TDS on sale of property under section 194-IA

Do you know that the sale of any immovable property in India may necessitate the deduction of tax at source under Income Tax Act, 1961. If not, this article is going to be quite handy and useful for you. TDS provisions in case of sale of immovable property are dealt by section 194-IA of the Income Tax Act, 1961. This article focuses on throwing light on the provisions of section 194-IA in a simple but lucid manner.

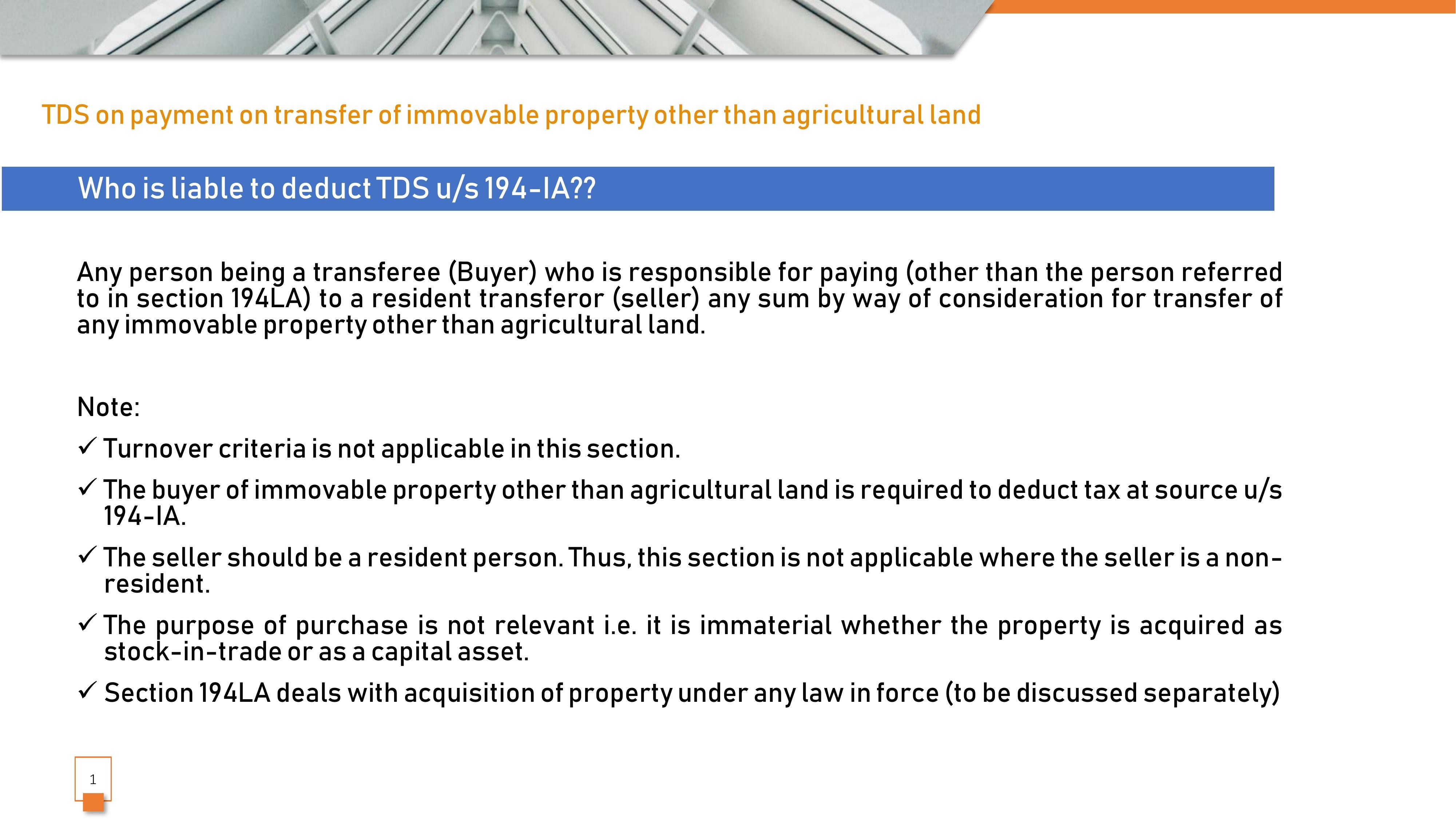

Who is liable to deduct TDS on the sale of immovable property?

