect of salary arrears. This tax relief is known as “Section 89(1) relief”. This relief is available both in the case of salary arrears as well as family pension arrears.

How to calculate tax relief under section 89(1) on salary arrears?

Rule 21A of the Income Tax Rules provides the manner of calculation of tax relief under section 89(1) of the Income Tax Act. Following are the steps for calculation of tax relief u/s 89(1):

|

Step-I: Calculate tax payable on the total income, including arrears of salary for the year in which the arrears of salary are received. |

|

Step-II: Calculate tax payable on the total income, excluding arrears of salary, for the year in which the arrears of salary are received. |

|

Step-III: Compute the Difference between Step-I and Step-II, the result is (A). |

|

Step-IV: Calculate tax payable on the total income, without including salary arrears, for the year to which the arrears are related- If ITR is already filed, pick the figure of tax from the ITR |

|

Step-V: Calculate tax payable on the total income, including salary arrears, for the year to which the arrears are related. |

|

Step-VI: Compute the difference between Step-IV and Step-V, the result is (B). |

|

Step-VII: Tax Relief allowable u/s 89(1) = (A)- (B) |

How to claim relief under section 89?

For making a claim for relief under section 89, an employee needs to submit Form 10E. Form 10E can be filed electronically (online) on the e-filing portal of the Income Tax Department. Please ensure that Form 10E is submitted before filing Income Tax Return.

Why filing Form 10E is important?

Form 10E is compulsory for making a claim for tax relief u/s 89(1) of the Income Tax Act. In case, Form 10E is not filed, the claim for tax relief will not be entertained by the Department and you will end up paying higher taxes and interest. Therefore, you should ensure filing of Form 10E before submission of your Income Tax Return online.

Is it necessary to attach a copy of Form 10E with ITR?

No, you are not required to attach a copy of Form 10E along with the ITR. Submission of Form 10E online is sufficient.

How to file Form 10E?

Follow the following simple steps to file Form 10E online on the e-filing portal:

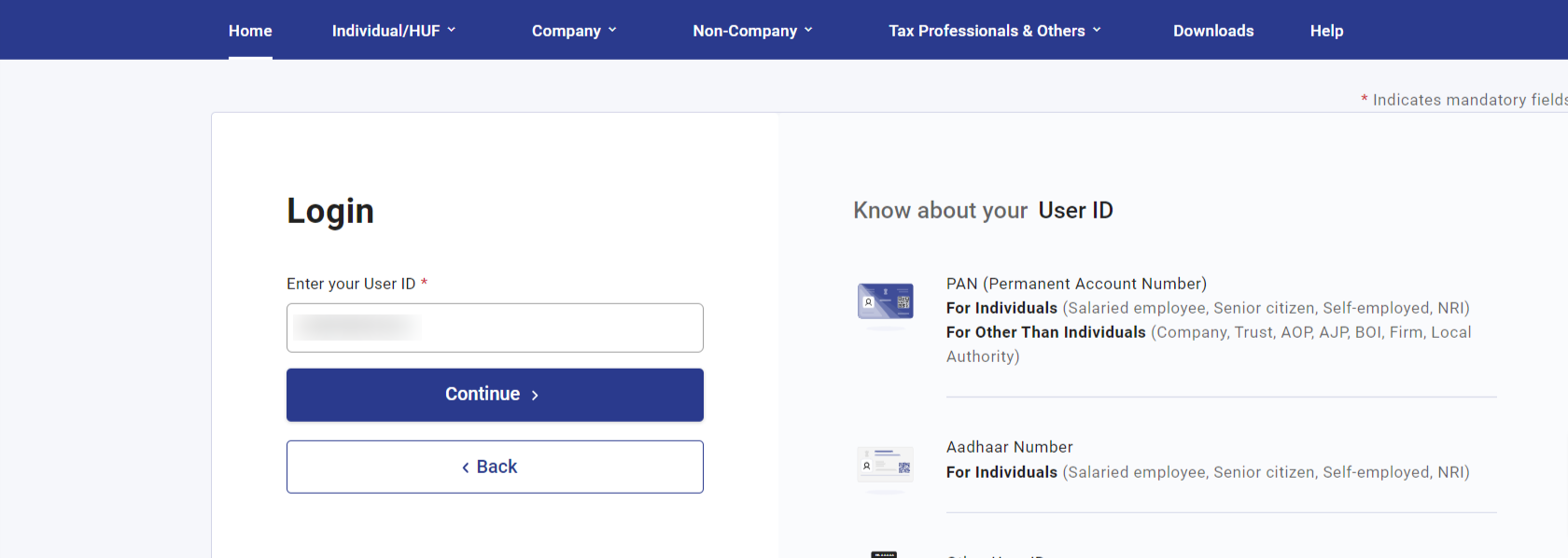

Step-I: Login to E-filing portal of Income Tax Department, Click the link: eportal.incometax.gov.in

Step-II: Enter PAN as your “User id” and click on “Continue”.

