TDS on payments of certain sums by certain Individuals or HUF- Section 194M

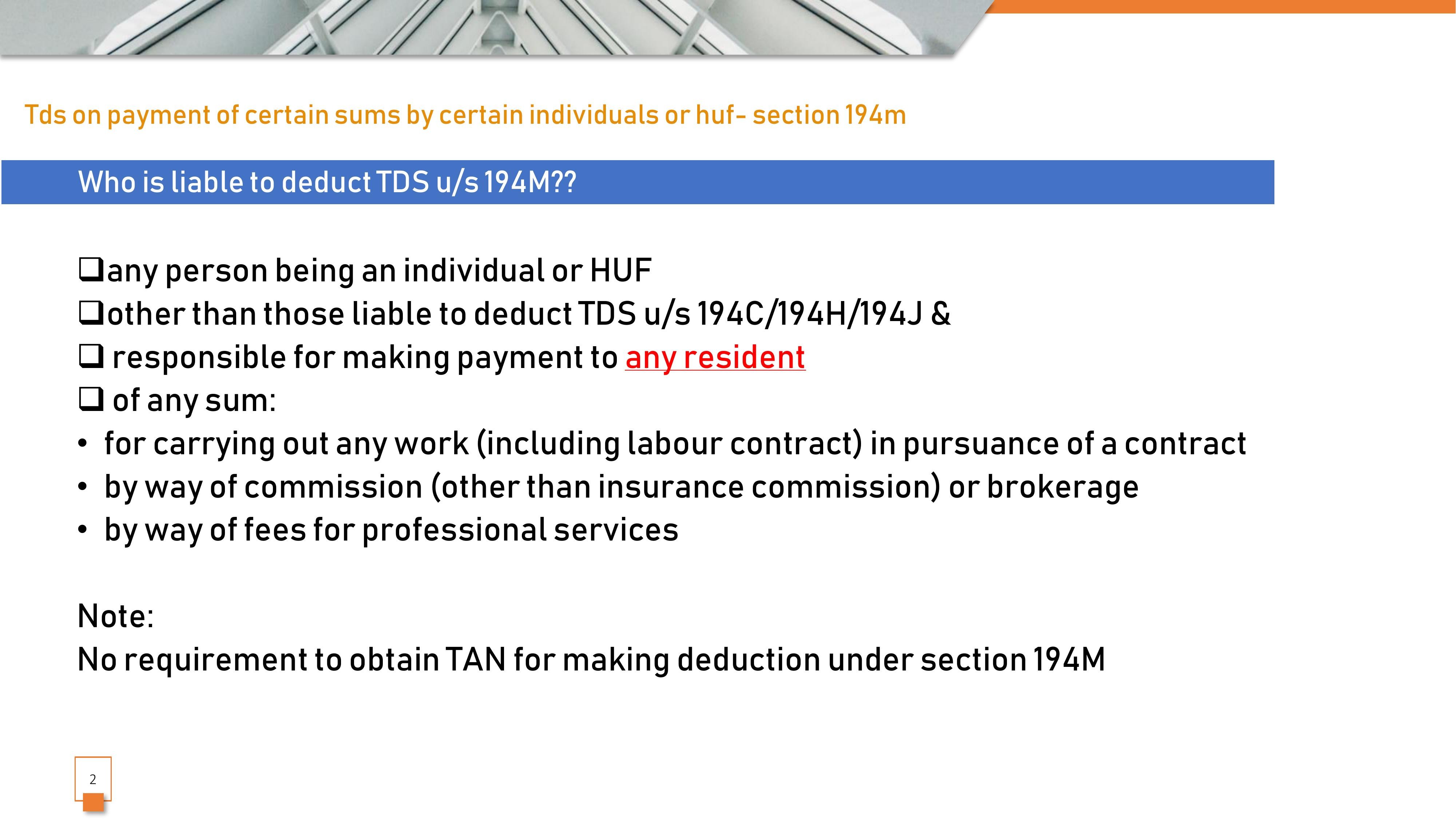

Till 31st August 2019, there was no liability on an individual or HUF to deduct tax at source on any payment made to a resident contractor or professional when it is for personal use. Further, if the individual or HUF is carrying on a business or profession which is not subjected to an audit, there was no obligation to deduct tax at source on such payments to a resident, even if the payment was for the purpose of the business or profession. Due to this exemption, a substantial amount by way of payments made by individuals or HUFs in respect of contractual work or for professional services escaped the levy of TDS, leaving a loophole for possible tax evasion. To plug this loophole, Finance Act, 2019 introduced section 194M to provide a levy of TDS at the rate of 5% on certain sums such as payment towards contractual works/ professional services/ commission paid by an individual or HUF who are otherwise not required to deduct TDS u/s 194C/194H/194J, if such sum exceeds Rs. 50 Lakhs in aggregate during the financial year. TDS under section 194M shall be deposited using the PAN of deductor and deductee and no TAN shall be required for the same.

