TDS on payments against Joint Development Agreements- Section 194-IC

Joint Development Agreements (JDA) are very common nowadays between the owner of land or building and a builder/ developer under which the builder/ developer agrees to discharge consideration to the owner in the form of share in the construction project. In some cases, the builder/ developer also agrees to pay some amount of cash in addition to the share in the project to the owner of the land/building. Section 194-IC has been brought into the law to cover such cases. Section 194-IC prescribes TDS @ 10% in the case of a joint development agreement where any person makes payment to a resident any sum by way of consideration not being 'consideration in kind'. This article describes the provisions of section 194-IC in a simple manner.

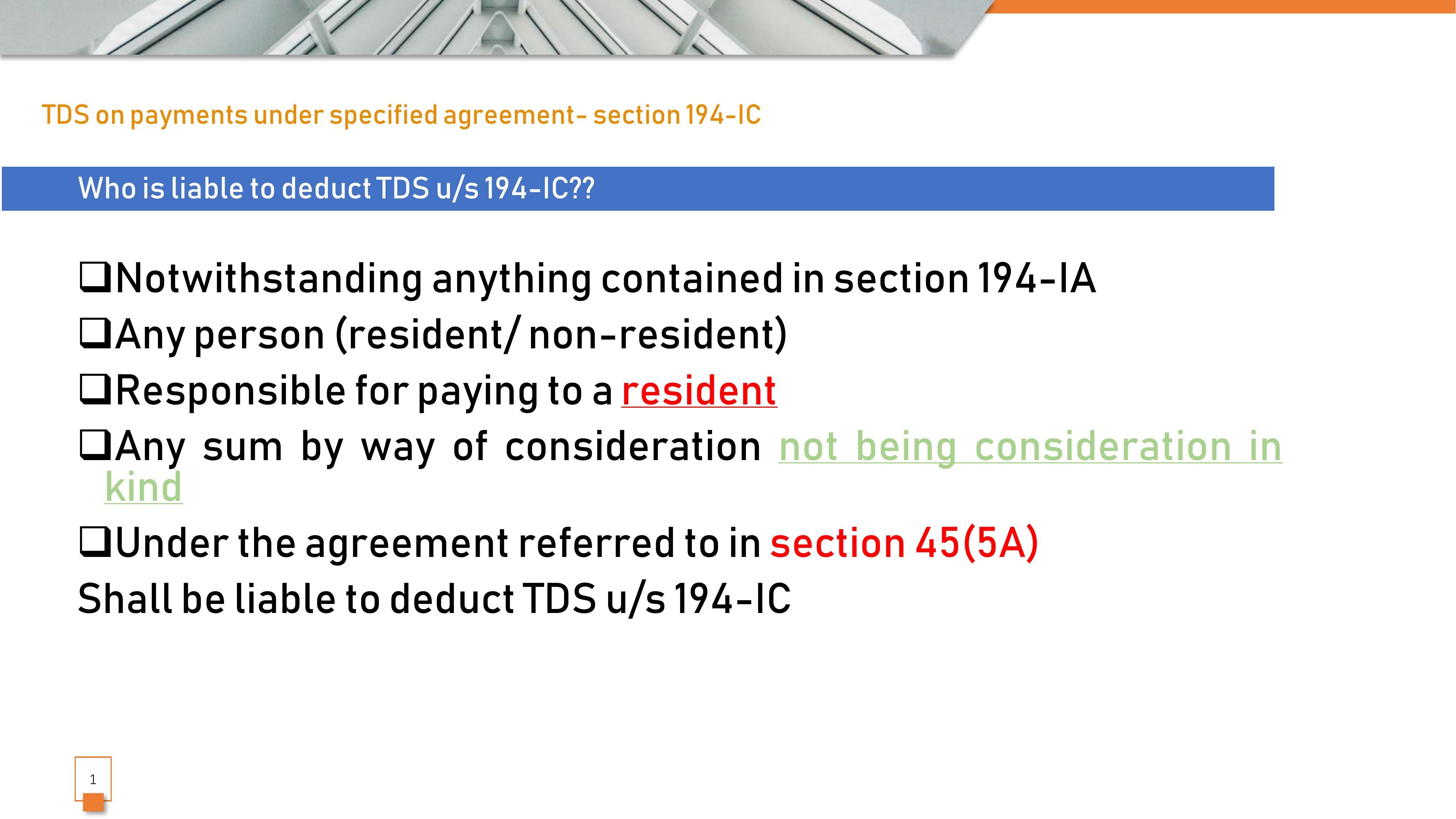

Who is liable to deduct TDS u/s 194-IC?