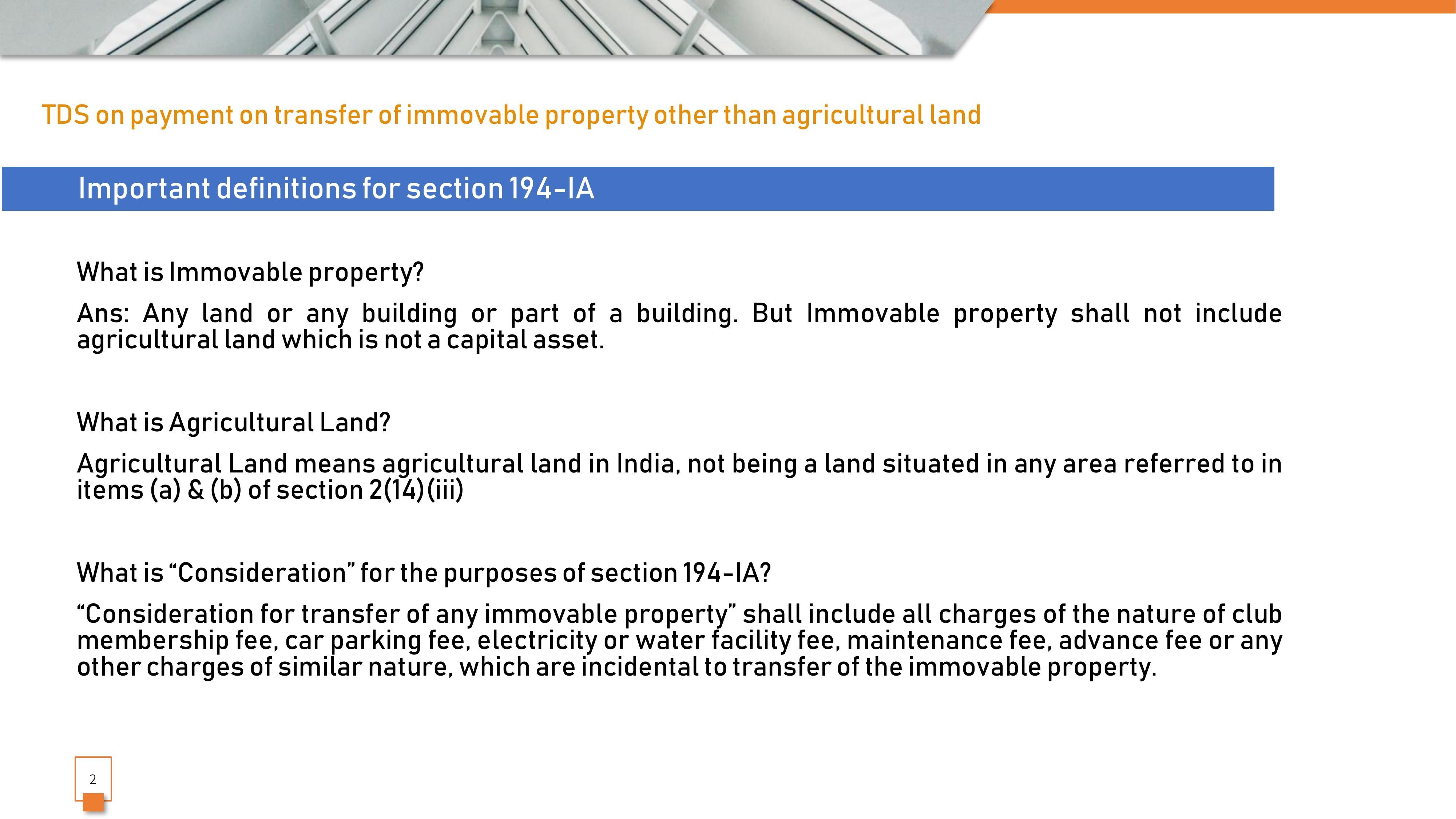

What is the meaning of consideration for the purposes of section 194-IA?