Who is liable to deduct TDS u/s 194M?

Is TAN required for deducting TDS under section 194M?

No, TDS under section 194M will be deposited using PAN of deductor and deductee.

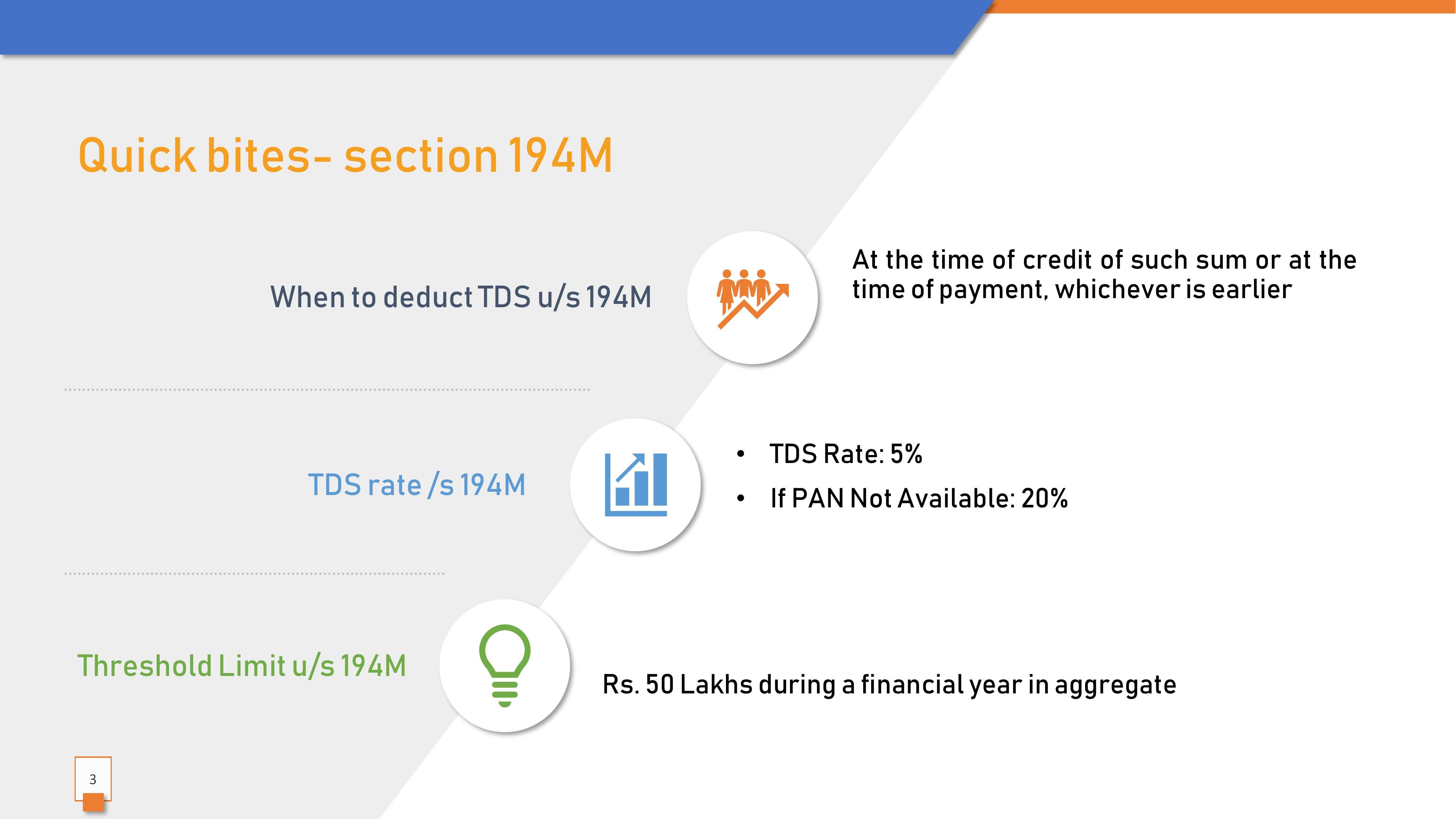

What is the rate of TDS under section 194M?

TDS shall be deducted at the rate of 5%. In case the PAN of the deductee is not available, TDS shall be deductible at the rate of 20%.

What is the threshold limit of TDS under section 194M?

The threshold limit of tax deduction under section 194M is Rs. 50 lakhs in aggregate in any financial year.

Disclaimer: The above article is for educational purposes only. Taxwink is not responsible for any loss or damage caused to any person due to the use of any information contained in this article. Readers are therefore requested to act diligently and under consultation with any professional before applying the information contained in this article.