TDS on Rent- Section 194-I

Rent expenditure is a very common expenditure in any business. Do you know the payment of rent by any business entity needs deduction of tax at source under section 194-I of the Income Tax Act, 1961? This article, answers all your questions and doubts regarding TDS on rent under the provisions of section 194-I of the Income Tax Act, 1961.

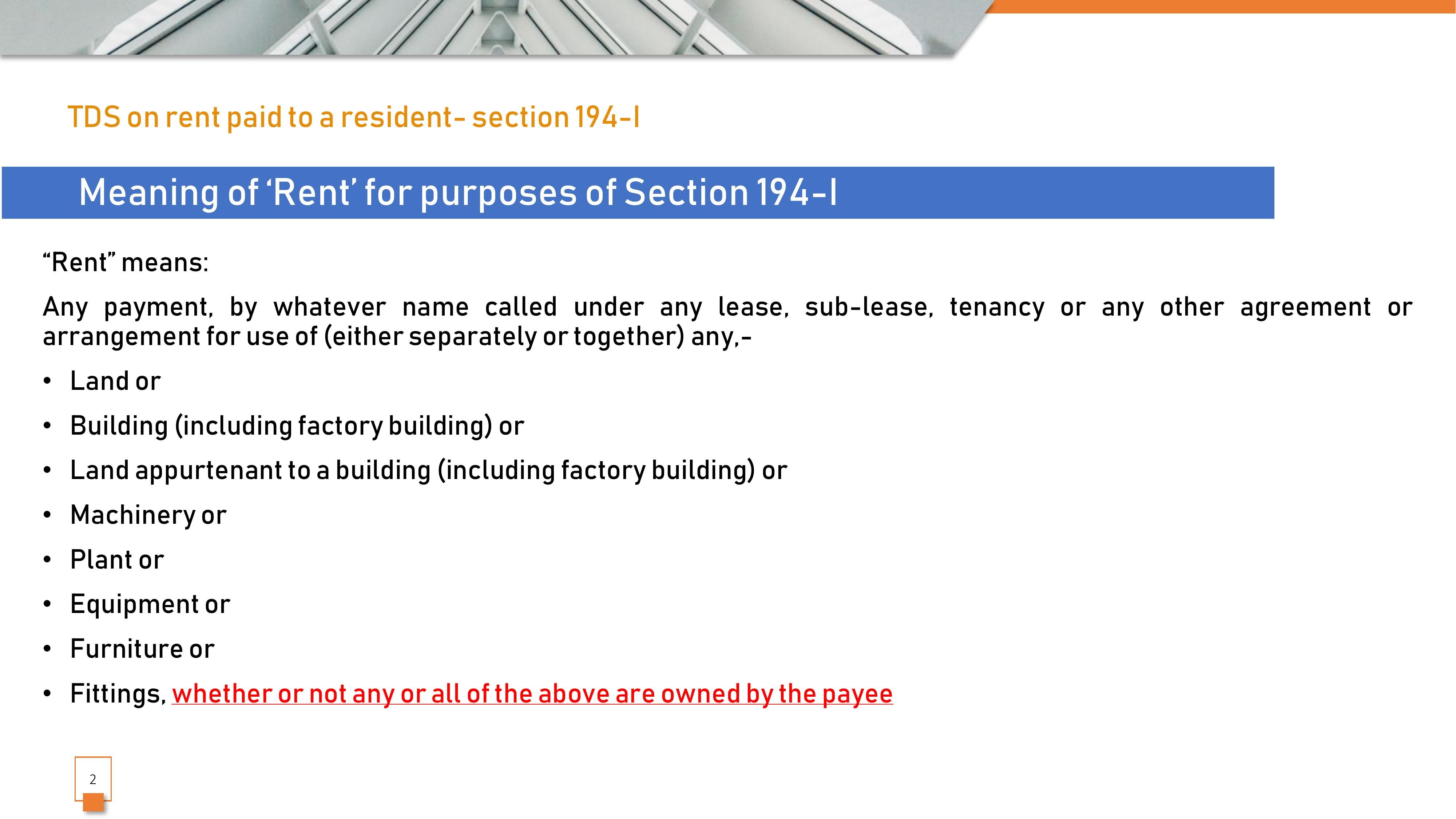

What is 'Rent' under section 194-I?