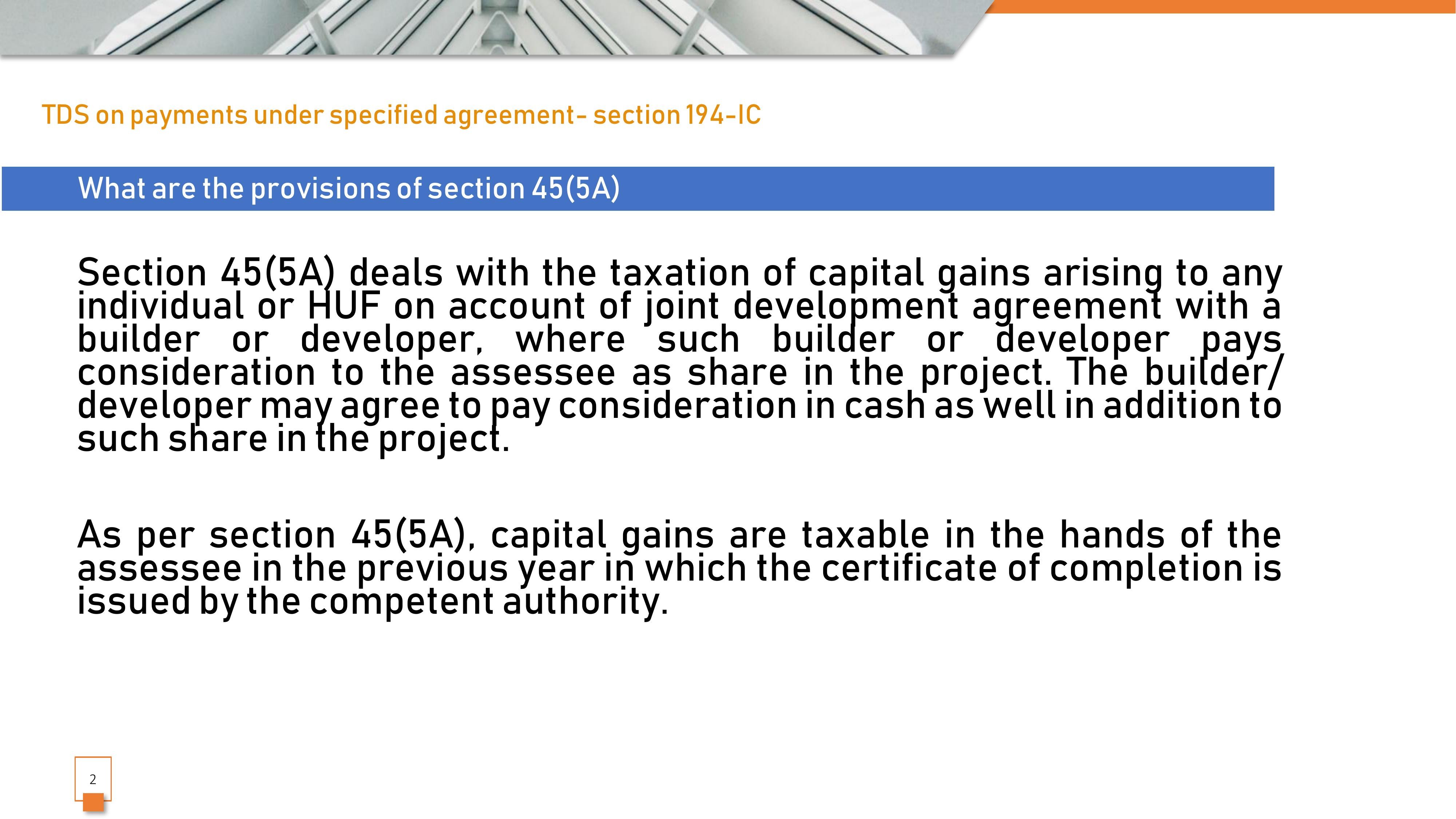

What are the provisions of section 45(5A)?