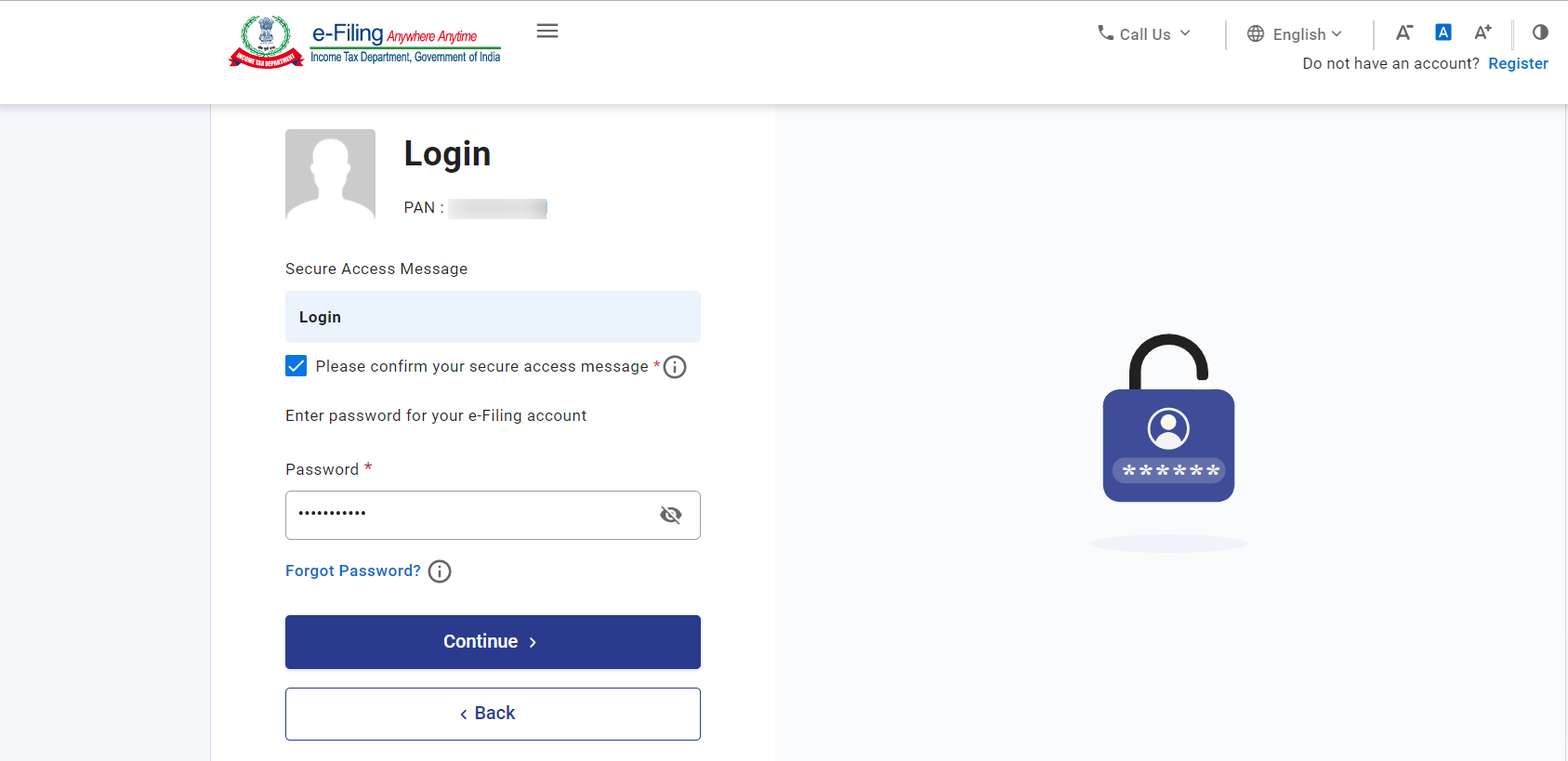

Step-III: Tick on the checkbox “Please confirm your secure access message” and enter the password and click on “Continue”.

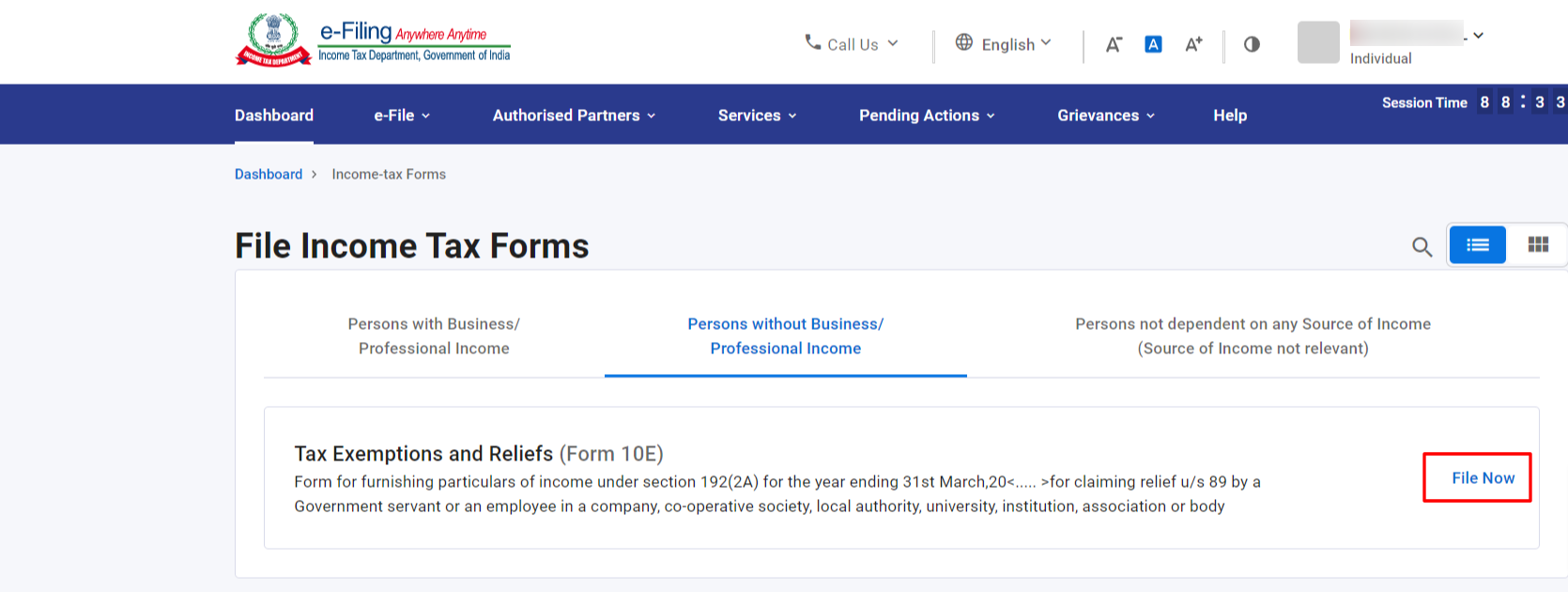

Step-IV: Your Income Tax Dashboard will appear on the screen. Click on e-file<

Step-V: In the next screen, in the section “Person without Business/Professional Income”, Form 10E will appear. Click on “File now”.