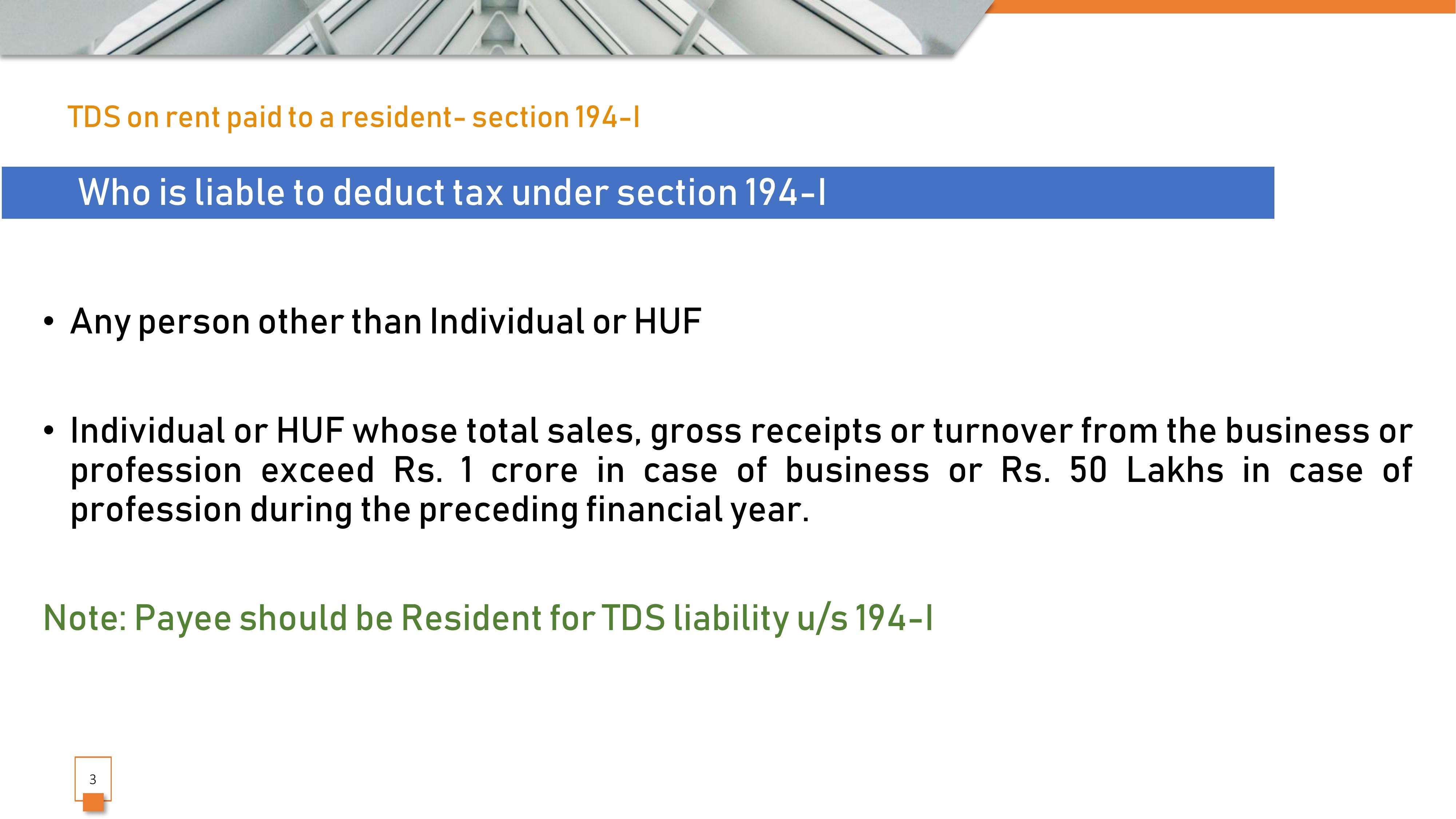

Who is liable to deduct TDS on rent under section 194-I?