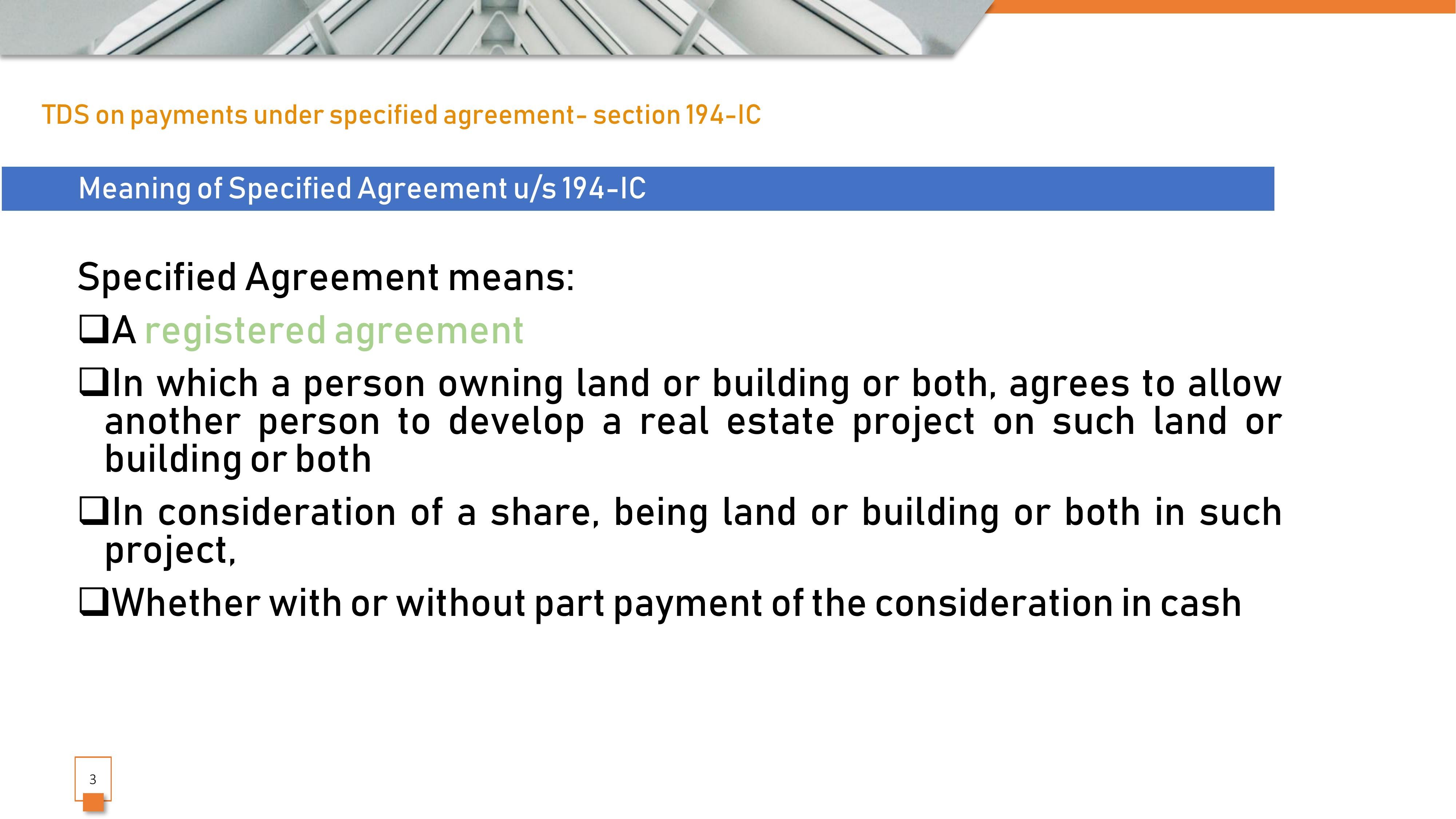

What is the meaning of 'Specified Agreement' u/s 194-IC?