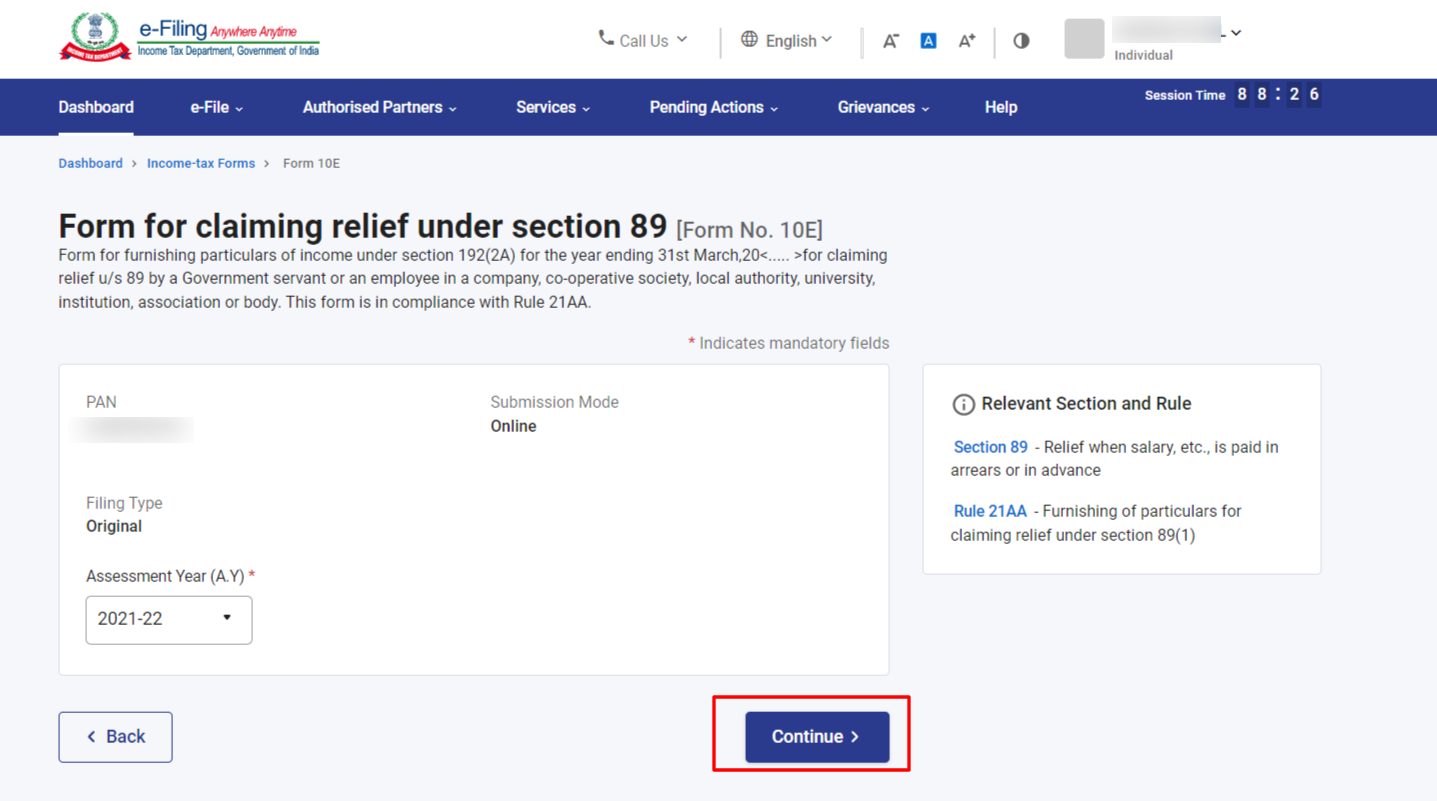

Step-VI: Select the Assessment Year and click on “Continue”>> Click on “Let’s get started”.