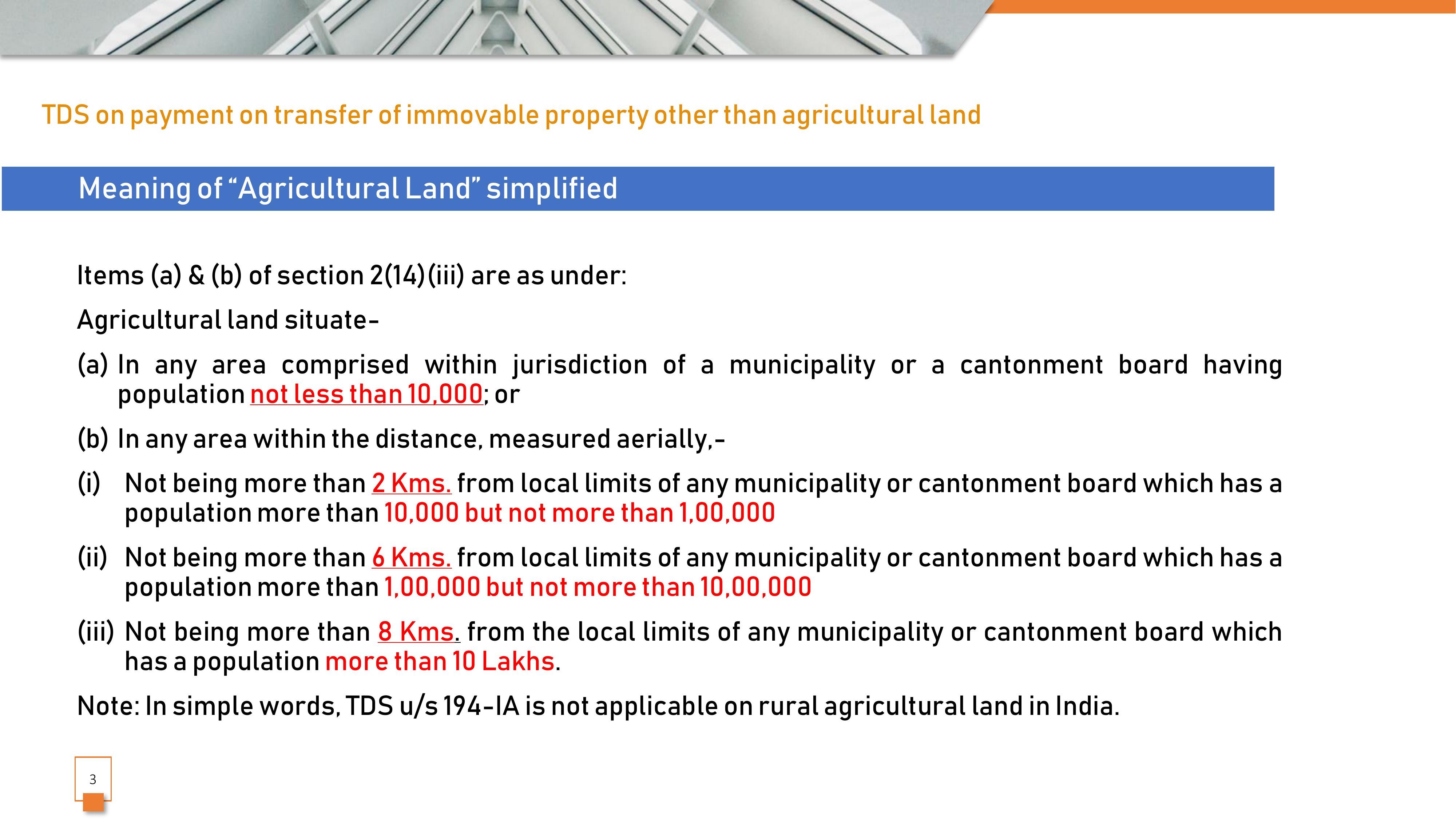

What is "Agricultural Land" for the purpose of section 194-IA?