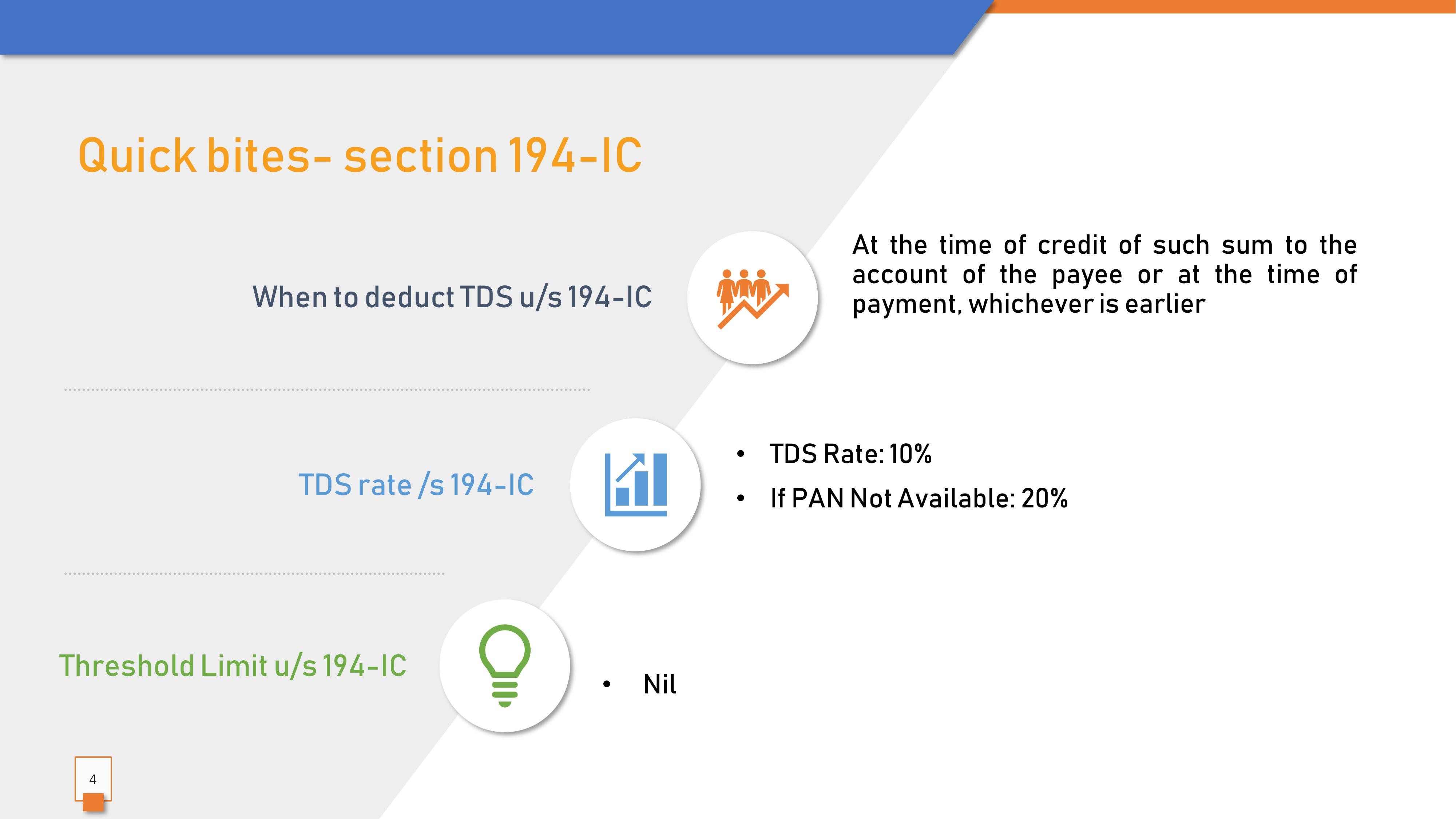

What is the rate of TDS u/s 194-IC?