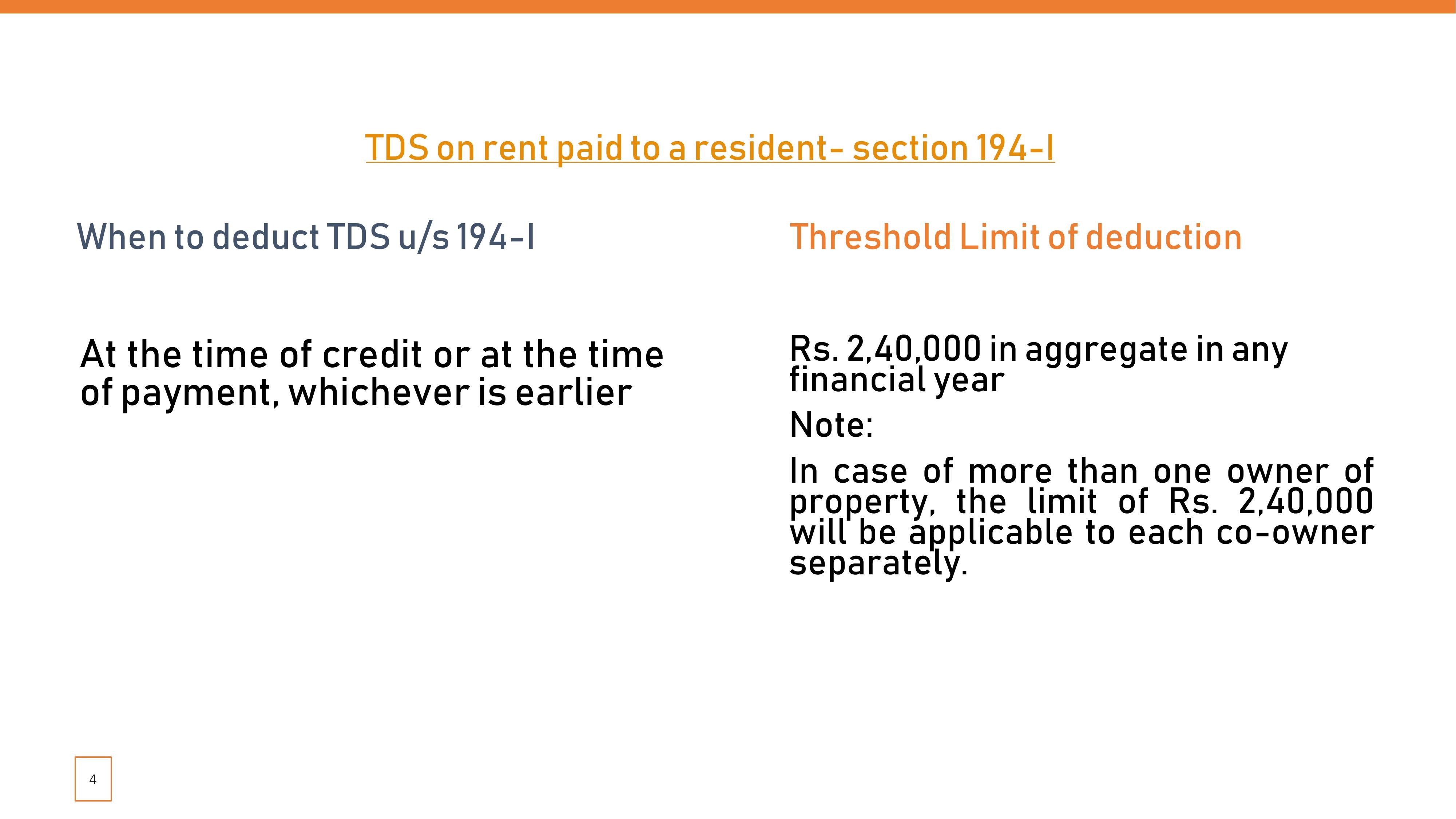

What is the threshold limit of TDS under section 194-I?

