CSR-1 Registration Services in India

What is CSR-1 Registration?

Corporate Social Responsibility (CSR) has become a cornerstone of responsible business practices in India. As per the Companies Act, 2013, Section 135, certain companies are required to allocate a portion of their profits to CSR activities. CSR Rules have been introduced in India in 2013 which provides that companies with a net worth of Rs. 500 crore or more or a turnover of Rs. 1,000 crore or more shall be mandated to spend 2% of their average net profits of preceding three financial years on CSR activities. Those NGOs who intend to participate and implement CSR initiatives of companies will be required to be registered through CSR-1 Form Filing. Thus, CSR Registration for NGOs is an essential process for organizations that want to implement CSR initiatives.

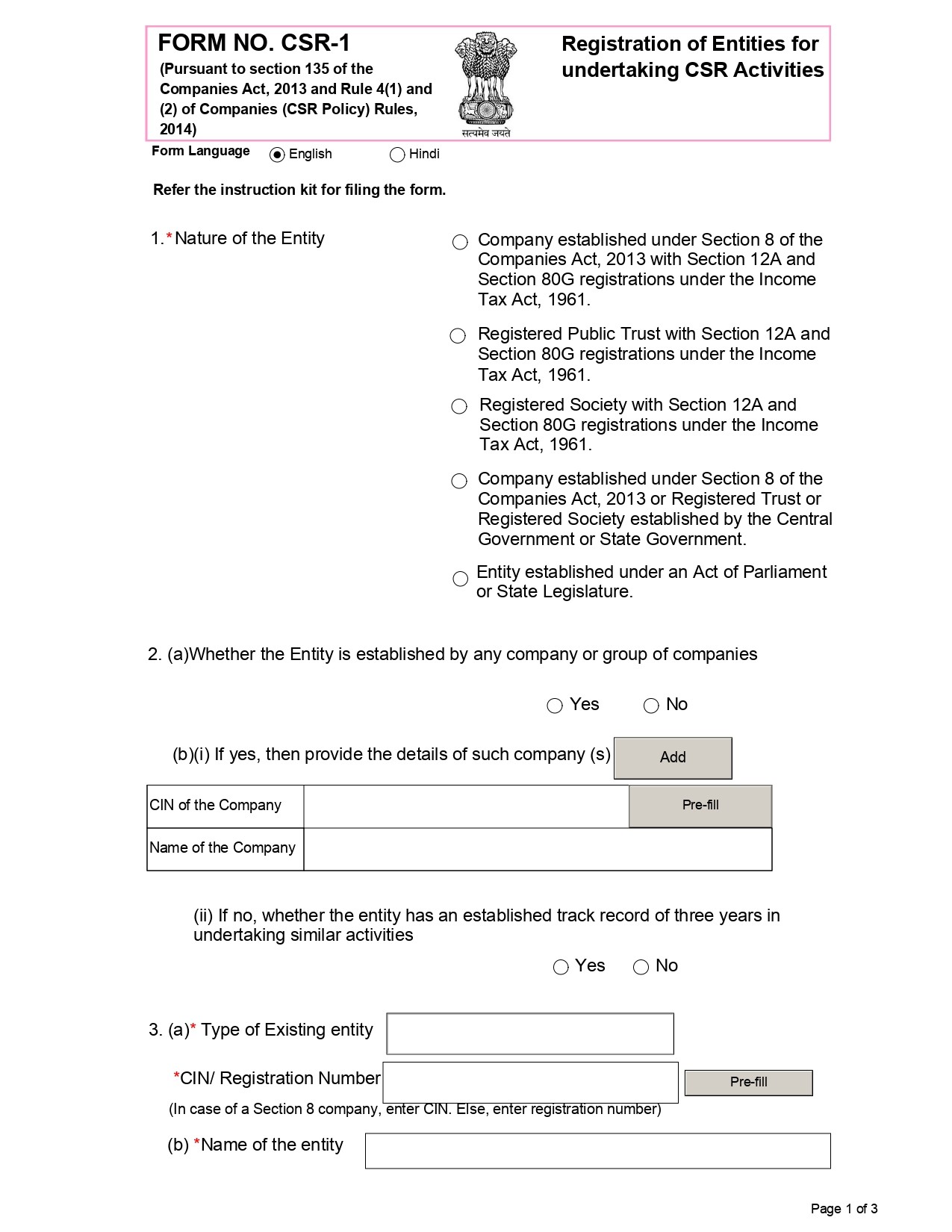

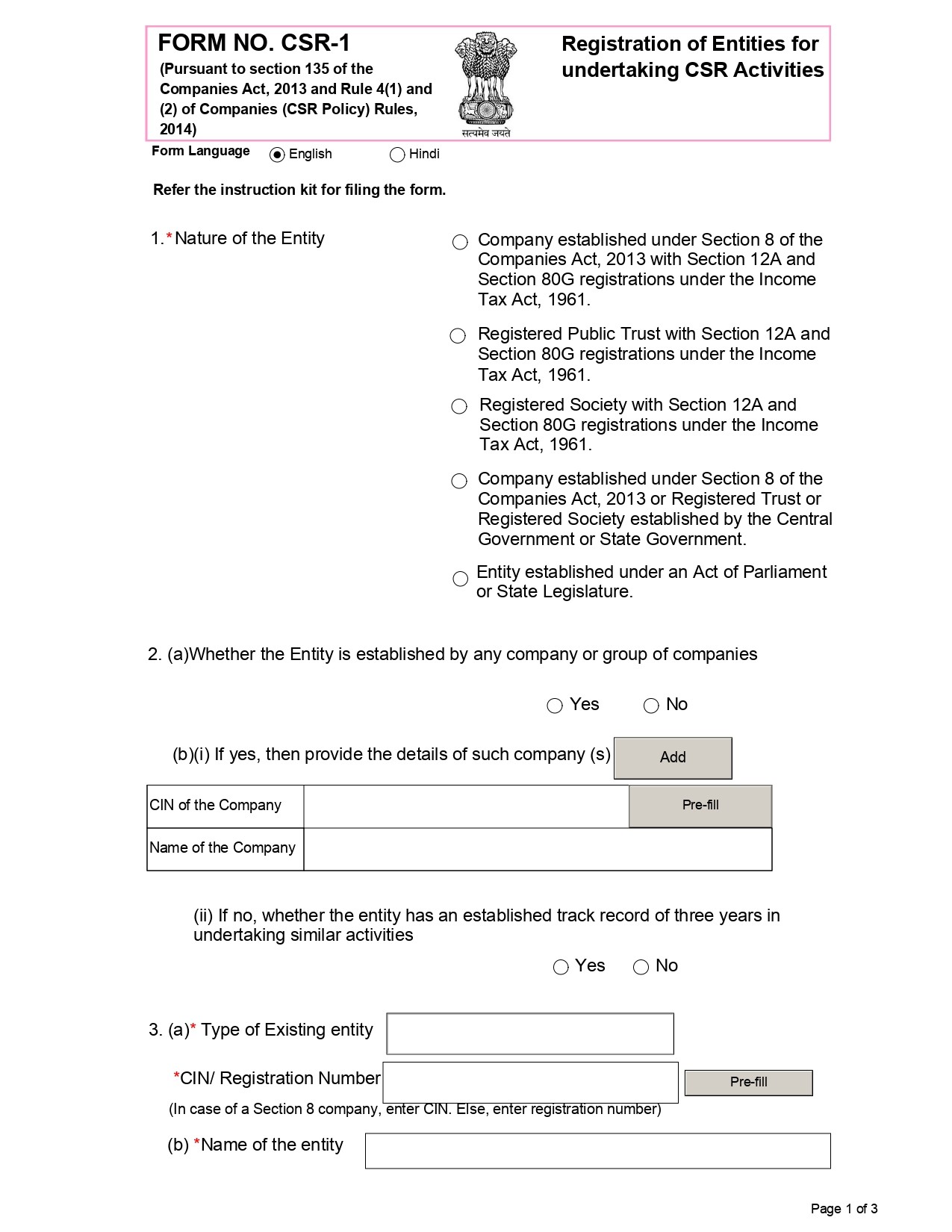

The Ministry of Corporate Affairs (MCA) has made available the Form CSR-1 on the MCA Portal. The NGOs (Trusts/ Societies/ Section-8 Companies) who intend to get CSR funds from the companies shall obtain registration with MCA in Form CSR-1. The purpose of CSR-1 registration for Trusts/ Societies is to ensure effective monitoring of the CSR activities conducted by the NGOs in the country. The registration of NGO with MCA will be valid for a period of three years. After the expiry of three-year period, the CSR registration for NGO can be renewed for further three years by submitting a fresh application to MCA.

Who needs CSR-1 Registration?

According to CSR Rules, 2014 of the Companies Act, CSR-1 Registration is mandatory for the following entities:

- Section-8 Companies

- Registered Public Trusts

- Societies Registered under Section 12A and 80G of the Income Tax Act

Only organizations that have completed CSR-1 Registration are eligible to receive CSR funds from corporate bodies. This registration ensures that your non-profit organization meets the legal requiements outlined in the Companies Act, 2013 and can efficiently access CSR funding for various community- driven initiatives such as education, healthcare, environment sustainability, rural development and more.

CSR 1 Registration for Non-Profits & NGOs in Jaipur, Rajasthan

If your organization is based in Jaipur or anywhere in India, Taxwink is your trusted partner for CSR 1 Registration. We are familiar with the local regulatory landscape and ensure that your NGO, trust, or society complies with the Companies Act, 2013 and CSR guidelines, making it eligible for CSR funding.

Whether you are a newly established non-profit or an established trust, our expert team can help you with CSR-1 registration anywhere in India, ensuring all processes are carried out efficiently and in full compliance with the law.