Section-194B: TDS on winnings from Lottery or Crossword Puzzles or Games

Everyone is curious about watching TV shows like "Kaun Banega Crorepati" or "Dance India Dance" and wonders how much amount will the participants get from this show. Do they get 100% of the winning amount? The answer to this question is "No". The Income Tax Act contains provisions of TDS due to which 30% tax is deducted from their winnings and only the net amount is paid to the participants. In this article, we will discuss the TDS provisions given under sections 194B & 194BB and answer all your doubts:

Who is liable to deduct TDS u/s 194B?

The person who is responsible for paying to any person any income by way of winnings from any lottery, crossword puzzle, card games, and games of any sort is required to deduct tax before making payment of such winnings.

Is TDS u/s 194B to be deducted where the receiver is a non-resident?

Yes, Section 194B is equally applicable in the case of resident as well as non-resident payees. Therefore, the payer should ensure tax deduction as per section 194B before making payment of any winnings to a non-resident also.

When to deduct TDS u/s 194B?

TDS under section 194B is to be deducted at the time of payment of the winning amount. If the payment is made in installments, then TDS ought to be deducted on payment of each installment.

What is the rate of TDS u/s 194B?

TDS u/s 194B is liable to be deducted at the rate of 30%. No surcharge or cess shall be added to TDS rates. However, if the amount of winning is not more than Rs. 10,000, no TDS is deductible.

How to deduct TDS in case winning amount is in kind or partly in kind?

The person responsible for paying shall, before releasing the winnings, shall ensure that tax has been paid in respect of the winnings.

For example: A wins a car in a lucky draw held by B Ltd. The market price of the car is Rs. 3 Lakhs. In this example, B Ltd. should ensure that Rs. 90,000 tax has been recovered from A before giving car to him. Otherwise, B Ltd. will itself has to pay tax calculated on the basis of grossing up concept:

Grossed up amount: 3 Lakhs * 100/100-30 = Rs. 4,28,571

Tax eligible to be deducted = 4,28,571- 3,00,000 = Rs. 1,28,571

Section 194BB- TDS on winnings from Horse Races

Section 194BB of the Income Tax Act, 1961 deals with the provisions of TDS in case of winnings from horse races. The questions and answers relating to Section 194BB are as follows:

Who is required to deduct TDS u/s 194BB?

According to section 194BB, any person:

- Being a bookmaker or

- A person to whom license has been granted by the Government for horse racing in racecourse or for arranging for wagering or betting in racecourse

is liable to deduct tax on payment of winnings made to any person (resident as well as non-resident)

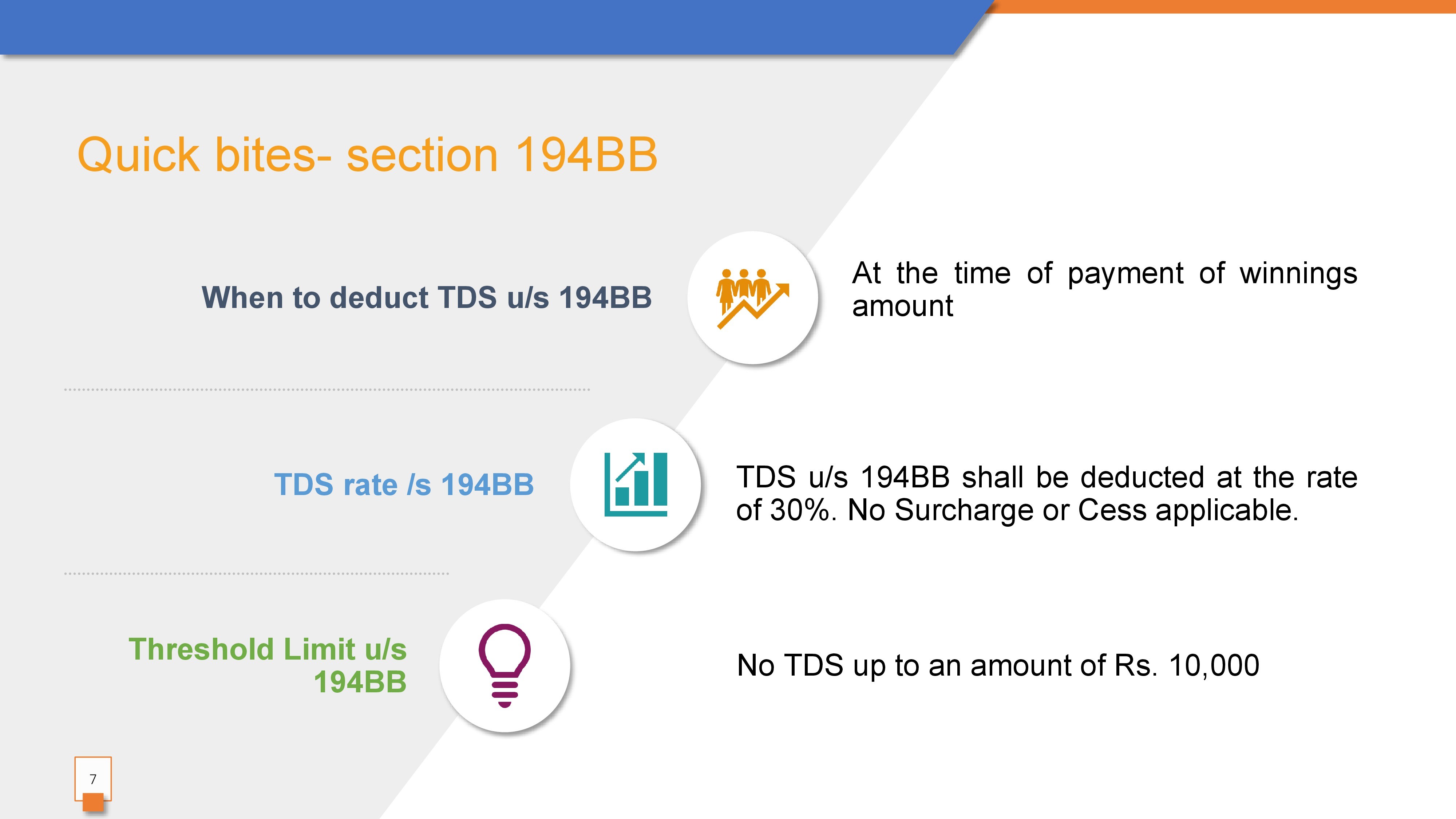

What is the rate of TDS u/s 194BB?

TDS under section 194BB is deductible at the rate of 30%. However, no TDS is deductible in case the amount of winning does not exceed Rs. 10,000

When is TDS u/s 194BB to be deducted?

TDS under section 194BB is required to be deducted at the time of payment of winning amount.

Disclaimer: The above article is meant for educational purposes only. Taxwink is not responsible for any loss or damage caused to any person from the use of any information contained in this article in any manner whatsoever.