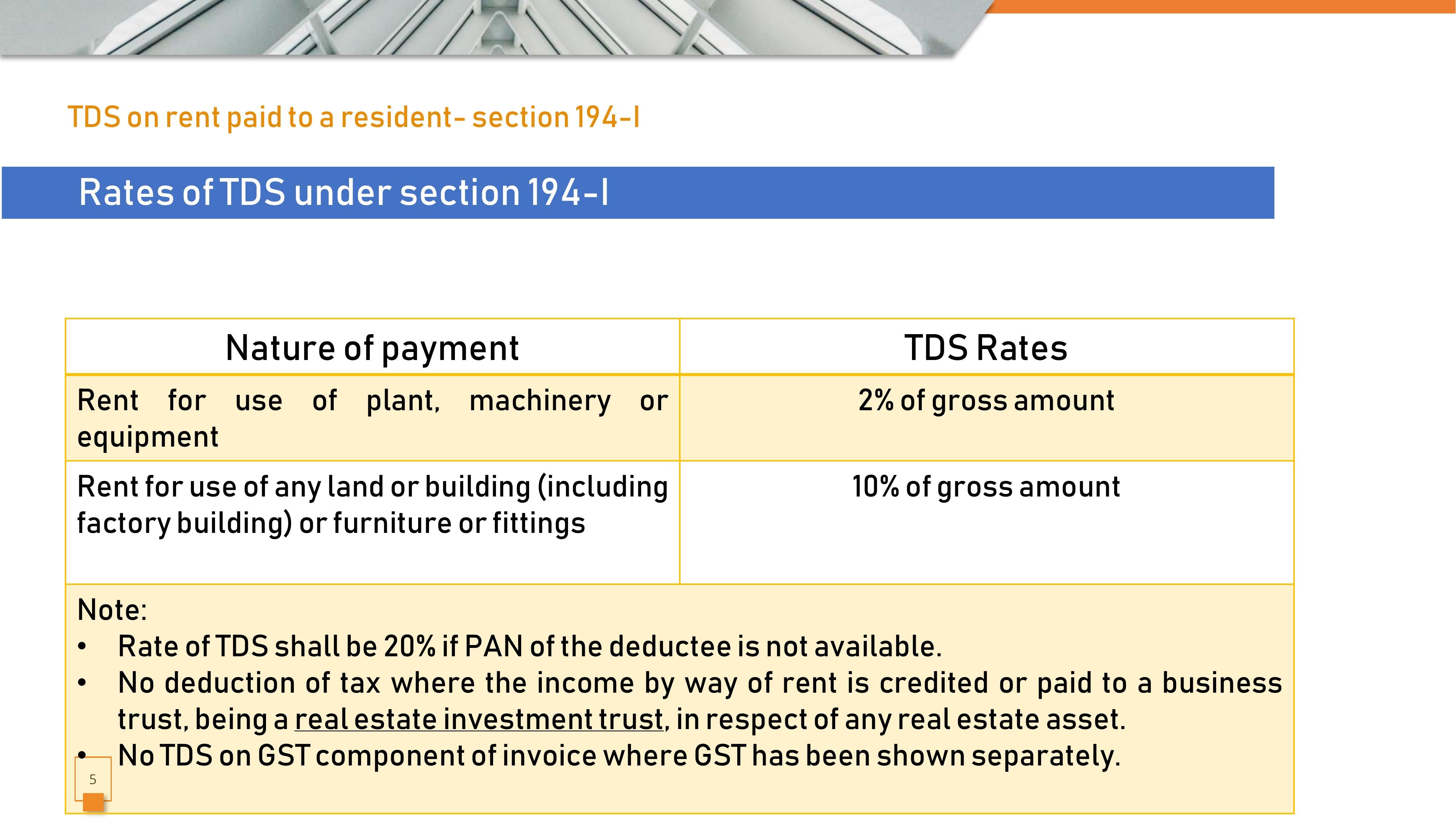

What are the TDS rates on rent u/s 194-I?

Is TDS deducted on Advance Rent u/s 194-I?

Is TDS deducted on rent security deposit u/s 194-I?

TDS on Cold Storage Charges- Section 194-I or Section 194C

TDS on payments made to hotels- Clarification by CBDT

Important Judicial Rulings - Section 194-I

Disclaimer: The above article is meant for educational purposes only. Taxwink is not responsible for any loss or damage caused to any person due to use of the above information. Readers are therefore, requested to act diligently and under consultation with any professional before applying the information contained in this article.