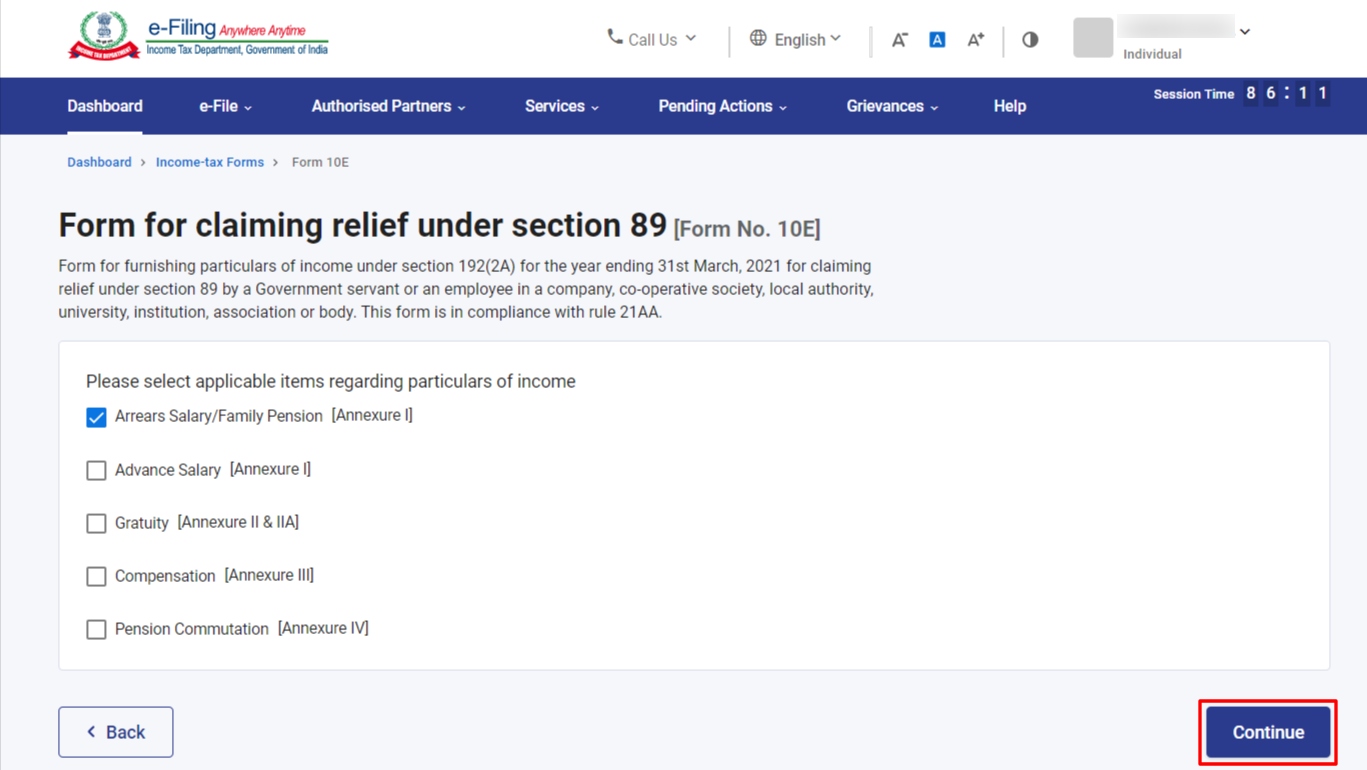

Step-VII: Click on Checkbox “Arrears Salary/ Family Pension [Annexure I] and click on “Continue”

Step-VIII: Details of Form 10E are to be submitted in three sections including Personal Information, Arrears Salary/Family Pension & Verification. Fill in the details and click on “Preview” after verification.

Step-IX: Check the details filled in Form 10E in the “Preview Section”. If details are found as correct, click on “Proceed to E-Verify”.

Step-X: E-Verify using Aadhar OTP on your mobile number or through digital signature.

Step-XI: On successful validation of form using Aadhar OTP or digital signature, you will be prompted to confirm final submission by clicking on “No” or “Yes”. Click on “Yes” for final submission and it's done.

File your Income Tax Return online

Conclusion: You can claim tax relief under section 89(1) even where the relief figures are not mentioned in Form 16. Even where the employer has already deducted TDS on salary arrears, you are eligible to claim relief under section 89(1) and reduce your tax burden and most importantly, don’t forget to file income tax return timely.