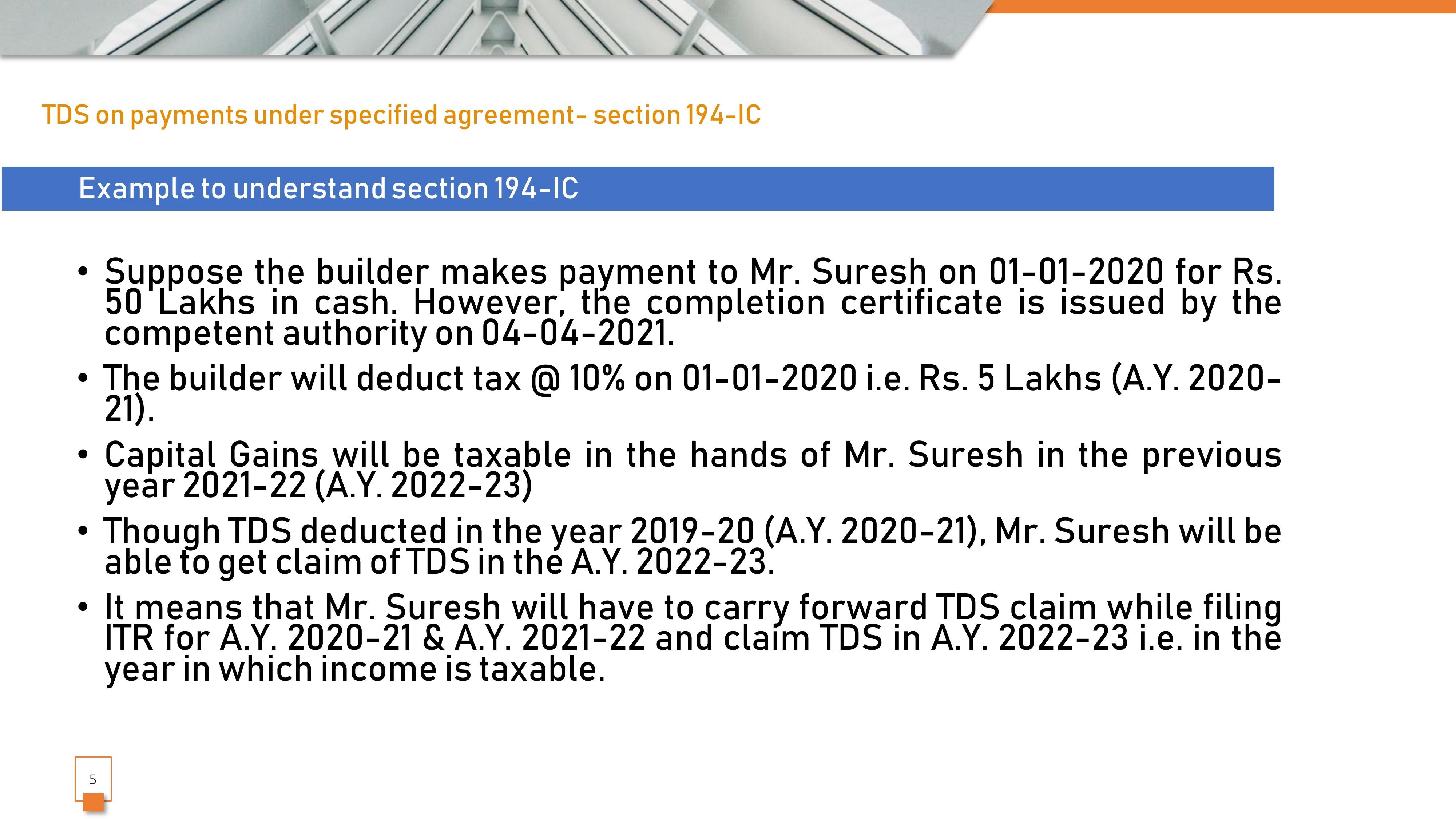

Example to understand section 194-IC

Disclaimer: The above article is for educational purposes only and Taxwink is not responsible for any loss or damage caused to any person due to any information contained in this article. Readers are, therefore, requested to act diligently and under consultation with any professional before applying the information contained in this article.