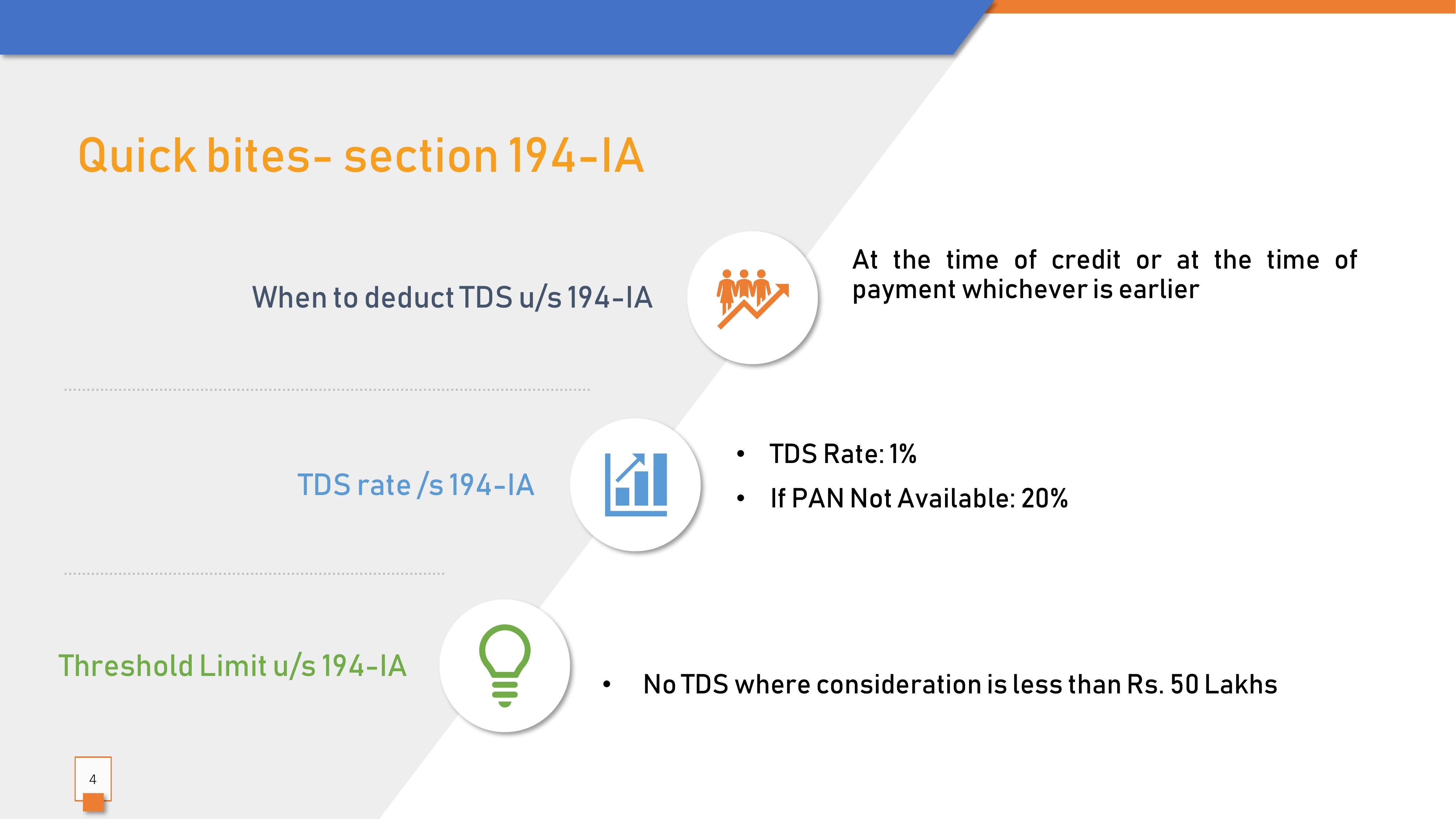

What is the rate of TDS under section 194-IA?

More than one buyer or seller in case of section 194-IA

TDS applicability u/s 194-IA in case of difference in stamp duty value & sales consideration

How to deposit TDS under section 194-IA?

Disclaimer: The above article is meant for educational purposes only and Taxwink is not responsible for any loss or damage caused to any person because of the above information. Readers are therefore requested to act diligently and under consultation with any professional before applying the above information.